Both John and I will be out of town for much of June. I’ll be overseas for much of this month and unreachable by phone, so if you have my cell number, please don’t use it. If you need to reach me, the best place is my email at lublin.david at gmail.com. As there will be a time difference and I’ll be on the go, please understand if replies are significantly delayed.

Monthly Archives: May 2014

WaPo Endorses in MoCo Legislative Races

You can find the full endorsements online:

District 14

House: Kaiser, Luedtke, Zucker

District 15

House: Dumais, Miller, Fraser-Hidalgo

District 16

Senate: Lee

House: Kelly, Frick, Korman

District 17

Senate: Kagan

House: Barve, Platt, Hoffman

District 18

Senate: Madaleno

House: Gutierrez, Waldstreicher, Shetty

District 19

House: Kramer, Cullison, Bardack

District 20

House: Hixson, Unger, Jawando

Hixson Endorses Smith, Moon

The day after Sen. Jamie Raskin endorsed Will Smith and David Moon for delegate, longtime incumbent Del. Sheila Hixson has done the same

Dear Friends

This has been an exciting primary season in District 20 and we have seen a wonderful group of candidates step forward and ask to represent District 20 in Annapolis. Making the decision to run for public office is not easy and I believe it takes personal courage and a great commitment to your community to do so. You open yourself to the judgment of your fellow citizens as you lay out your vision for the future, and believe me, District 20 is filled with strong, well-articulated opinions on most topics!

I have watched all of the candidates put themselves forward and express hopes and aspirations for our District, our County, and our State. After attending one of our candidate forums, a friend from North Carolina said to me, “Heck we would take any one of them!” All the candidates have a lot to proud of, and I am sure all of them will continue to contribute to our community.

But this is politics and difficult choices have to be made. The question for me is which of these excellent candidates best reflect the values and diversity of District 20 and demonstrate an ability to move from being an advocate of a particular view to being a representative of many views?

The two candidates that I feel best meet these qualities and the progressive values and diversity of District 20 are Will Smith and David Moon. I am proud to endorse them, and as I have learned a thing or two about how Annapolis works, I will proudly serve with them and support them as they learn the ropes of being a State delegate. The District 20 delegation has enjoyed a formidable reputation as a cohesive and very effective legislative team. This effectiveness will continue with Will and David joining Jamie Raskin and me as we continue to fight for what is right and fair.

I have known Will Smith for more than five years now, and I am increasingly impressed by this young man. Born and raised in Silver Spring, the first member of his family to graduate from college, he has a very impressive background as a lawyer and scholar with undergraduate and law degrees from the College of William and Mary and a Masters degree in public policy from Johns Hopkins University. He continues to serve our country as an officer in the Naval Reserves, and recently served as an appointee in the Obama administration. But more than that, Will has had “boots on the ground” in our community. Will established the Youth Achieve Scholarship Fund, raising thousands of dollars for scholarships for young people from our community. He is active in GapBuster Learning Center, and is a Board Member for the Gandhi Brigade, IMPACT Silver Spring, and the NAACP Montgomery County Chapter. Will speaks eloquently about the public policy challenges of our State, from education and solving the achievement gap, to business development and job creation. He has an impressive knowledge of policy details and is an astute analyst of the costs and benefits involved in policy implementation. I would welcome Will Smith as a partner on the District 20 team.

David Moon is an intense, accomplished political and community activist. He holds progressive ideals close to his heart and is willing to stand up and fight for his values. As he says, he “is not waiting for Superman”. David is a civil-rights lawyer and an influential activist in issues that impact our community. He has run political campaigns in which he proved to be an adept strategist and master of social media. He has worked on issues such as the Dream Act and voter registration with Casa de Maryland and has developed an expertise in mass transit as Executive Director of Communities in Transit. For several years, his political blog, Maryland Juice, has been a must-read analysis of political developments in Montgomery County and around the state. He knows District 20 from the ground up. Now he is ready to take the next step as a member of the House of Delegates in Annapolis representing our wonderful diverse district. I will be very proud to serve with David Moon and Will Smith and I offer them both my heartfelt endorsement.

Delegate Sheila Hixson, D-20

Ways and Means Committee

On Taxes, Part III

This three-part series on tax policy concludes with a discussion of stability, purpose and balance. (Read Part I and Part II.)

Stability

Progressive taxes tend to be the most volatile, that is they tend to go up and down with the economy. When rich people are doing well, they really rake in the cash but the drop off in bad times is precipitous. This outcome is unsurprising as the income of wealthy taxpayers is more sensitive to the performance of volatile assets.

For this reason, the least progressive taxes tend to be the most stable during recessions. While this is an argument against solely relying on taxes on the wealthiest taxpayers, it is not one against progressive taxation. As one senior legislator explained to me, a good way to look at taxes is that they are a portfolio. You have to have a mix of progressive and stable non-progressive tax revenue sources. Spending below the State’s means in good times (i.e. a rainy day fund) is also good insulation against inevitable downturns.

