By Adam Pagnucco.

A document written by a special assistant to County Executive Marc Elrich lays out the administration’s views on the county’s charter limit on property taxes. And its approach is a simple one: make tax hikes easier.

The county’s charter limit on property taxes was approved by voters in 1990. In simple terms, it allows the county’s total volume of property tax collections to rise annually at the rate of inflation (with a few exceptions like new construction) unless the county council votes to override the limit. Under the original 1990 law, the limit could be overridden with a vote by seven council members. In 2008, tax activist Robin Ficker passed a charter amendment raising the override requirement to nine council votes. Two years ago, voters passed another amendment changing the override requirement to a unanimous vote of all current council members, a change designed to deal with council vacancies. Ficker has qualified another amendment to the charter this year which would revoke all overrides of the limit if approved by voters.

Elrich made his dislike of the current charter limit structure plain in his most recent recommended budget. In his budget message, Elrich wrote:

When the County Council proposed to the voters our current Charter limit on property taxes in 1990, few people could have foreseen the dramatic changes that would take place in Montgomery County and around the globe. In the past 30 years, our school population has grown by 65 percent and our overall population has grown by 40 percent. The services we provide are now more complex and seek to address a range of challenges, from traffic congestion and climate change to health care disparities and linguistic diversity. And over the past four decades, our property tax rate has declined by 35 percent.

We have all witnessed other local governments regionally and nationally experience generational decline due to conflicting, irreconcilable fiscal policies. Montgomery County is at the precipice of such a decline if we cannot get ourselves out of this cycle of self-enforced structural deficits and inequitable, unpredictable revenue caps. Therefore, I will be sending the Council a proposal for a Charter amendment that will revise our revenue cap to provide certainty to homeowners. This proposal will eliminate our old, cumbersome revenue cap and replace it with a three percent cap on the increase in any homeowner’s taxable assessment. This will give our taxpayers real protection from unexpected increases in property values. It will also provide the County Government with a higher degree of predictable tax revenues like every other jurisdiction in our region.

Without such a change in the Charter, our community could be facing a situation in FY21 where a recession and deflation cripple our ability to provide emergency services and a quality public education system. This perfect storm would threaten lives and diminish the value of properties in our County. I will not stand by and let our community be harmed by the ghosts of voters from four decades ago.

An internal document written by one of Elrich’s special assistants, Debbie Spielberg, lays out the administration’s specific objections to the current charter limit. (Spielberg is the Hand of Elrich. No one in the administration is closer to the boss.) Among Spielberg’s criticisms are that the current charter limit structure does not capture growth in the tax base, is vulnerable to underestimates that affect the taxable base subject to the limit forever and leaves open the possibility of having a zero inflation rate stop increases in collections. Spielberg is right on all of these points. She also alleges that the charter limit has caused MoCo to have a lower property tax rate than most of its neighbors. This point is more complicated. MoCo’s property tax rate was in the middle of the pack for Maryland counties in FY20 and is lower than much of Northern Virginia because those localities do not charge income taxes. Spielberg’s memo is reproduced below.

The administration is fearful of what would happen if voters pass the new Ficker amendment, which would remove the county council’s ability to break the charter limit. Spielberg’s memo proposes an alternative charter amendment that would do three things.

- It would apply the charter limit to the property tax rate, not the volume of collections.

- It would allow six council votes to raise the tax rate. The current override requirement is a unanimous vote by all current council members.

- It would limit the growth in the taxable value of an owner-occupied residential property to 3% per year.

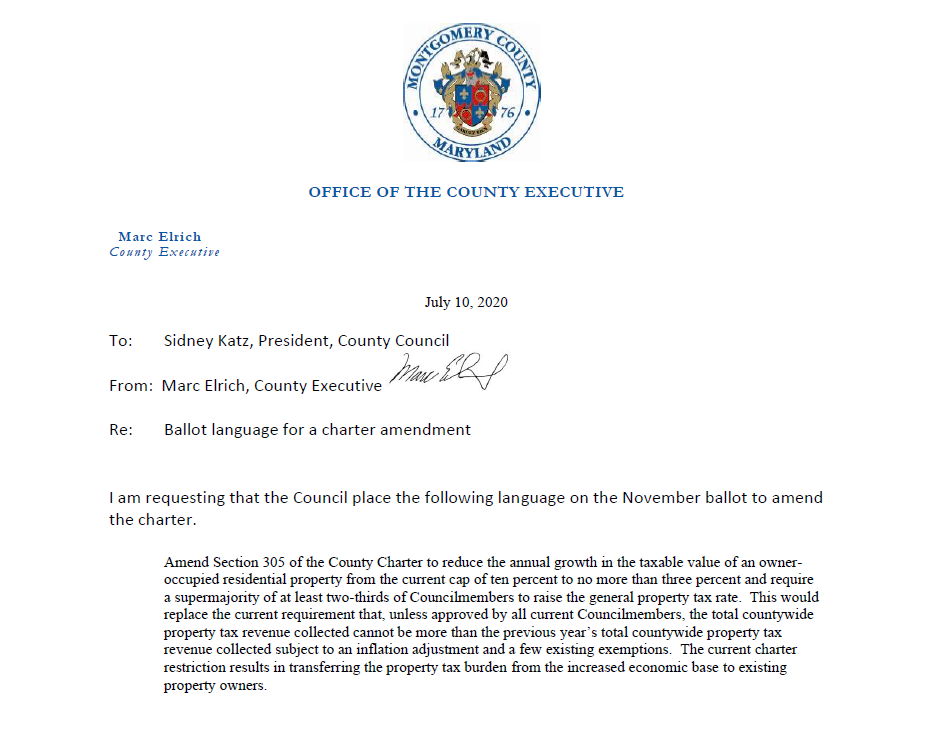

Elrich’s official charter amendment request to the council appears below. The council and the voters – but not the executive directly – can place charter amendments on the ballot.

The obvious impact of this proposal would be to make property tax hikes easier. Instead of one council member being able to block an increase, now four would be required to obstruct it.

The less obvious impact has to do with the distribution of future tax increases. Right now, the county limits the annual increase of taxable assessments on principal residences to 10%. The administration’s proposal would lower that to 3%. That looks good for homeowners but let’s think about the properties that are not principal residences: commercial properties and residential rental properties. If homeowners are shielded from tax hikes, commercial entities and residential renters will pay more. This is a significant policy shift with two consequences. First, it would impede the county’s commercial sector from recovering from the COVID-19 economic crisis. (Let’s remember that MoCo had major competitiveness issues before the virus arrived.) Second, renters – especially low-income residents and small businesses – have been dramatically affected by the current economic downturn. How much more can they pay? Policy makers should think carefully about having them assume more of future tax burdens.

The looming prospect of a new Ficker amendment has generated both this concept as well as another amendment on property taxes now before the county council. (The council’s version would require a unanimous council vote to raise the tax rate and contains no redistribution of the tax burden.) If one or both alternatives to Ficker make it to the ballot, voters will face complicated choices on tax policy. And they will do it during one of the worst recessions ever.