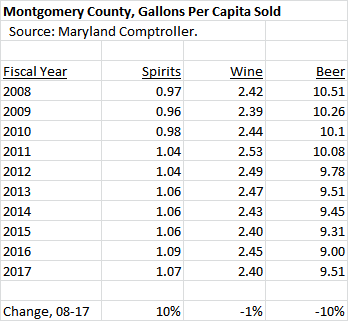

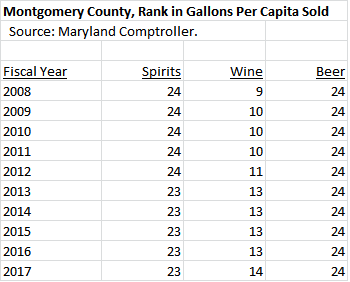

Calling the laws governing the sale of liquor in Montgomery “antiquated and byzantine,” Councilmember Hans Riemer (D-At Large) came out in favor of abolishing the county liquor monopoly in an email blast sent out yesterday by his campaign for county executive.

This is quite a change.

Over three terms on the County Council, he has opposed doing away with the monopoly. The Nighttime Economy Task Force, which Councilmember Riemer chaired in 2013 studiously stayed away from recommending its abolition even though it was the obvious way to stimulate restaurant growth and nightlife.

Two years later in 2015, Riemer wrote here on Seventh State: “I strongly believe our county alcohol regime holds back the vibrancy of our restaurant and nightlife economy and negatively impacts the choices residents get in stores.” But even as he recognized its faults, he opposed ending the monopoly.

Instead, he championed an unworkable bill that would have allowed businesses to buy directly “boutique brands” that weren’t among the 4,500 carried by the then-Department of Liquor Control (DLC). Except that distributors were never going to run nearly empty trucks to stores or restaurants to deliver a case or two of their more obscure brands.

Meanwhile, Riemer worked to kill a bill sponsored by Del. Bill Frick (D-16) to allow county voters to decide whether to retain the monopoly. Even after the fiasco surrounding deliveries to bars and restaurants right before New Year’s just a couple of months later, Riemer stuck to his position against abolition.

Now, after three terms on the Council, Riemer has come out against the monopoly as part of his campaign for county executive.

He even argues that he is somehow more radical than David Blair because:

David Blair, on the other hand, also wants to keep the County in the liquor business. Rather than just getting out, Blair wants the County operations to compete with the private sector – creating a gigantic mess that will cost taxpayers dearly while needlessly subjecting employees to conditions that would be extremely stressful and demoralizing.

Keeping the county in the liquor business would increase competition, which is the entire point of abolishing the monopoly, while simply shutting it down as Riemer proposes would decrease it. The county liquor business might not survive this competition, but they are already established and positioned to give it a go. It’s hard to imagine that this would be more “stressful and demoralizing” than being fired, as Riemer suggests.

But the real story remains that Riemer has upended his position after twelve years on the Council as part of campaign for higher office.