By Adam Pagnucco.

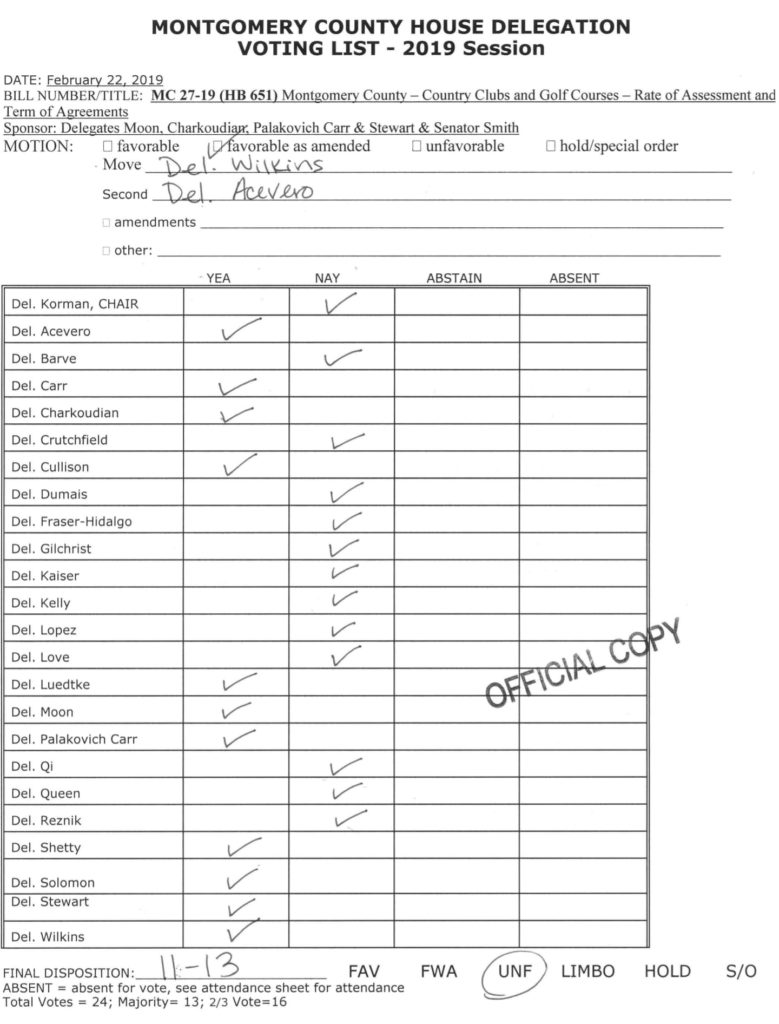

Delegate David Moon’s local bill on country clubs, which would have phased out a $10 million special tax break received only by country clubs with golf courses, did not get much love from elected officials. The County Council did not support it (despite recently passing $53 million in budget cuts), the County Executive outright opposed it and Moon’s colleagues in the MoCo House Delegation killed it on a 17-7 vote. This story is not quite over though because Moon has a statewide bill that would not eliminate the tax break but would limit country clubs’ assessed land value to one percent of market value.

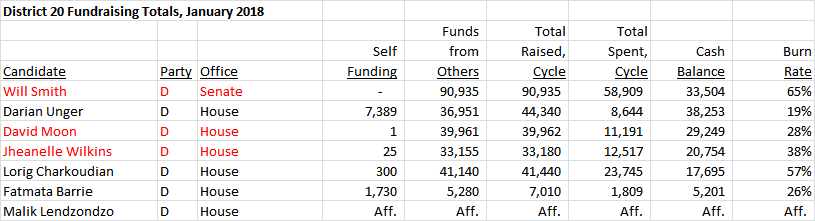

Elected officials may not have embraced Moon’s bill but there is another group of people who absolutely loved it: non-incumbent candidates for office. In the wake of the bill’s death, MANY candidates made clear they would support it if elected. Here’s a sample.

