Today, I am pleased to present a guest post by Adam Pagnucco:

Even though MoCo consumers are fleeing the county’s archaic liquor monopoly, county officials are going all out to save it. Their arguments boil down to essentially one point: we need the money, and terrible things will happen unless we get it. The County Executive’s spokesman has said that a reduction in liquor monopoly money “means a reduction of county services or an increase in taxes.” And Council Member Hans Riemer has said that a loss of liquor money would mean “jeopardizing our ability to hire teachers or police officers.”

Are they right? Let’s look at the data.

First, let’s consider the nature of the county’s budget. It is not a static, zero-sum thing. Rather, it is a dynamic and growing thing that increases almost every year. The county deliberately sets property tax rates to increase collections at the rate of inflation (its charter limit) regularly. Income and energy tax collections rise with private-sector growth. State aid, mostly going towards public schools, has been rising. All of these factors have contributed to a steadily growing county budget.

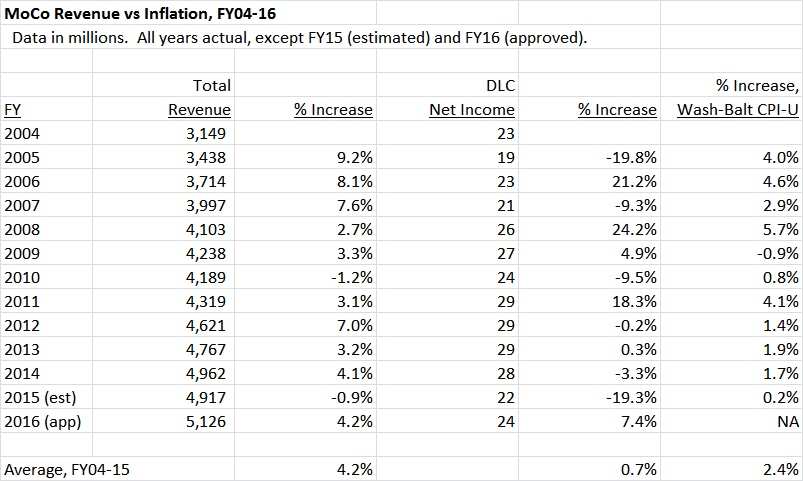

The chart below shows a comparison of total county revenues, net income from the county’s Department of Liquor Control (DLC), and the rate of inflation in the Washington-Baltimore metro area from Fiscal Year 2004 through Fiscal Year 2016.

A few things stand out. First, total revenues grew in ten of these twelve years, with small declines occurring in 2010 and 2015. (Data for the latter year is still an estimate). Second, total revenue has been growing at an average rate (4.2% a year) that is almost double the rate of local price inflation (2.4%). Third, net income from the liquor monopoly is a tiny fraction of the county’s budget and has been largely stagnant. In 2004, liquor money was 0.74% of the county’s budget; in 2016, it is projected to be 0.47%. Part of this is because the county has begun issuing bonds against liquor profits and thus must pay debt service. But another part is that the monopoly is poorly managed. Over this period, the county saw an average annual revenue gain of $25 million from liquor and $140 million from other sources.

That means county revenues would still go up even without liquor monopoly money. There would be no need for cuts.

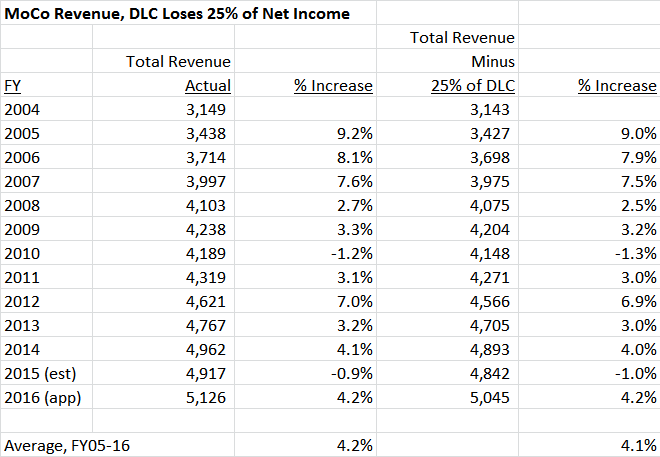

Comptroller Peter Franchot has proposed allowing the private sector to compete with the county’s Department of Liquor Control (DLC). What would happen to county revenues if that were to occur? That depends on how retailers, restaurants and consumers react. Let’s consider what would happen if DLC were well-managed, price competitive and truly focused on customers. Under this scenario, it might lose just 25% of its net income. Here’s how county revenues would have performed since 2004 if that were the case.

