By Adam Pagnucco.

The Daily Record has reported that a House of Delegates subcommittee has effectively killed Delegate Lily Qi’s bill allowing some grocery stores to sell beer and wine.

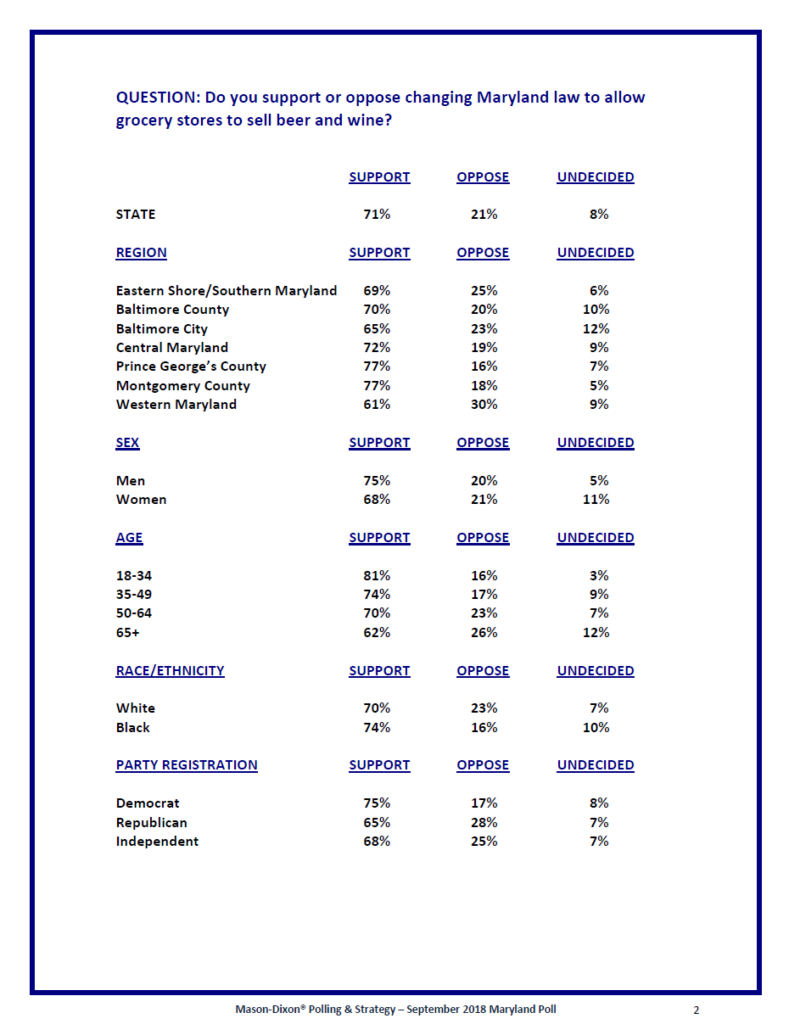

Passing this legislation was always going to be an uphill battle even though more than 70% of Marylanders support grocery store sales of beer and wine and the Maryland Retailers Association was making a big push for it. The Daily Record quoted Eastern Shore Republican Delegate Steven Arentz making the classic argument against the bill:

Most of our package stores are family-owned… We have three major grocery stores in Queen Anne’s County, and each one of them has a liquor store within 100 yards of them… this will put them out of business.

