By Adam Pagnucco.

It’s that time: here are the political awards for 2020, the year that was!

Politician of the Year: Governor Larry Hogan

There is really no other choice. Because of the unique demands of the COVID-19 crisis, it’s possible that no Governor of Maryland has wielded more power than Hogan did in 2020 since the colonial era. Local governments, employers and residents all over the state have had to react to his many executive orders. He has had successes, such as Maryland’s relatively low COVID case rate compared to the rest of the country, and he has had failures, such as the flawed test kits from South Korea. Above all, he has been incredibly consequential – far more than any other political figure in the state – and that is enough for this award.

Debacle of the Year: The Purple Line

Again, there is no other choice. The Purple Line’s public-private partnership (P3) was supposed to protect taxpayers from liability, but its collapse will cost us $250 million that would otherwise be available for other transportation projects. The state is promising to complete the project, which will someday generate real benefits for the Washington region, but no one knows its completion date or its ultimate cost. With another P3 pending for the Beltway/I-270 project, the Hogan administration owes it to Marylanders to report on lessons learned from the Purple Line so that its mistakes are not repeated.

Runners Up

Two powerful officials – Hogan Chief of Staff Roy McGrath and MoCo Chief Administrative Officer Andrew Kleine – lost their jobs due to scandal. The McGrath story may not be over.

Worst Move of the Year: Robin Ficker’s Question B

Ficker thought he could get MoCo voters to approve a draconian tax cap that would handcuff county government forever. Instead, not only did voters reject his idea, but they approved a competing ballot amendment (more below) that will actually generate more revenue for the county over time.

Runners Up

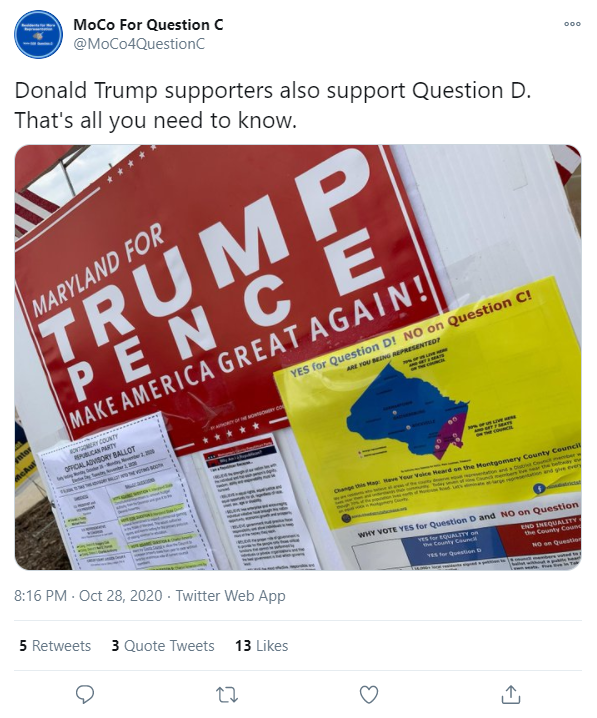

MoCo Republicans badly wanted the nine council district charter amendment to pass but they wound up helping to defeat it because of their prominent embrace of it in the toxic year of Trump. Talbot County officials insisted on keeping a confederate statue at their courthouse, a long-term loser for the county.

Best Move of the Year (Tie): Andrew Friedson’s Question A and Evan Glass’s Question C

Former Obama Chief of Staff Rahm Emanuel once said, “Never allow a good crisis to go to waste.” Council Members Andrew Friedson and Evan Glass sure didn’t, drafting competing ballot questions against Ficker’s anti-tax charter amendment and another amendment providing for an all-district council structure. The result of the passage of Friedson’s Question A and Glass’s Question C is a more rational, liberalized property tax structure and a larger county council to service a larger population.

Runner Up

Baltimore County Executive John Olszewski Jr. issued an executive order capping third party food delivery app fees at 15%, preventing excessive fees ranging as high as 30%. The order also bans them from reducing driver compensation and tips to comply with the fee cap.

