By Adam Pagnucco.

MCGEO President Gino Renne has sent out a blast email to his MoCo government members celebrating his new agreement on pay increases. Gino is right to celebrate because overall, both the COVID pay he negotiated and the new deal constitute a huge win for labor.

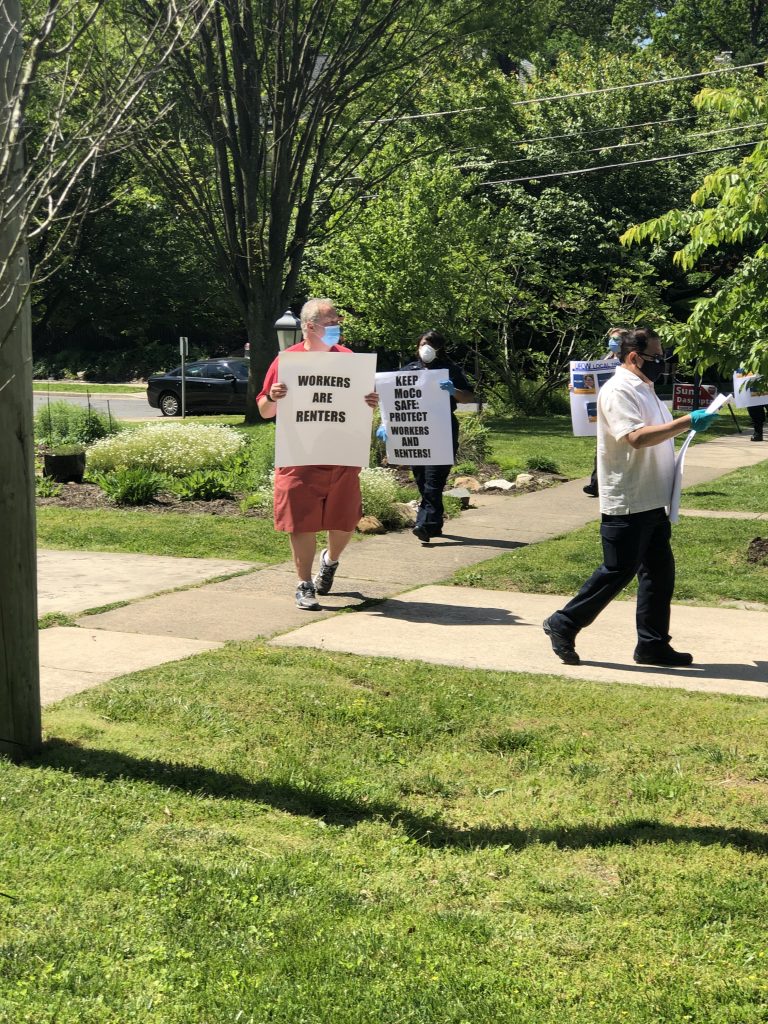

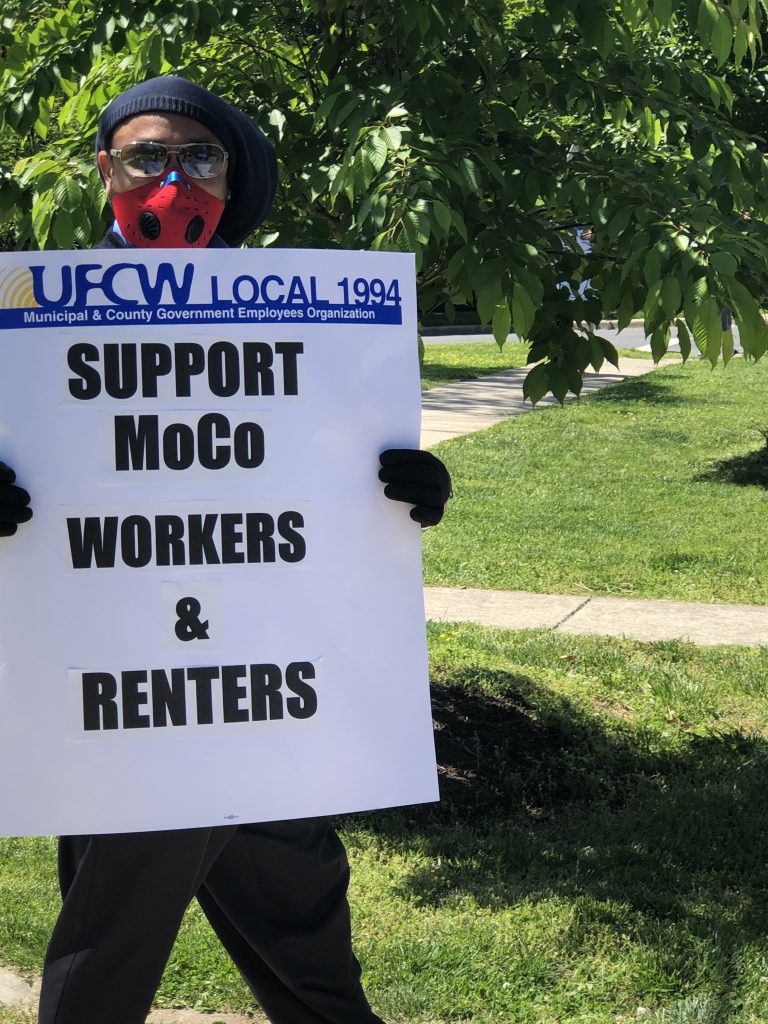

Let’s go back to May 2020. Facing a budget-ravaging pandemic, the county council voted down compensation increases contained in the collective bargaining agreements negotiated by MCGEO, the fire fighters and the police, the three unions who together represent MoCo employees. Those agreements contained $28 million in FY21 compensation increases, amounting to $38 million on an annualized basis. Labor was outraged and proceeded to picket the home of Council Member Hans Riemer, who was particularly vocal in abrogating the agreements.

But just a month before, the unions negotiated COVID pay agreements with County Executive Marc Elrich that provided far more than their abrogated contracts. The county eventually paid out more than $80 million in accordance with those agreements, greatly exceeding the $400,917 spent by Park and Planning and more than double the cost of the unions’ rejected contracts. And as the price for agreeing to let COVID pay end, Gino negotiated a 3.5% service increment, a 1.5% general wage adjustment and longevity pay which, on an annualized basis, should deliver tens of millions more for his members. Plus he can negotiate even more pay increases for FY22.

Gino and Marc Elrich in March 2017.

This was a master clinic on negotiating strategy, a colossal win for the unions and another story adding to Gino’s legend. We reprint his blast email below.

*****

From: UFCW Local 1994 MCGEO info@mcgeo.org

Subject: [External] Montgomery County Members | Breaking News – Local 1994, FOP 35, IAFF 1664 & County Executive Reach Agreement on FY 21 Compensation Package and COVID Differentials

Reply-To: info info@mcgeo.org

[Action Alert]

Breaking News – Local 1994, FOP 35, IAFF 1664 & County Executive Reach Agreement on FY 21 Compensation Package and COVID Differentials