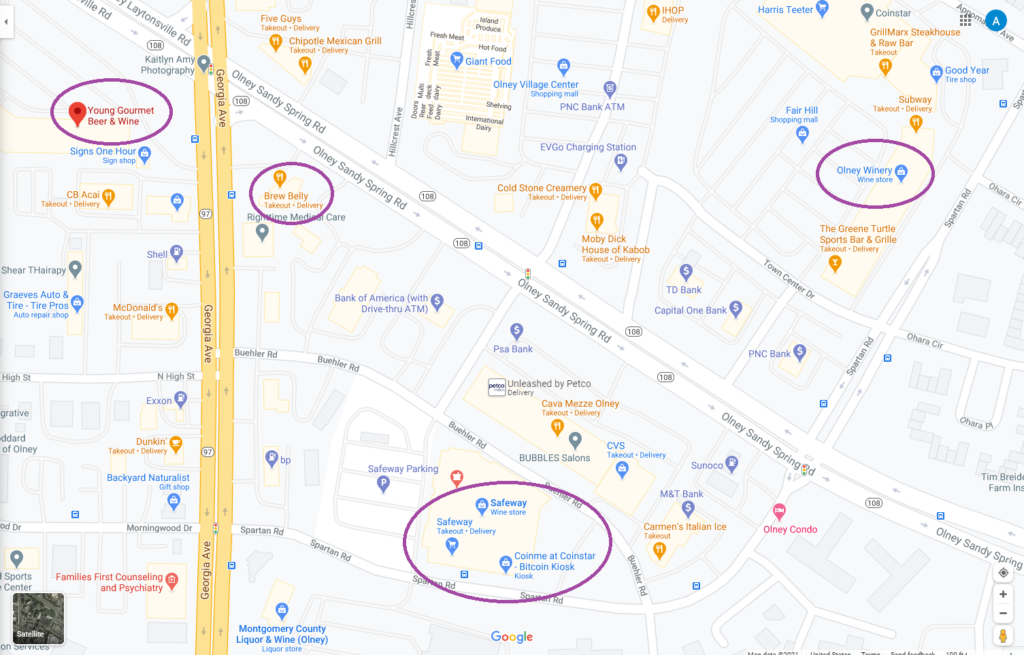

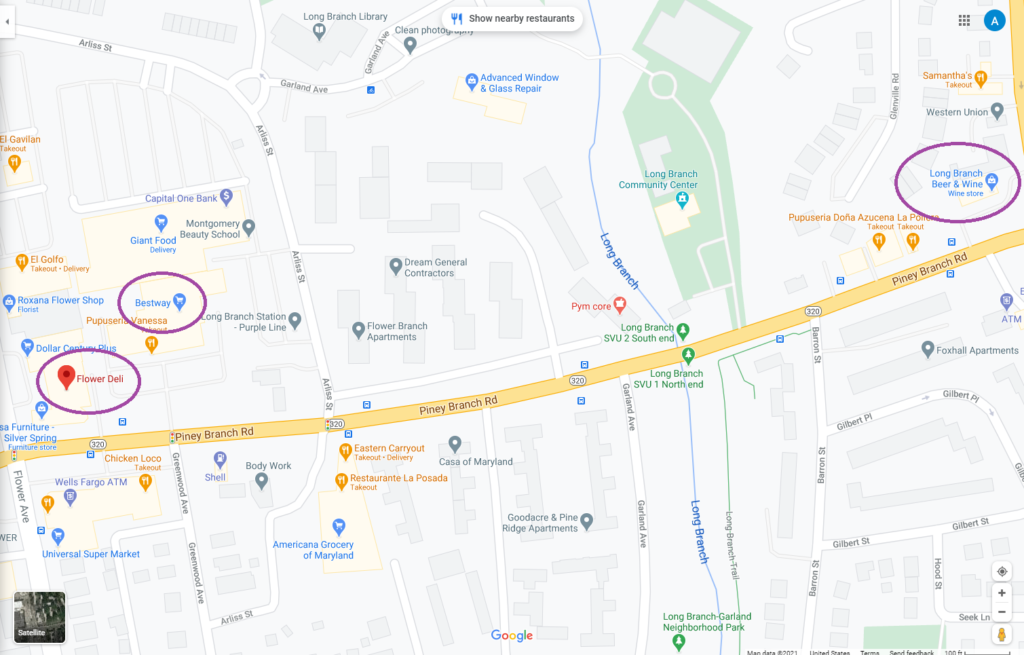

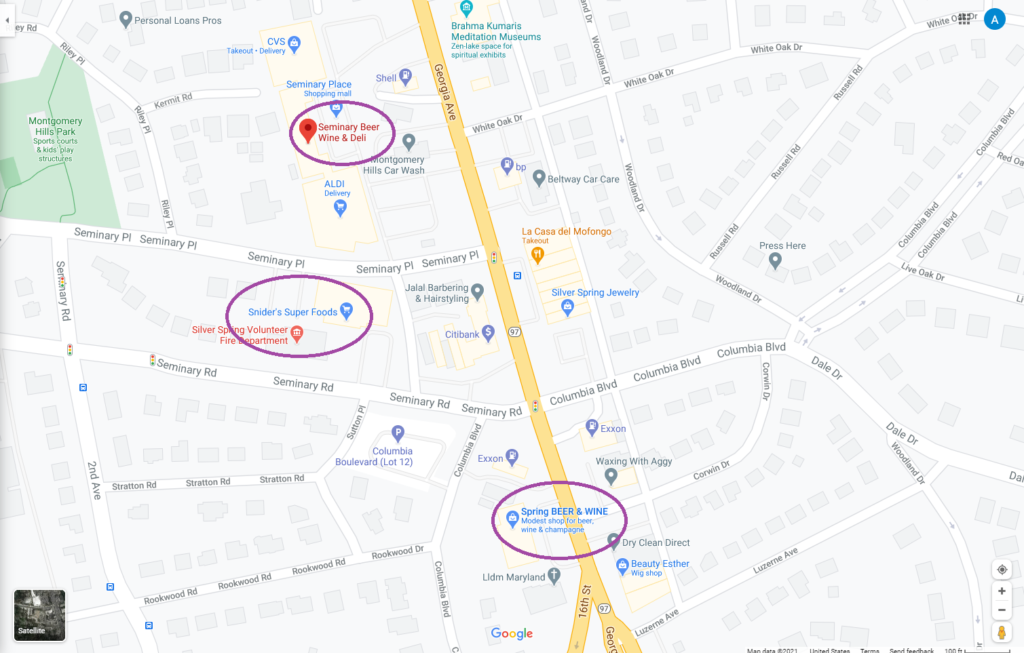

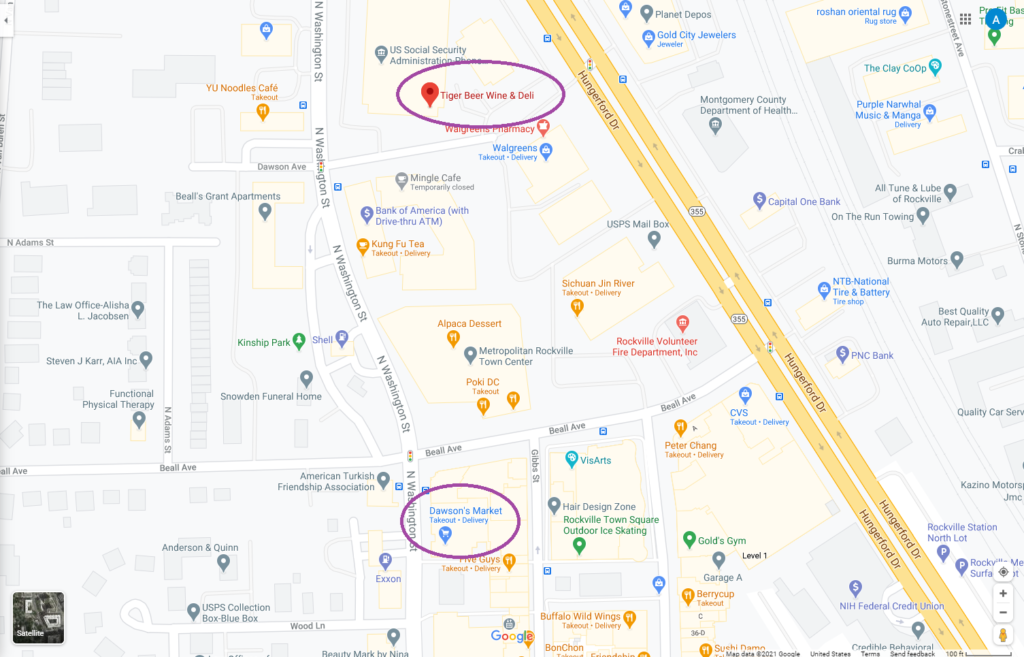

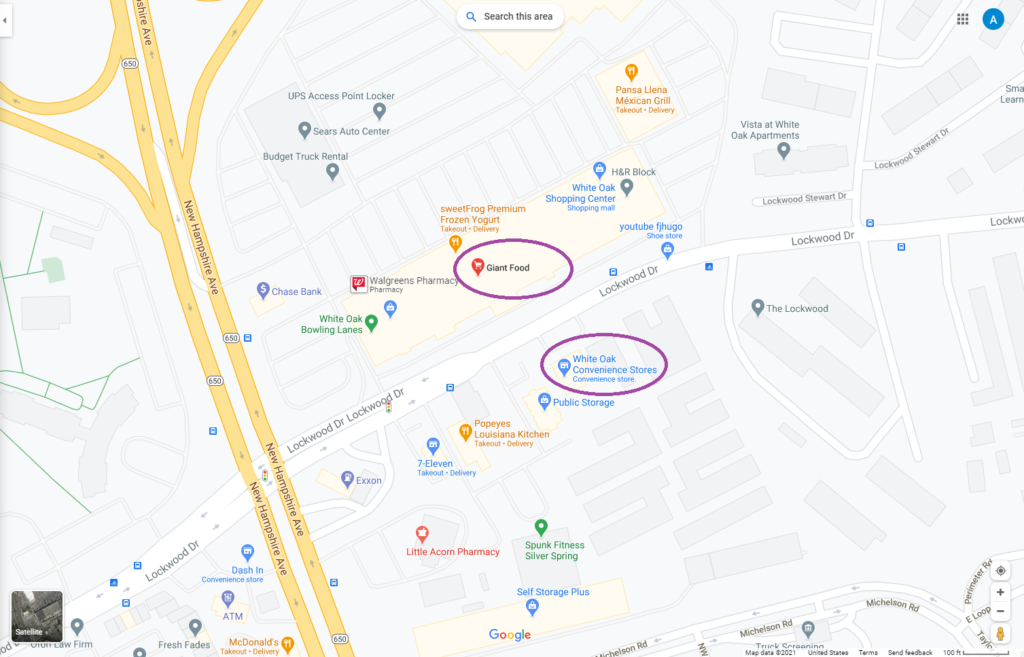

But Delegate Qi correctly noted that six MoCo grocery stores allowed to sell beer and wine had smaller beer and wine stores nearby, as we reported on Seventh State. The notion that grocery store alcohol sales will wipe out package stores is a myth and we proved it. But this myth is hard to kill because many people, including elected officials, repeat it endlessly despite evidence to the contrary.