Missing in Action Award: Almost Everyone Planning or Thinking of a Run for Governor

Comptroller Peter Franchot is the only declared candidate for governor. He has a war chest, a statewide profile and a consulting firm. Right now, he has no competition. As Roger Waters would say, is there anybody out there?

Big Deal of the Year: Moratorium Repeal

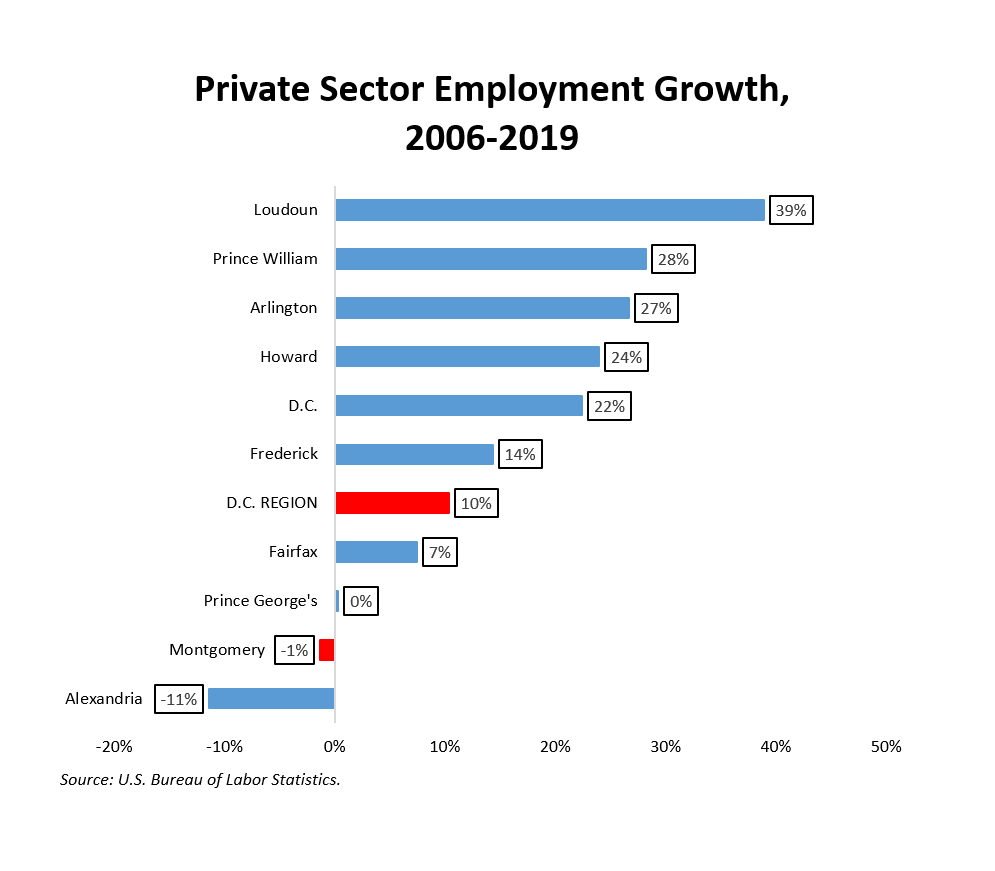

The county council repealed the county’s illogical housing moratorium policy, which did not accomplish its intended purpose (alleviating school crowding) but did prevent housing construction in the face of MoCo’s affordable housing shortage. Housing construction still has challenges – including financing problems stemming in part from slow job growth – but the council was right to junk moratoriums that did no good and made housing problems worse.

Just Because She’s Great Award: Delegate Anne Kaiser

She never asks for attention or takes credit for anything. But Delegate Anne Kaiser is everything you could want in an elected leader: smart, practical, savvy, mentors younger politicians and plays the long game. Best of all, she’s a down to Earth person who doesn’t let success go to her head. She’s a worthy successor to the great Sheila Hixson as chair of Ways and Means. Long may she serve.