The CARES act which provided funding for local government operations during the pandemic ended December 31, 2020. When the CARES act ended, the county became responsible for all costs, to include COVID differential pay. Since January 1, the County Council has insisted that our COVID differential pay end immediately and they planned to pass a resolution to end it this past week. The differential was bargained between Local 1994 and the County Executive for the additional risk assumed during the pandemic. The three county government unions, FOP Lodge 35, IAFF Local 1664 and Local 1994, engaged the County Executive and members of the Council to voice our concerns over their attempt to end COVID differential pay, and reminded them that increments and general wage adjustments were not funded for FY21.

After multiple meetings with the County Executive and members of the Council, we agreed to a FY21 GWA of 1.5% to begin in the last pay period of June 2021 and a service increment and longevity step to those eligible consistent with the MCGEO Collective Bargaining Agreement. The service and longevity increases will be effective April 11, 2021, for those who missed their increment or longevity step between July 1, 2020, and April 11, 2021. Members who are eligible between April 12 and June 30 will receive their FY21 increments and longevity step on the date due.

Now that the Council has assured the County Executive and the Unions that a GWA and increments will be funded before the end of the fiscal year, effective tomorrow (2/14/2021), the COVID differential pay will end. Although we know that the COVID differential was not nearly enough money to assume the risk of a deadly pandemic, it helped to make working in these conditions bearable. Understand, Montgomery County employees received the highest COVID differential pay in the DMV, if not the nation. Other local jurisdictions who provided a COVID hazard pay ended it months ago. In the event a new stimulus package includes money for a hazard pay, we will be back to the bargaining table with the executive on your behalf.

As always, your best interests and the interests of your union brothers and sisters are paramount. Take care of one another.

In Solidarity,

Gino Renne