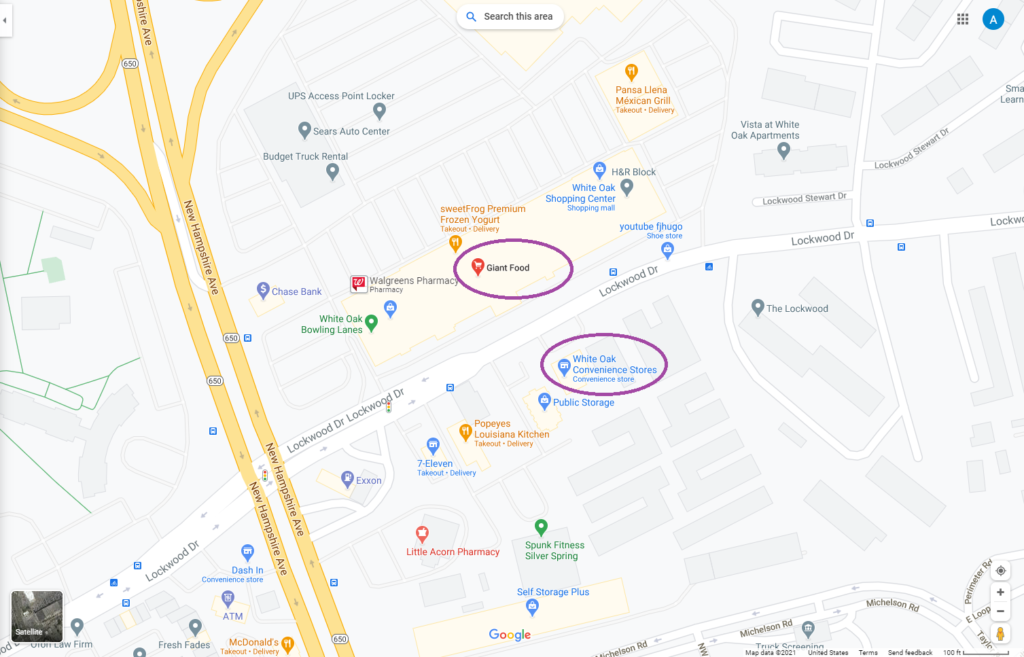

The map above shows the Giant on New Hampshire Avenue in Silver Spring, which is allowed to sell beer and wine, and the White Oak Convenience Store, a beer and wine shop, directly behind it. Both appear in purple ovals.

The bill is still technically alive in the Senate as it was introduced there by Baltimore City Senator Cory McCray. But the vote by the Alcoholic Beverages Subcommittee of the House Economic Matters Committee against Qi’s version of the bill prompted her to say that she is withdrawing it.

Delegate Qi told me that she believes the vote in the Alcoholic Beverages Subcommittee against her bill was unanimous. The members of the subcommittee are:

Talmadge Branch, Chair (Democrat – Baltimore City)

Jay Walker, Vice Chair (Democrat – Prince George’s)

Steven Arentz (Republican – Eastern Shore)

Benjamin Brooks (Democrat – Baltimore County)

Ned Carey (Democrat – Anne Arundel)

Seth Howard (Republican – Anne Arundel)

Kriselda Valderrama (Democrat – Prince George’s)