MoCo Feud of the Year: JOF vs Stephen Austin

In one corner: political newcomer Stephen Austin, running for school board on a platform of opposing MCPS’s boundary analysis. In the other corner: former school board member Jill Ortman-Fouse (universally known as “JOF”), leader of a movement favoring boundary studies in the interest of equity. This was never going to be a great relationship, but this feud set a record for most screenshots in a MoCo political dispute. Here’s to more in the new year!

Runner Up

County Executive Marc Elrich vs Governor Larry Hogan. This one runs hot and cold but it flared big-time when Hogan stopped MoCo from instituting a blanket shutdown of private schools. These two can’t stand each other so expect more this year.

Media Outlet of the Year: Baltimore Brew

If you’re not reading Baltimore Brew, you need to start doing it right now! No city scandal can hide from the Brew’s hustling, dirt-digging journalists, whether it’s document shredding, scams, SLAPP suits, politician tax liens, travel expenses, or other questionable activities. Baltimore Brew is a must-read and a true gem of Maryland journalism.

Game Changer Award: Len Foxwell

For more than a decade, the Franchot-Foxwell partnership roiled Annapolis, grabbed headlines and marched steadily towards Government House. Now Foxwell is a free agent and available for hire as a communications, public relations and political strategist. Few people combine knowledge of politics, policy, press and all things Maryland like Len. Having him on the market is a game changer, especially for anyone who hires him.

County Employee of the Year: Inspector General Megan Davey Limarzi

Limarzi is MoCo’s dynamite inspector general, whose reports on mischief in county government regularly rock Rockville. Two especially notable reports revealed an “overtime scam” in the fire department and overpayment of COVID emergency pay in at least one county department. In Fiscal Year 2020, complaints to the inspector general increased 92%, suggesting confidence in her work. Count me as her biggest fan!

Runners Up

Like Calvin and Hobbes, Travis Gayles (the county’s health officer) and Earl Stoddard (the county’s emergency management director) come as a pair. Both of them have played critical roles in responding to COVID. Gayles is a happy warrior who shrugs off criticism and is indefatigable in his job. Stoddard is a stand-up guy who earned a lot of respect in taking responsibility for the county’s grant management issues. Given the nature of their jobs, Gayles and Stoddard are not always loved, but they deserve credit for taking the heat and carrying on when so many other health officials are leaving around the country.

Quote of the Year: “Hope is Not a Fiscal Strategy”

Council Member Andrew Friedson has said this so many times that his colleagues (and executive branch officials) are probably sick of hearing it. But it’s true: the county has been praying since the summer for a federal bailout that has yet to arrive while the day of reckoning is near. We could have done better.

Gaffe of the Year: “Can I Say the Council is Fact Proof?”

Here is an instance in which County Executive Marc Elrich’s snarky sense of humor was not appreciated by the county council in this hot mic moment. Can we get more hot mics please?

Survivor of the Year: Linda Lamone

After numerous glitches in the primary election, state elections administrator Linda Lamone looked like she might finally be run out of Annapolis. But she outlasted calls for her resignation and the general election went better, so she remains in her job. Given her many problems and a string of bad audits, Lamone isn’t just a survivor of the year – she is THE survivor of the last twenty years. State leaders need to restructure the accountability of her position after she finally retires.

Departure of the Year: Bob Dorfman

We’re not fans of the county liquor monopoly here at Seventh State, but former monopoly director Bob Dorfman was a capable manager who tamed some of its worst problems. Depending on who succeeds him, the county could really miss him.

Most Ignored Story of the Year: Public Information Act Suspension

The Elrich administration’s indefinite suspension of public information act deadlines is the single biggest setback for open government in MoCo that I have seen in almost 15 years of writing. And yet to my knowledge, not a single politician said anything about it publicly and not a single D.C. area press outlet has followed up. I’m not surprised by the politicians. But I am surprised by how meekly the press surrendered to the suspension of one of the greatest tools of investigative reporting available – the public information act. To quote Roger Waters again, is there anybody out there?

That’s all for 2020, folks!