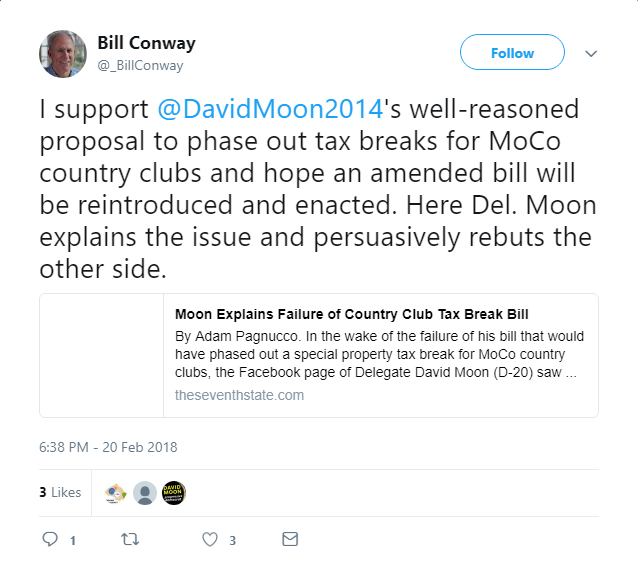

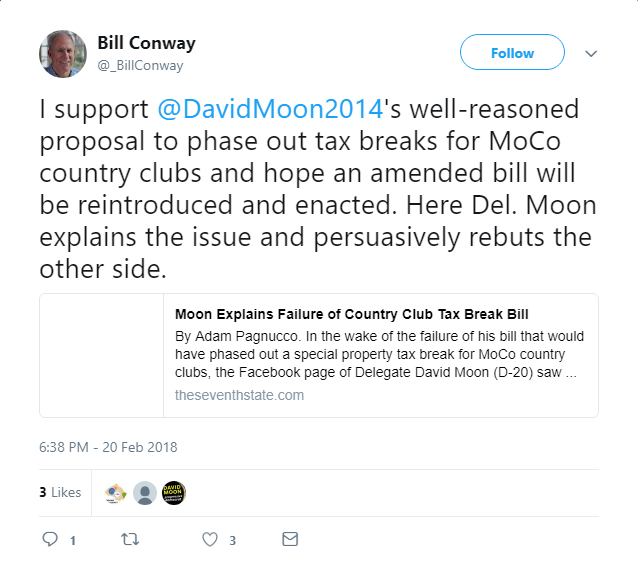

Bill Conway (Council At-Large) tweeted in support of the bill.

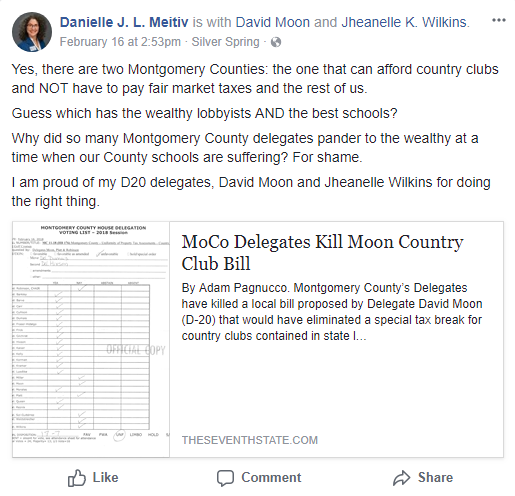

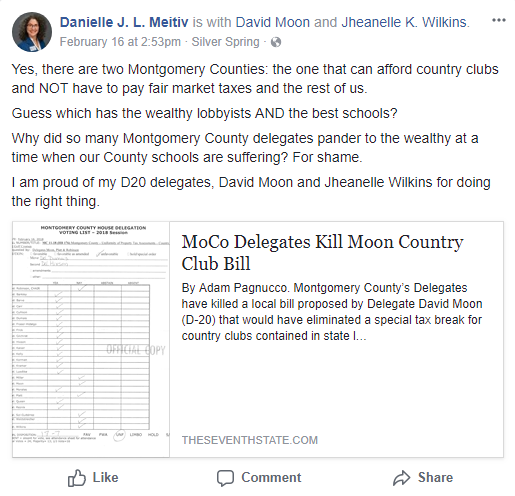

Danielle Meitiv (Council At-Large) wrote in support of the bill on Facebook and criticized those who voted against it.

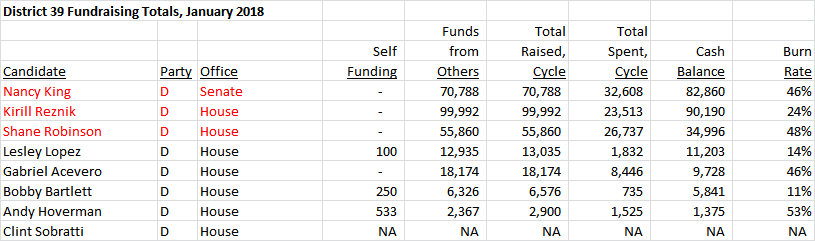

Andy Hoverman (House D-39) took out a Facebook ad supporting the bill. Among the District 39 Delegates, Shane Robinson voted for the bill while Kirill Reznik and Charles Barkley (who is running for Council At-Large) voted against it.

Three non-incumbent candidates for Delegate in District 18 spoke out in favor of the bill on Seventh State’s Facebook page.

Emily Shetty said, “We have a budget deficit and are struggling to fully fund schools and other high priority services. I support David’s bill, and appreciate and would have supported the amendments he made to further tailor it as well. I don’t think it’s fair for private clubs to benefit from tax breaks otherwise unavailable to families and other employers in the state.”

