By Adam Pagnucco.

Right about now, the happiest man in Montgomery County lives in Boyds. He is 74, a huge sports fanatic, a long time attorney, a former state Delegate, a perpetual candidate and a tireless activist. He loves the County Council because some of its members give him endless material for use in his never-ending demagogic campaign to weaken and ultimately paralyze county government.

Yes folks, we are talking about the notorious political heckler Robin Ficker. And he must be jumping for joy at the news that some members of the council are considering a possible new soda tax.

Ficker has been running for office and placing charter amendments on the ballot, mostly intended to limit taxes, since the 1970s. The huge majority of his amendments have failed, often because the political establishment labeled them “Ficker amendments” to exploit the national infamy of his heckling at Washington Bullets games. One exception was the razor-tight passage of his 2008 charter amendment mandating that all nine Council Members vote in support of exceeding the charter limit on property taxes. But Ficker has never had more ammo than in the last four years and he has used it to push his anti-government agenda. Consider what has happened.

The council’s approval of a large salary increase for its members in 2013 and its passage of a 9% property tax hike in 2016 gave Ficker’s term limits charter amendment momentum. Some Council Members then used their campaign funds to finance a lawsuit to keep term limits off the ballot, which failed. Council Member Nancy Floreen’s “exasperated” and “defensive” performance in a television debate with Ficker and Council Member George Leventhal’s comparison of term limits supporters with Brexit voters didn’t help. Ficker predicted term limits would pass by twenty points; instead, they passed by forty.

Robin Ficker thanks MoCo voters for giving him his biggest political win ever.

That’s not all. Ficker has enrolled in the public financing system established by the council for his latest Executive run. And he requested the county government’s email lists after another resident obtained them under the Public Information Act. Any competent campaigner – maybe even Ficker – should be able to use those thousands of emails to raise enough money to qualify for public matching funds.

And now we have news of the soda tax, which prompted gleeful self-promotion by Ficker in Bethesda Magazine’s comment section. Expect a Facebook ad soon.

Your author does not enjoy writing this column because we find merit in this particular tax. Sugary drinks and soda are public health menaces, especially to children. The intended use of the money for early childhood programs is a good idea. And the current tight budget does not give any quick or easy options for funding undeniable, but expensive, priorities like early childhood education. But the counter-argument from Ficker, who calls Council Members “tax increase specialists,” is obvious. “They’re not listening to you,” Ficker will tell the voters. “You told them no more tax hikes and they’re going to do it anyway.” Even Leventhal, who has voted for numerous tax hikes and has done as much to promote public health as any Council Member ever, has come out against the new tax.

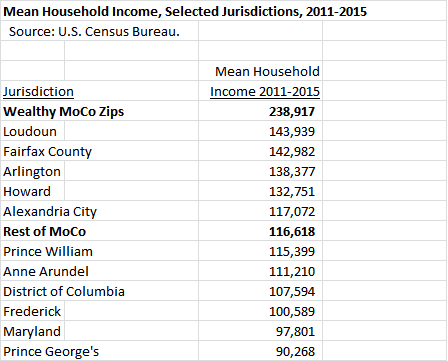

The danger here is not that Ficker will be elected. Voters made that mistake once all the way back in 1978 and have never come close to repeating it since. The real problem is the next charter amendment that Ficker will inevitably introduce after his latest election campaign fails. Whatever else Ficker is, he is an astute student of Maryland county tax policies. He is fully aware of the taxation and spending limits in the Prince George’s County charter, such as the requirements that the property tax rate may not exceed 96 cents per $100 of assessed value and that bond issues, new taxes, other tax increases and some fee increases be approved by voters. He is also aware of provisions in the state constitution and several county charters that forbid legislative bodies from adding spending to executive budgets. Indeed, some of his past charter amendments have been variants of such policies.

It’s one thing to raise taxes during terrible economic downturns as the county did in 2010. That simply had to be done. It’s a very different thing to discuss new discretionary tax hikes in times when voters are not convinced that they are absolutely needed. If the council would like to have more money available for worthy programs, it should focus on growing the economy, stop adding ongoing miscellaneous spending financed by one-shot revenue sources, redirect cable fund money to purposes that actually benefit the public and restrain some parts of the budget to finance expansions of others. Doing those things will free up tens of millions of dollars, and maybe more, over time. But constant talk, and occasional passage, of discretionary tax hikes will only help Ficker place a Prince George’s-style anti-tax doomsday charter amendment on the ballot. Should such a thing pass, no soda tax will save us.

Hence a warning. If you give Robin Ficker enough ammo, even he will eventually hit the target.