By Adam Pagnucco.

The state’s Office of Legislative Audits (OLA), which is part of the General Assembly’s Department of Legislative Services, is one of the most useful offices in all of state government. Its many audits of state agencies are often must-reads for those who care about the proper functioning of government. And this week, OLA dropped a bombshell:

Because of mistakes made by the state in calculating homeowner tax credits, thousands of MoCo homeowners have been overcharged on their property taxes.

In most states, local governments assess property values, send property tax bills and handle appeals. Maryland uses a hybrid system in which the State Department of Assessments and Taxation (DAT) calculates assessments and tax credit values which the local governments use when they send tax bills. The state handles appeals.

OLA audits agencies all over state government. On October 5, OLA released an audit of DAT that contained many troubling findings. Of most significance is its finding that a mistake in calculating homeowner tax credits resulted in thousands of MoCo homeowners being “improperly” – yes, that’s the word OLA used – overcharged on taxes.

OLA’s Finding 5 starts with this statement.

DAT did not ensure HTCs [homeowner tax credits] were properly calculated. As a result, HTCs awarded to thousands of homeowners in certain jurisdictions were improperly reduced by at least $4.4 million in fiscal year 2019. Most HTCs are calculated automatically by DAT’s automated system based on applicant income data entered in the system by DAT employees. Certain HTCs are calculated manually by DAT employees when a homeowner does not receive an individual real property tax bill (such as in the case of a housing cooperative) or for new home purchases where the tax credit must be prorated for less than a year.

The improper HTC calculations that we address in this finding were the result of DAT’s incorrect treatment of certain additional tax credits offered by certain local jurisdictions. Because each local jurisdiction may or may not provide its residents with other tax credits, which are in addition to the HTC provided for in State law and are paid for by the State, each jurisdiction could be impacted differently or not at all by this finding.

Let’s recall that Montgomery County offers MANY property tax credits and exemptions.

OLA continues:

DAT did not periodically review the programming of its automated system to verify that it was calculating HTCs in an accurate manner and in accordance with the law. As a result, DAT was not aware that it had incorrectly programmed the system and that HTCs for residents of at least one jurisdiction (Montgomery County) were not being calculated consistent with the law as further described below…

DAT’s automated system improperly deducted the income tax offset credit (ITOC) administered by Montgomery County from homeowners’ State and County real property tax liabilities, resulting in the HTCs awarded to homeowners in Montgomery County being improperly reduced. Specifically, individual homeowners under the age of 65 had their State and County HTCs improperly reduced by amounts up to a total of $692, and homeowners at least 65 years old had their HTCs reduced by amounts up to a total of $1,038. Based on our analysis of HTC applications processed in DAT’s automated system for Montgomery County residents in fiscal year 2019, the improper reduction of homeowners’ tax liabilities resulted in reduced HTCs awarded to 5,388 applicants totaling $4.4 million. We determined that, based on the automated system’s programming for Montgomery County, DAT improperly calculated HTCs dating back to at least 2005 in the same manner. We could not readily determine the amount by which HTCs were improperly reduced for years prior to fiscal year 2019…

DAT received advice from its legal counsel on January 23, 2019 that confirmed our determination that DAT’s HTC methodology commented upon above was incorrect.

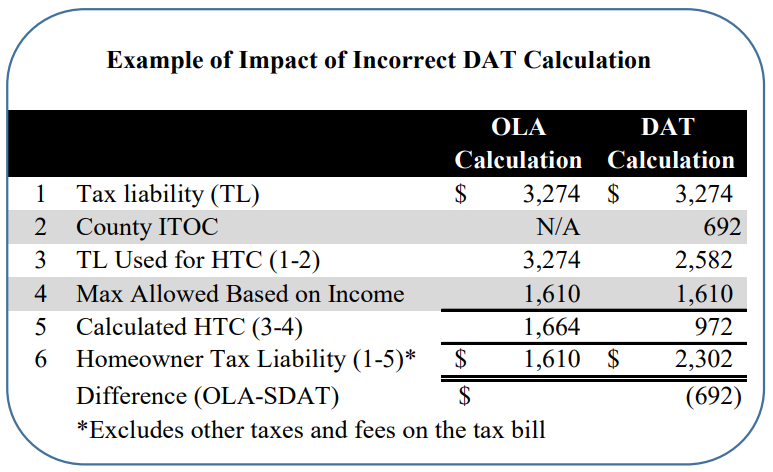

OLA offers this example of DAT’s miscalculation of the homeowner tax credit.

As the above example shows, the state’s miscalculation of the homeowner tax credit increases the homeowner’s tax liability, resulting in an overcharge on property tax bills. One of OLA’s recommendations was that DAT “consult with legal counsel on how to proceed regarding any refunds resulting from the HTC miscalculations including the $4.4 million noted above.”

DAT (which refers to itself as SDAT) was not having any talk of refunds. DAT responded:

SDAT disagrees with the sentiment of impropriety in the statement “HTCs awarded to thousands of homeowners in certain jurisdictions were improperly reduced by at least $4.4 million.” Before OLA began their audit, SDAT made a policy determination that increased the amount of tax credits received by certain jurisdictions in future years. Subsequent conversations with SDAT’s Assistant Attorney General confirmed that this is the appropriate course of action moving forward, but the Department does not feel as though prior year calculations were inaccurate as they were consistent with the Department’s practice at the time and implicitly upheld by PTAAB and Maryland Tax Court decisions.

OLA shot back:

DAT’s statement that the PTAAB and the Maryland Tax Court “implicitly upheld” the specific calculation method we addressed in our report is not consistent with its position during our audit fieldwork or subsequent to the audit when we discussed the finding with DAT management. Furthermore, the statement is questionable since the specific calculation method we addressed was demonstrably improper, and our assessment that the calculation method was improper was consistent with advice DAT received from its legal counsel in January 2019 as noted in our report.

So the two agencies are deadlocked. OLA can’t force DAT to give anyone any refunds. But the General Assembly can and OLA is an arm of the legislature.

MoCo’s 8 state senators and 24 delegates need to get all over this like white on rice. Government bureaucrats don’t get to screw up, get caught and then say, “Sorry, we’re keeping the money.” If OLA’s findings hold up, our delegation must ensure that any MoCo homeowners who were overcharged must be identified and paid refunds.