By Adam Pagnucco.

In November 2016, I wrote a three-part series called MoCo’s Two Electorates. (Here are the links to Part One, Part Two and Part Three.) I also wrote a piece titled “MoCo Revolts” in the wake of the term limits vote.

The combined thesis of those pieces are the following.

1. MoCo has two electorates: people who regularly vote in Democratic primaries and people who vote in general elections. Both electorates are important. Democratic primaries choose the county’s elected officials while general elections decide ballot questions and charter amendments.

2. There are roughly 40,000 Super Democrats in MoCo who vote in every primary. Relative to general election voters, they tend to be slightly more female, older, slightly higher income, slightly more likely to live in a single family home and more concentrated in downcounty. They are also slightly LESS diverse than general election voters.

3. Democrats comprise roughly 60% of general election voters with some variation by year. Republicans have outnumbered unaffiliated voters among the rest of actual voters though not by a lot. That means Republicans and unaffiliated voters can team up with a minority of Democrats to pass ballot questions.

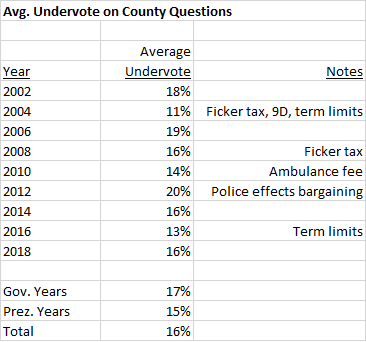

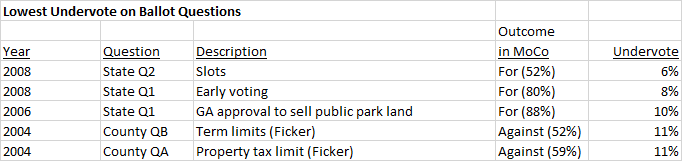

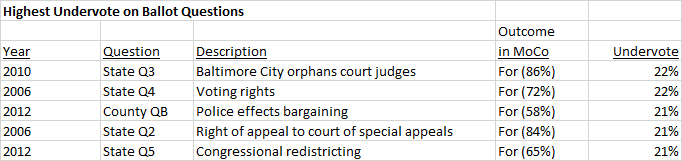

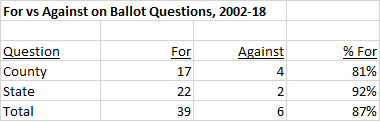

4. On four straight meaningful local ballot questions since 2008, the general electorate took arguably the less progressive position in their votes. They voted in favor of Robin Ficker’s anti-tax charter amendment in 2008, against Ike Leggett’s ambulance fee in 2010, in favor of repealing some collective bargaining rights for police in 2012 and for term limits in 2016. This trend among the general electorate should not be comforting to the left. Term limits passed with a whopping 70% of the vote and only four precincts in the entire county voted against them.

Accordingly, these are the prophecies I made back then.

November 7, 2016: “Term limits is the issue of the day and will be decided soon enough. But a broader question looms. Given the differences between MoCo’s Two Electorates, what happens when elected officials cater to one of them at the heavy expense of the other? The recent large property tax hike, which was spread all across county government, was aimed at the priorities of liberal Democratic voters. It also became the core of the push for term limits which is aimed at the general electorate. This suggests a need for balance and restraint by those running the government. Because if one of the two electorates feels unheeded, either one has the tools to strike back – either by unseating incumbents or by shackling them with more ballot questions and charter amendments.”

November 11, 2016: “Opponents of term limits may be right about one thing – they may change the names of elected officials, but not the type of them. Democrats, often very liberal ones, will continue to be elected because of our closed primary system. But the combined message of the last four ballot questions imposes a hard choice on the elected officials of today and tomorrow. They can try to balance the interests of various constituencies across the political spectrum at the possible cost of losing the progressive support that influences Democratic primaries. Or they can stay the course and watch more moderate general election voters pass even more restrictive ballot questions, including perhaps the ultimate bane of progressivism – a hard tax cap.”

What has happened since then? First, let’s consider these two facts from the 2018 elections.

Geography: In the 2018 Democratic primary, the Democratic Crescent (a term I coined for the areas in and near the Beltway stretching from Takoma Park to Kensington and Bethesda) accounted for 34% of voter turnout while Upcounty accounted for 25%. In the 2018 general election, the Democratic Crescent accounted for 27% of voter turnout while Upcounty accounted for 31%. (The rest of the county accounted for 42% in each case.)

