By Adam Pagnucco.

According to a mass email sent by Deputy Chief Administrative Officer Fariba Kassiri, Alcohol Beverage Services (ABS) Director Bob Dorfman is leaving his position effective today. The email is reprinted below.

*****

Subject Line: Bob Dorfman/Acting ABS Director

From: Kassiri, Fariba

Sent: Monday, December 14 2020

To: #ABS All

Cc: #MCG.Department and Office Directors; #MCG.SeniorEAAContacts; #MCG.Legislative Branch Directors

ABS Employees,

Effective today, Bob Dorfman will be moving on from his position as Director of Alcohol Beverage Services. On behalf of the County Executive, I want to thank Bob for his 4 years of service to Montgomery County Government and acknowledge his significant accomplishments during that time. ABS would not be the success it is today without his leadership and vision. I thank him for his many contributions and wish him well in his future endeavors.

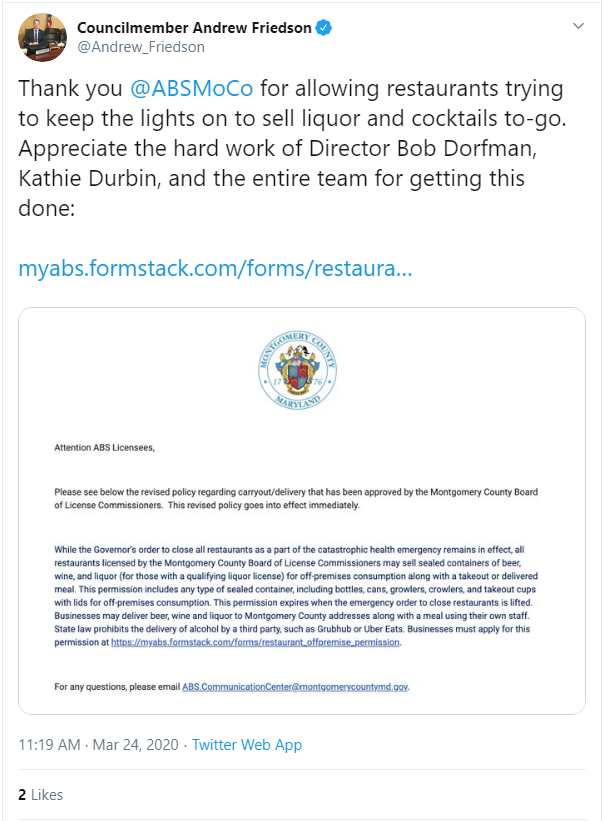

Kathie Durbin will be Acting ABS Director until a permanent director is appointed.

*****

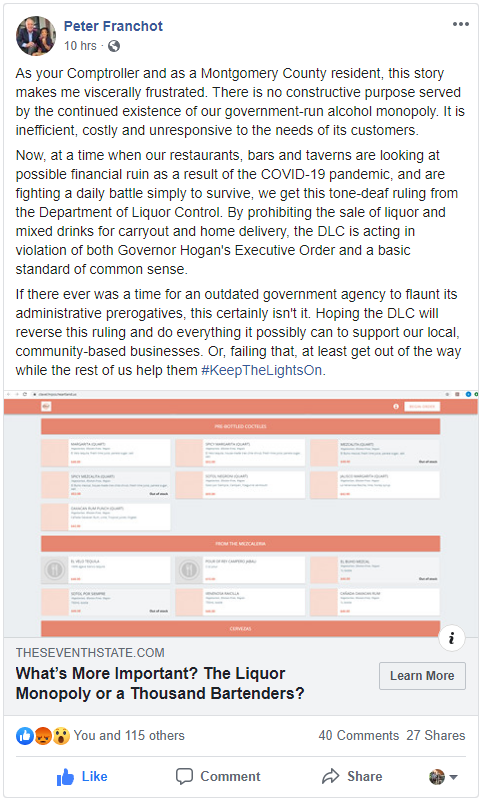

It’s difficult to describe just how badly the liquor monopoly was doing when Dorfman, a former Mariott executive, was hired to run it four years ago. The monopoly had suffered critical delivery outages in the week between Christmas and New Year’s two years in a row. It was riddled with crime and abuse, with employees skimming booze and selling it for cash, driving drunk in county trucks and running the warehouse with sticky notes. Licensees were so upset at the monopoly’s failures, especially with regards to special orders, that Delegate Bill Frick (D-16) introduced a bill to allow county voters to end it. (I organized a coalition to support Frick’s bill.)