Purpose

The central purpose of taxes is to raise revenue to pay for government services. More broadly, they should be designed to encourage economic prosperity. On occasion, they can also help to encourage or to discourage an activity (e.g. smoking, energy use). Their purpose is not to punish people for doing well—something sometimes forgotten in the new focus on economic inequality.

At the same time, this does not prevent tax policy designed to protect people with lower incomes (i.e. low taxes) or make it easier through spending to make it possible for people who work hard to live decent lives (e.g. health care, earned income tax credits, educational spending).

Balance

Relatedly, part of the danger of increased polarization can be a lack of proportion in approach. Funding government services costs money. Few enjoy paying taxes but they are the price we pay to have police, fire, schools, roads, etc. While the conservative desire to shrink government is perfectly legitimate that desire goes far overboard with those who attack all taxation and view any taxation as virtually illegitimate.

On the other side, some progressives seem to talk about corporations and profits as if both are inherently illegitimate rather than as employers or engines of economic activity. Moreover, the goal of progressive tax policy should not be endlessly higher taxation or to kill economic growth. As former President Bill Clinton loved to remind Democrats, low unemployment was the best anti-poverty program.

Raskin Endorses Moon and Smith, Defends Shurberg

In a major boost to their campaigns, incumbent Sen. Jamie Raskin has endorsed David Moon and Will Smith for the two vacant delegate seats in District 20. Both Moon and Smith had managed one of Jamie’s earlier campaigns. Previously, Jamie had already endorsed incumbent Del. Sheila Hixson.

Despite not endorsing him, Raskin also defended Jonathan Shurberg against attacks on him for having been suspended temporarily from the practice of law for co-mingling client funds with his own:

Because of my allergy to negative politics, I have been unhappy about the imbalanced ad hominem attacks (not coming from District 20) on my friend and Delegate candidate Jonathan Shurberg. While he was found to have negligently misappropriated client funds, he was punished for it, no clients were harmed, and all funds were restored. In my opinion, this event should be viewed in the context of Jon’s significant public contributions to our community . . .

Raskin’s endorsement of David Moon:

Born in Takoma Park to Korean immigrants, David Moon has had an unusually effective career as a grassroots political organizer, civil liberties and civil rights policy consultant and attorney, and founder of the awesome political blog Maryland Juice, which was named one of the nation’s best by the Washington Post. A champion of insurgent reform politics, David volunteered to manage my underdog campaign for the Senate in 2006 and, through many sleepless nights and by precocious mastery of the new social media, built the organizational infrastructure for the movement that changed Montgomery County politics forever. Recognized for his dazzling political mind and devotion to social justice in our community, David went on to run numerous successful campaigns at the county and state level. He also used his formidable political skills to mobilize thousands of Marylanders to defend at the polls our legislative victories on marriage equality and the Dream Act. What impresses me most about David is his wonderful modesty, his passion for service to our community, and his love of making both democracy and new technology work for all. He will make an exceptionally able and faithful servant to Silver Spring and Takoma Park in the House of Delegates, and I support him with pride.

Raskin’s endorsement of Will Smith:

Born at Holy Cross Hospital in Silver Spring, the son of a Barwood taxi driver and a civil servant at GSA, Will Smith is the first person in his family to graduate from college, a gifted lawyer and former legislative assistant at the ACLU of Washington, a passionate Democrat, a U.S. Naval Reserve Officer and Obama administration appointee, and a young person of awesome intellect, character and commitment. In 2010, Will ran the combined campaign of the District 20 Delegation (Delegates Hixson, Hucker, Mizeur and myself), and in that capacity I got to know him as a zealous advocate for the young people of Silver Spring and Takoma Park. An active Board Member for the Gandhi Brigade, IMPACT Silver Spring, the NAACP Montgomery County Chapter, and GapBuster Learning Center, Will established the Youth Achieve Scholarship Fund, which has raised tens of thousands of dollars for college scholarships for young people in our community. As a Delegate, Will promises to fight hard to promote educational excellence for all of our kids, accelerated school construction in Montgomery County, and criminal justice reform, especially passage of the “Second Chance Act,” a measure to shield from public scrutiny marijuana possession and other nonviolent misdemeanor convictions several years after a person completes his term; with Will’s urging, I introduced the Second Chance Act in 2014 and we passed it in the Senate this Session but it languished on the House side. I know that, as a Delegate, he will not rest until he gets the job done. I also know that he will stay in close touch with our community groups and neighborhood associations because he is totally accessible and responsive; my friend Paula Kowalczuk remembers him coming to register voters for several hours on the weekend when he was in high school! I have great confidence in Will and support him with pride and excitement for the future.