Diversity: Precincts that were majority white cast 60% of the votes in the 2018 Democratic primary and 58% of the votes in the 2018 general election. Precincts that were at least three-quarters white cast 22% of the votes in the Dem primary and 20% of the votes in the general. Precincts that were less than 40% white cast 24% of the votes in the Dem primary and 26% of the votes in the general. All of this suggests that the general electorate is slightly more diverse than MoCo’s Democratic primary electorate, which I also found in the 2014 data I examined years ago.

In other words, despite the substantial growth in voting in 2018, the differences between MoCo’s two electorates continued.

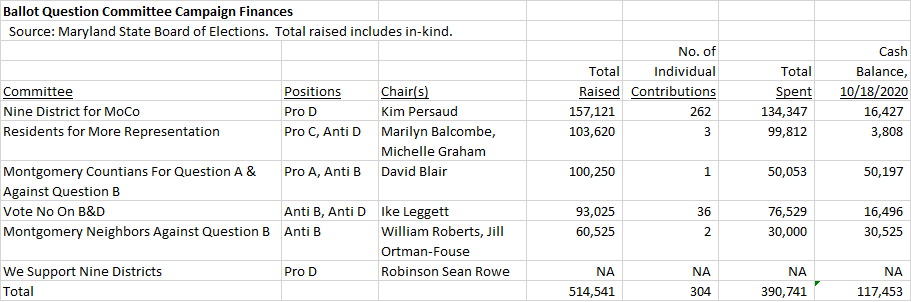

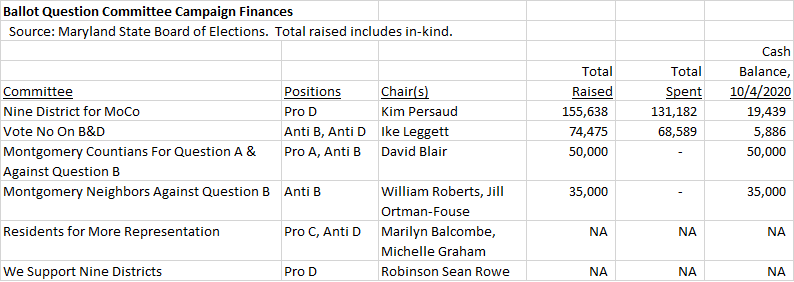

Two years later, ballot questions are THE local issue now. The county’s elected officials are up in arms about Ficker’s newest anti-tax charter amendment (which I predicted four years ago) and the nine districts charter amendment. Groups like Nine Districts for MoCo and former school board candidate Stephen Austin’s Facebook group did not exist in 2016, but they are playing in county politics now. Austin’s group has 8,500 members, bigger than any other online group devoted to MCPS. Nine Districts gathered more than 16,000 petition signatures for their charter amendment, of which 11,522 were found to be valid. Both groups direct their influence at the general electorate rather than just Democratic primary voters. Neither depends on the blessings of the Democratic Party but rather employs a combination of social media, press interest and (in Nine Districts’ case) developer money to get their points across. As for the Republican Party, it has found new life in promoting ballot questions like Ficker’s Question B and Nine Districts’ Question D.

Guess what? These kinds of things are here to stay. Regardless of what happens this year, don’t be surprised if more charter amendments appear on the ballot in 2022 and 2024 that arouse the ire of those in power. Tough beans for them because they are powerless to prevent it.

Have today’s county elected officials heeded the prophecies of 2016? For the most part, their agenda reflects the wishes of the progressive left – defunding the police, pursuing racial equity, cracking down on rent increases, resisting ICE and emphasizing transit over road construction. The one exception is that the county council (unlike the executive) has been resistant to tax hikes. Progressives sometimes complain that the county government doesn’t go far enough, but it does go in their direction. The problem is that other groups in the general electorate – Republicans, unaffiliated people and moderate to conservative Democrats – either don’t rank these priorities as highly as do progressives or in some cases might even oppose them. Mix that in with the county’s perceived anti-business reputation and geographically specific issues like school boundary lines and M-83 and many in the general electorate are not in the same place as the Super Democrats.

MoCo still has two electorates. One has the power to pick elected officials. The other can decide ballot questions that fundamentally change the structure of county government. We shall soon discover the depth of differences between them as well as their relative balance of power in controlling the county’s destiny.