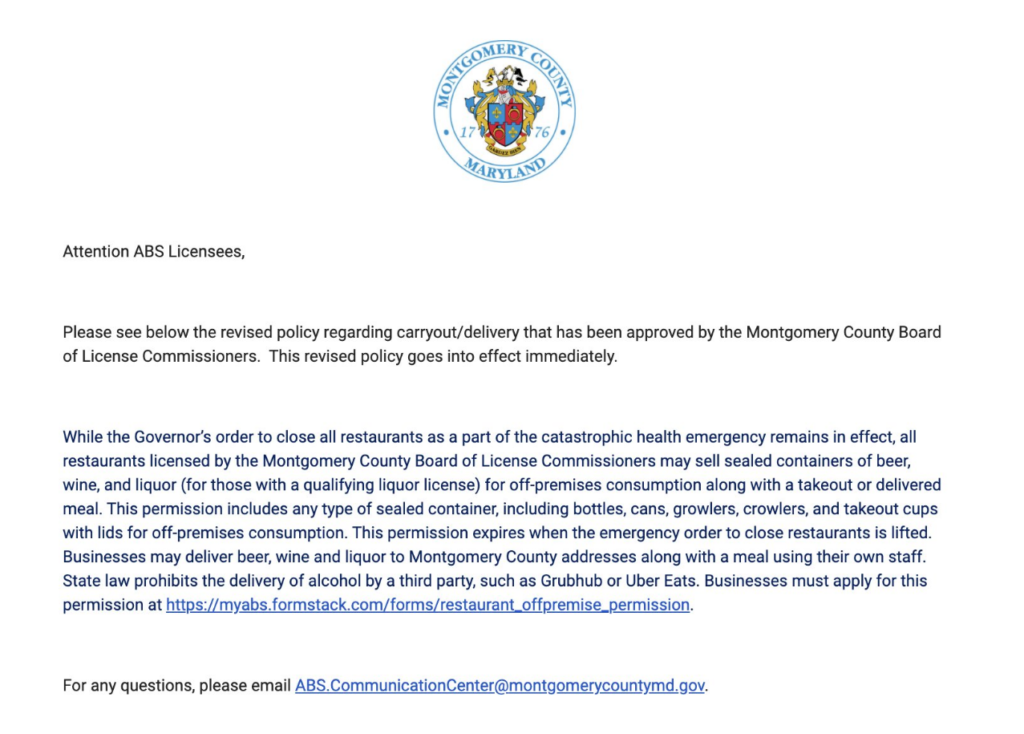

Dorfman’s success was to do what prior leaders had promised to do for years: run the organization like a business. Even some of the monopoly’s harshest critics conceded that, under Dorfman, the department’s delivery accuracy and service improved. Special orders were still an issue but there were no more week-long outages during holiday periods. Dorfman’s performance was good enough that pressure to abolish the monopoly eased off, at least for a little while. One caveat: Dorfman’s pursuit of the bottom line was great for the monopoly but not always for licensees. He instituted a new bottle fee for licensees at county liquor stores and blocked reform passed by the General Assembly to allow private stores to sell spirits.

Dorfman was also an aggressive defender of his organization, going after both Council Member Hans Riemer and Seventh State founder David Lublin in public. When Riemer found out that county liquor stores were losing money and suggested shutting them down, Dorfman called him “ill informed” and said he “obviously doesn’t care much” about county employees. No other department head has said such things about a sitting Council Member in recent memory!

Departing department directors often take extended departures, with their last days scheduled for weeks or months after their announcements. That’s not the case with Dorfman, who is out effective today. That makes me wonder whether he is leaving on good terms with the administration. In any case, his example offers a lesson: if the county wants the liquor monopoly to perform like a business, it has to hire someone to run it who knows how to run a business. Dorfman was that guy. We shall see if County Executive Marc Elrich heeds that lesson when hiring Dorfman’s successor.