How Property Taxes Work in Montgomery

Under current law, Montgomery County may only collect the same total amount in property taxes across the county as the previous year – also known as the constant yield tax rate –adjusted for inflation. So if the County collected $100,000,000 in property taxes last year and inflation is 3%, it may collect $103,000,000 this year. The only exception is if the County Council votes unanimously to raise property taxes.

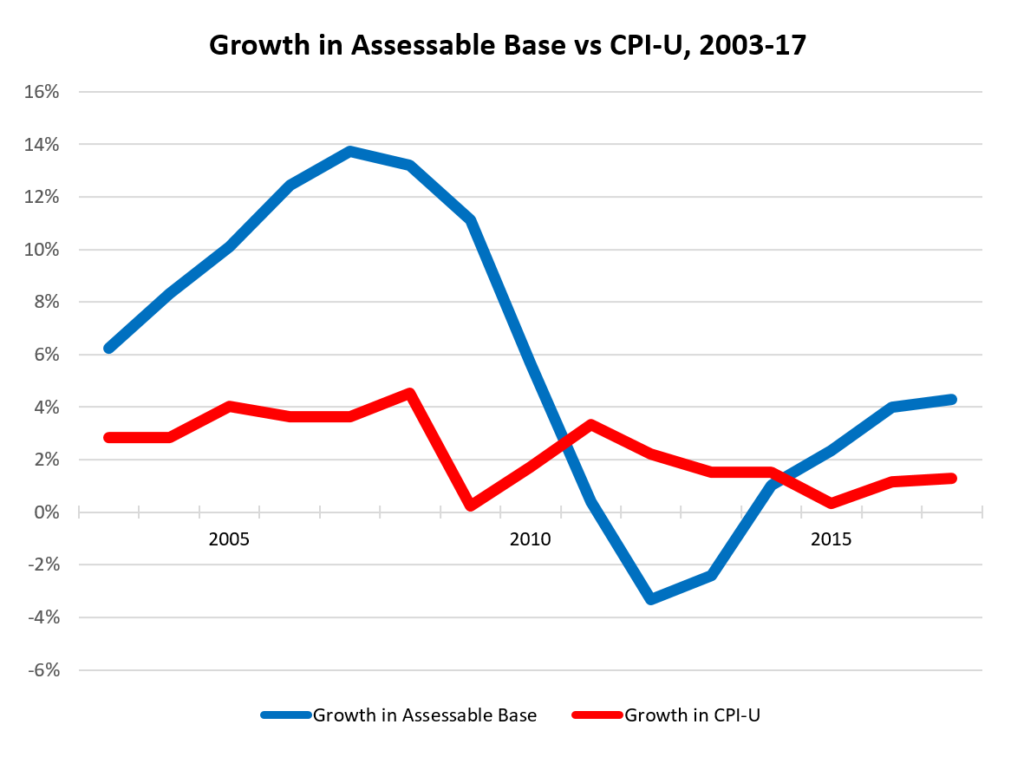

This legal limit forces the county to adjust the tax rate based on changes in total value of assessed property in the tax. If the county’s tax base increases by 10% due to increases in real property values, the County treasury does not because the County must adjust the property tax rate downward, so it collects no more than last year adjusted for inflation. The county can also adjust rates upward if needed to collect the permitted amount.

Question A changes that system. It would cap property tax rates instead of receipts. Montgomery would see great increases in the amount of property tax collected when property tax values grow without changing the rate because they would no longer need to adjust the rate downward so they don’t collect more money.

Councilmembers will claim that they did not increase property taxes because they left the rate unchanged, but the County will collect a lot more. By keeping the focus on the rate rather than amount collected, the county can even nominally reduce the rate and claim that they reduced property taxes even as they go up in real terms and the county collects more than previously.

How Question A Raises Property Taxes

Councilmember Andrew Friedson, the sponsor of the amendment, argues that residents will benefit when housing values go down. However, the Council can vote to increase the rate to collect as much as the previous year as under the current system, just like the 8.7% tax increase that they adopted in 2017. There seems little doubt that they would do this if needed to avoid substantial cuts in spending.

In times when property values rise quickly, this can add up fast, Property taxes increases are limited to 10% a year but this is far above inflation and add up very quickly. If you pay $5000 in property taxes now, you would pay $6655 if you had the maximum increase each year for three years. The key caveat, of course, is that it all depends on how your property values change. But the amendment has no limit on the rate of growth in property taxes.

Confusing Wording

I’m not thrilled that the wording of this charter amendment focuses on limiting rates, and thus gives a rather deceptive impression that it limits, rather than increases, property taxes. (Some proponents argue that it doesn’t but since the unquestionable purpose is to allow the county to reap more revenue, it seems a fair characterization.)

Timing and Impact During an Economic Crisis

Normally, in an economic crisis, it’s not unusual to see housing values fall. But many in Montgomery have paradoxically seen their housing values rise because the crisis is due to COVID and more people are seeking larger spaces with some attached outdoor space. No one knows the future, but this would result in higher property taxes with the next set of assessments.

Many property owners in the county have seen salaries and benefits cut sharply due to the shutdown and economic crisis. Federal government workers haven’t seen pay cuts, but they haven’t had a decent pay raise in years. That’s true of many people.

As a result, a lot of people are ill-positioned to pay a property tax increase even though they may well receive one as a result of this charter amendment the next time that their properties are assessed.

Higher Taxes for Residents, Lower Taxes for Favored Developers

For me, the final straw is that the county council overrode the county executive’s veto of a huge dollop of corporate welfare for developers in the form of 15-year tax breaks (!) by 7-2 the other day. While I realize that opponents as well as the executive support Question A, and I am grateful for their votes and outspokenness on the issue, the Council seems far too inclined to continue down this path after the election. If they can afford giving tax cuts to developers to build high-priced apartments, I don’t see why they need to raise mine.

We Need Property Tax Reform, This Isn’t It

There are unquestionably problems with the county tax system. The three-year assessment cycle creates some odd quirks. Additionally, the current limit doesn’t take into account a growing population as well as other needs. In short, the budget corset is too tight. The unanimity requirement further limits the authority of our representatives too much, even if the voters passed it. But this isn’t the right way to do it, or the time, so I voted no.

But Others See It Differently

Adam outlined previously why some view this property tax increase as a good idea. Even leaving aside one’s desire to fund progressive policies, as I mentioned in the previous section, the current system does not provide sufficient funding with increases over time because it doesn’t into account factors like population growth and other needs. So I can see how other people might see this differently.

I mention this because, like much in politics, I see this as an issue on which reasonable people can disagree. Much of the rhetoric surrounding the ballot questions, even the form of the county council, has been getting more and more vehement on social media. Since we’re in a moment that is already overheated on steroids (now there’s a mixed metaphor!), it seems worth a mention that we’ll manage whatever the outcome of this ballot question.

Question B

Vote No. This is Robin Ficker’s latest very bad idea that would make current problems with the property tax system worse.