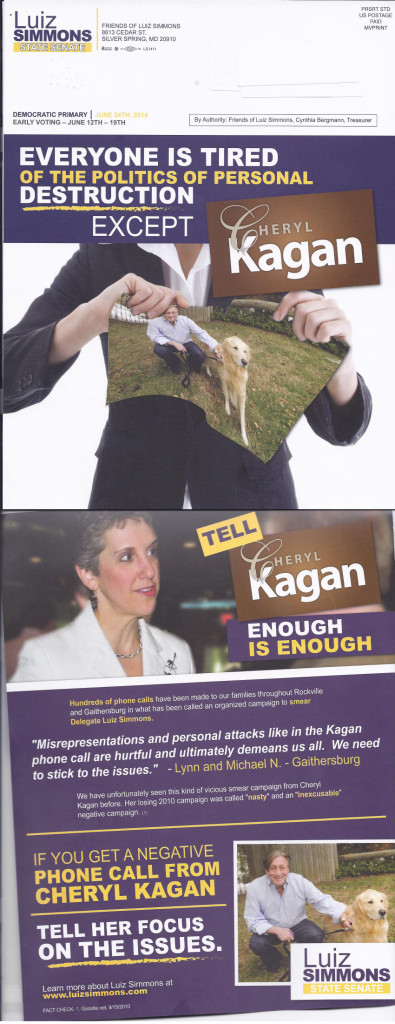

Simmons Negative Mail Piece

On Taxes, Part II

The second in a series on tax policy. (Read Part I here.)

Redistribution at the State Level

Different counties have different per capita tax bases. As a result, it makes sense that school aid to Maryland counties should take wealth into account with the key caveat that each county must raise its fair share of taxes. This is one of the key ideas behind the much-debated Maintenance of Effort law. Poor counties cannot simply pocket aid from the state without raising their fair share in terms of their tax base. Nonetheless, school aid should not be on a simple per student basis.

Additionally, in estimating the amount redistribution between counties or individuals, we need to take into account both taxes and spending. Expenditures on colleges and universities disproportionately help middle-income and wealthy taxpayers.

Redistribution at the County Level

In all the discussion of economic inequality, it often seems lost that the greatest redistribution occurs towards those with children in the public school system. Educational spending takes up an enormous share of county budgets and overwhelms spending in other areas. This is why double-income no kids families are such desirable residents—they contribute a lot in taxes but demand less in the way of services. Sure, we all benefit from having an educated population but paying for it is a transfer from those without to those with kids.

Subsidy Abolition

The competition among states through subsidies for large companies is execrable. Conservatives should hate them because they are economically inefficient and businesses should go where it makes sense. Progressives should hate them for the additional reason that they result in levying higher tax rates on businesses that do not have the leverage to advocate for them. It’s probably just a pipe dream but the states should negotiate a compact to end them.

Internet Taxes

We subsidize businesses located out of state by de facto exempting them from state taxes. (De facto because you’re supposed to pay state and local taxes on these purchases but nobody does.) The effect is that brick-and-mortar stores that actually employ people in Maryland must collect taxes but Internet businesses located elsewhere do not. This makes no sense to put it mildly and is increasingly economically distortive as more business occurs in the form of e-commerce.

Ike Leggett’s First TV Ad

Bill Ferguson Video

On Taxes, Part I

The first in a short series on tax policy.

Progressive Taxation Overall

Some progressives believe that every single tax must be progressive. Instead, progressivity is more properly measured by an examination of overall taxes rather than each tax separately. In other words, regressive taxes—such as the gas tax or car registration tax—are fine as long as the overall system remains progressive.

Federal Taxes Should be the Most Progressive

The ability of many businesses and individuals to move pits states and localities against one another in terms of the tax burden. While not all businesses can easily change locale, others may choose where to locate based at least partly on state and local taxes. In contrast, it’s harder for many businesses to escape the United States even in our increasingly globalized economy.

Even Flat Taxes Can be Progressive

If you have a flat tax rate of 5% that only kicks in after the first $50,000 in income, the percentage of total income paid will vary dramatically based on income. People who earn less than $50,000 will pay nothing, while people who earn $70,000 will pay $1000 (5% of the $20,000 above $50,000) or 1.4% of total income. In contrast, people with incomes of $120,000 will pay $3500, or 2.9% of income. Someone with an enviable income of $1,000,000 per year would pay $47,500, or 4.75%.

In the years when Maryland became the wealthiest state in the country, we had a very flat tax that was not at all progressive because the top marginal rate kicked in with only a few thousand dollars of income. Today, we have gone in the opposite direction with progressive taxation with a variety of marginal rates.

Broad Based is Best

The temptation to encourage or to discourage different activities through the tax code is great. But loopholes or variation in tax rates are economically distortive and make the code more complex. Broad based taxes also spread the pain of taxation across different businesses and fields of economic activities.

Externalities are the Exception

The key exception to broad based taxes should be when economic activity dumps costs unfairly on the public sphere. Pollution is the key example as polluters dump the cost of cleaning up their mess on everyone else. As a result, levies on these sorts of activities can help discourage them or pay for cleaning up the mess at time even if broad-based taxation should remain fundamental.