By Adam Pagnucco.

For the first time in its history, the Montgomery County Government will be applying for a line of credit. That’s a sign of how seriously county officials are taking the deep economic downturn caused by the COVID-19 crisis.

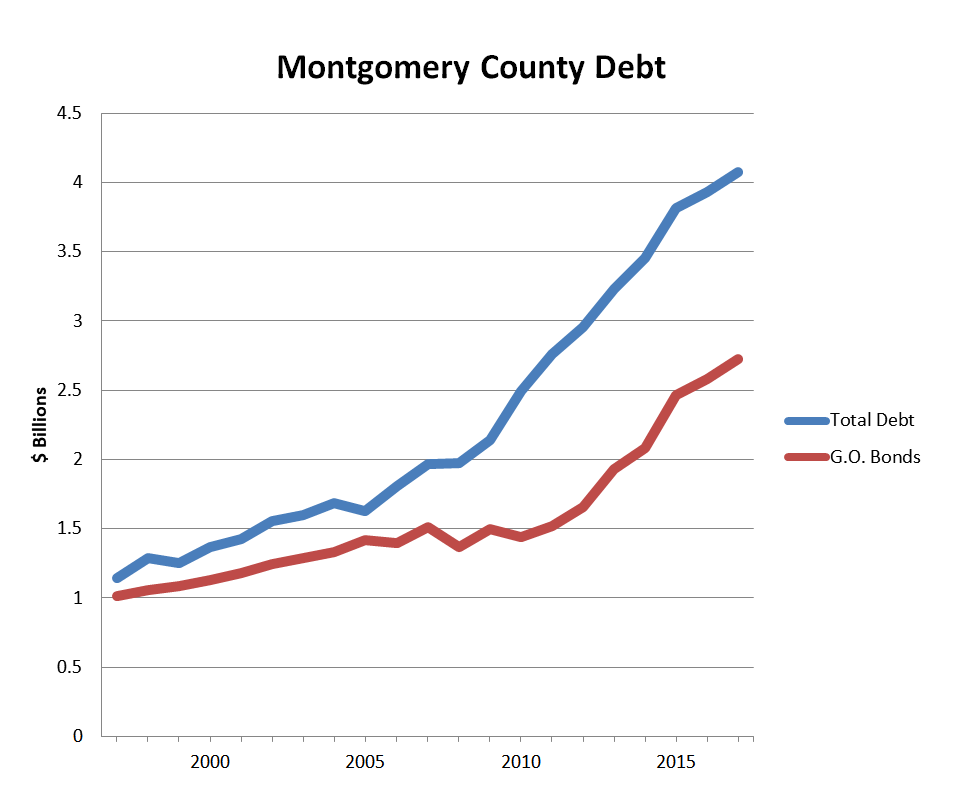

MoCo’s general obligation bonds have enjoyed a AAA rating since the 1970s. The county almost lost its credit rating in 2010 but avoided that fate through doubling the energy tax, implementing massive spending cuts and passing a plan to increase reserves to 10% of revenues in ten years. (The county has since met that target.) As bad as that year and others surrounding it were, the county never had to take out a credit line.

Now it will.

County budget director Rich Madaleno confirmed that the county planned to apply for a credit line in a conversation with the county council yesterday. The county’s Office of Legislative Oversight (OLO) has posted documentation on how a credit line would function in the context of county government. County governments, especially well-managed ones, hardly ever use debt to fund operating expenses. Indeed, section 312 of the county’s charter states, “No indebtedness for a term of more than one year shall be incurred by the County to meet current operating expenses.” So if MoCo borrows against the line, it would have to pay back the money pretty quickly.

When questioned about the purpose of the credit line by Council Member Andrew Friedson, Madaleno replied:

It’s to make sure in the extremely rare case that if there were a cash flow issue because of what you well know is the schedule of disbursements – we do not collect the income tax, the state does – we get them on set schedules. If we have to pay bills while two weeks before the February distribution or the November distribution you have in essence a credit card. And as any consumer knows, in these sorts of situations, you would want that credit card in hand and not be applying for it at the register because you don’t know if you’re going to get it and what the rates are going to be. This is a best practice. This is not at all, not at all and you can ask Mr. Coveyou [the county’s finance director] – this is not at all an action being taken because we are concerned about liquidity. This is a backup insurance plan as you would want a smart organization to have in its back pocket.

Let’s remember that the county has had to deal with state distribution schedules of income taxes for decades and never needed a line of credit until now. The difference between now and those other decades is the sheer havoc the COVID-19 crisis could wreak on county finances. Consider that the current worst case scenario estimates up to a $600 million revenue loss in FY20 and FY21 combined and that the current projection for ending reserves in FY21 is $554 million. No one should take comfort from those numbers, particularly given the possibility of their getting worse.

A sneak preview of a county budget briefing six months from now.

The amount of the county’s credit line has not been established but multiple sources suggest that it could be in the hundreds of millions of dollars. No information is available yet on which financial institution(s) would issue it.

Montgomery County is not alone. State and local governments around the country either have or are seeking lines of credit, including the State of New York ($3 billion), the State of Illinois ($1.2 billion), the City of Louisville in Kentucky ($240 million), the State of Rhode Island ($150 million), Cook County in Illinois ($100 million), the City of Portland in Oregon ($100 million), the City of New Orleans in Louisiana ($100 million), Fauquier County in Virginia ($50 million) and the City of Montgomery in Alabama ($35 million). By far the most cited reason for these credit lines is to hedge against the revenue impacts of COVID-19.

Madaleno could be right that this is a smart backup insurance plan. Even Friedson, who has been hammering the Elrich administration’s budgetary practices of late, called it a “prudent action.” But let’s not delude ourselves. Montgomery County Government is preparing for a serious recession.

This year’s budget is only the beginning.