In the real world, the county’s total revenues grew by an average 4.2% a year. If DLC had lost 25% of its net income, the county’s total revenues would have grown by an average 4.1%. There would be almost no difference to the county’s bottom line.

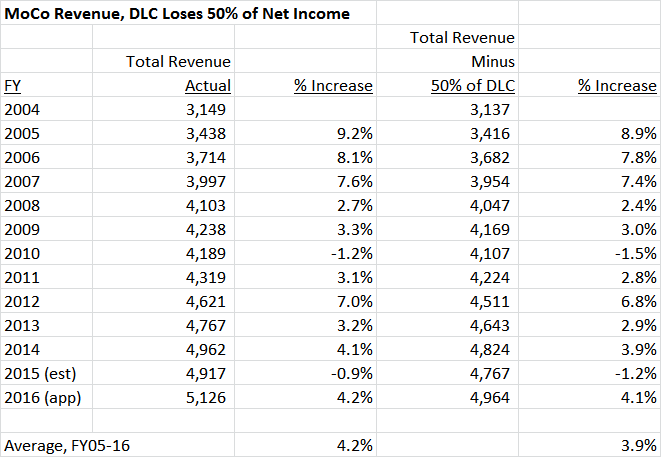

Now let’s suppose that DLC loses 50% of its net income. Here’s how that scenario would have played out.

The county’s average annual total revenue growth changes from 4.2% to 3.9%. Again, not much difference.

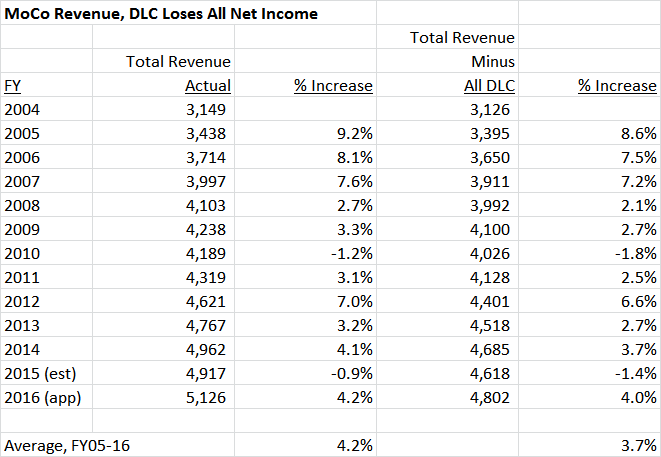

Finally, let’s look at what would have happened had DLC net income disappeared entirely.

The county’s annual total revenue growth changes from 4.2% to 3.7%. The latter number is still 55% greater than the average rate of price inflation in the Washington-Baltimore area (2.4%). Furthermore, let’s keep in mind that this scenario would only occur if DLC were so awful that all of its customers fled. If that’s the case, why should DLC be protected by a monopoly at all? And the data above completely omits any extra revenue the county would earn from a revitalized private sector free of the monopoly that it calls “an Evil Empire.” Extra money from property taxes and income taxes could close some of this gap.

This discussion is not exclusively hypothetical. In July, the County Council passed a mid-year savings plan that trimmed $54 million from the budget it had passed only two months before. That amount is more than twice as much as the county earns from its liquor monopoly. Public education and public safety were not jeopardized. That’s because the overall budget provided for a $209 million increase from the prior year’s estimated revenue. County government continues to grow and no apocalypse has occurred.

Finally, consider this. There are more than three thousand counties in the United States. Very few of them have MoCo’s resources. All of them except us have figured out how to pay for their priorities and balance their budgets without needing a liquor monopoly. Are MoCo’s elected officials the only county leaders in the entire United States who can’t figure out how to live without one? I think not; I have seen them deal with much more serious budget problems effectively.

The county government doesn’t need its liquor money. So let’s End the Monopoly.