Mila Johns said, “I 100% support David Moon’s bill. I have previously stated that on this page and I’m extremely grateful to Jeff Waldstreicher and Ana Sol Gutierrez for their principled vote. I read Al Carr’s reasoning and while I understand how he came to his decision, I disagree with it. It’s simply hard to believe so many in our county discarded a very reasonable way to raise revenue in a time of such painful budget shortfalls.”

Leslie Milano said, “Here’s where I stand: We cannot continue to subsidize a luxury restricted to the wealthy when taxpayers do not have access to the very thing they are subsidizing. The fact that only the very wealthy can access this subsidized luxury is extremely distasteful, especially when there is a great deal of poverty in our county as well as a budget shortfall of $120M affecting a variety of areas for every taxpayer. I would sponsor or co-sponsor a revised bill come January to ensure that clubs are paying their fair share. I agree with Ike Leggett that MoCo clubs shouldn’t be taxed differently than clubs in other counties, but I think we need to course correct MoCo clubs first with a local bill – as a sign of good faith – and in a second bill address remaining clubs in the state, which is David’s proposal. It will be easier to pass in two stages and moves us in the right direction.”

Among the District 18 Delegates, Al Carr voted against the bill while Ana Sol Gutierrez (who is running for Council District 1) and Jeff Waldstreicher (who is running for Senate) voted for it.

Several other candidates sent us statements in support of the bill. They include:

Brandy Brooks (Council At-Large)

Our budget and tax policies should be built around the mutual concept of the common and each contributing their fair share. The common good should guide us in our decisions as well as our interactions with one another. It’s clear the special tax breaks for country clubs benefit only a few. When wealthy special interests have a major influence over the policy discussions — even around common sense bills to create tax equity — our communities suffer. The county faces a huge budget shortfall, a severe housing crisis, income inequality, and education and opportunity gaps in our schools, to name a few of the pressing issues. Yet, the arguments made by those opposing the bill fail to address these needs. Instead, the country club lobbyist gave lawmakers an ultimatum: kill this bill or workers lose their jobs. All too often, hourly and low wage workers are the first to suffer when management says they need to tighten their belt. Our policymaking should be focused on the common good. Lawmakers need to hear the voices of everyday people over corporate and big money interests. Our voices — the voices of everyday people — must be central in our policymaking, otherwise we further divide the county into the haves and have nots.

Hoan Dang (Council At-Large)

I strongly backed Delegate Moon’s bill to phase out the special property tax break for Montgomery County country clubs. I was disappointed that this bill was killed by special interests in this County. This action is another example of why we need more efforts to take money out of politics, such as the public financing of all candidates in Montgomery County from School Board to the General Assembly.

Seth Grimes (Council At-Large)

I support ending special tax treatment for country clubs. Thanks to David Moon for taking a shot. We’ll try again in 2019.

Ben Shnider (Council District 3)

It’s common sense that clubs with annual dues in the tens of thousands of dollars should pay their fair share in taxes when we’re struggling to keep up with vital investments in transportation, school facilities, and other critical infrastructure. It’s not sustainable to keep raising taxes on working families in the County to meet our budgetary needs.

Vaughn Stewart (House D-19)

It’s a shame that this proposal to bring the taxes paid by country clubs in line with the far higher taxes paid by working families and seniors failed to generate wide support. The extra $10 million of revenue per year would be especially beneficial at a time when the county is cutting school funding to address a $120 million budget shortfall caused in part by wealthy residents strategically withholding capital gains. If we can’t afford to pay teachers and staff what they deserve, we can’t afford tax breaks for Montgomery County’s Mar-a-Lagos. I’ve spoken to thousands of District 19 residents since starting this campaign, and they want to know how I’m going to reduce their healthcare costs, create alternatives to traffic congestion, and fully fund their kids’ schools. Not one of them has asked me to continue subsidizing the golf games of our county’s wealthiest few. I look forward to helping Delegate Moon revive this bill next session.

Editor’s Note: All three District 19 Delegates – Bonnie Cullison, Ben Kramer and Marice Morales – voted against the bill.

Chris Wilhelm (Council At-Large)

I’m disappointed that our County and State representatives weren’t willing to stare down the country club lobbyists on this bill, especially when the County is getting ready to balance the budget by cutting from education and other important services. I see this issue through a racial equity lens: how can we claim to “resist” and stand up for our diverse community when so many of our officials were unwilling in this instance to help shift the tax burden from lower and moderate income residents to the ultra wealthy? This is why Montgomery County needs to stop patting itself on the back for being the most progressive place in the world; we aren’t.

*****

Additionally, institutional supporters of Moon’s bill include SEIU Local 500, MCGEO, National Nurses United, Montgomery County Young Democrats and the Sligo Creek Golf Association (which advocates for a public golf course).

Moon’s statewide bill, which limits but does not abolish the country club tax break, is headed to a hearing before the Ways and Means Committee tomorrow (February 27). The Chair of the Committee, Delegate Anne Kaiser (D-14), voted against the local version of the bill.