Today, I am pleased to present a guest blog by Montgomery County Executive Ike Leggett:

REALLY Setting the Record Straight…

Adam Pagnucco’s blog entry, Setting the Record Straight, does anything but set the record straight. Let’s be clear – I did not “throw in the towel” on privatizing the County’s Department of Liquor (DLC). The record clearly shows that I introduced State legislation that would have privatized our DLC while also protecting and maintaining the significant revenue stream of over $30 million a year it contributes to the County budget. Some on our County Council and in the State Delegation felt that, given the progress we’ve seen in DLC since we brought in a new management team with considerable liquor industry experience, and a number of substantive changes we had made to the organization already, we should give them additional time to make even greater improvements.

Philosophically, I am not opposed to privatization, but I also stand by my statement that not one of the critics of the County’s Department of Liquor Control (DLC) put forth a viable privatization proposal that would hold the County budget harmless by replacing the DLC’s profits. The County DLC is a taxpayer asset that produces a net profit of over $30 million a year and to privatize without replacing the revenue would be a disservice to our taxpayers.

After months of soliciting proposals, not one person or organization offered a viable plan to privatize DLC while maintaining the approximately $30 million in profits, including groups that assured us they would. While Mr. Pagnucco claims that his plan would have done so, his route to privatization, simply put, was based on faulty assumptions.

Mr. Pagnucco’s proposal was not ignored. It was carefully reviewed by us in the County and it was also reviewed by a consultant hired to review privatization options It was judged not viable because the underpinnings of the proposal were either unworkable, not legal or just plain wrong. Here’s why:

First, Mr. Pagnucco made a basic math mistake. He estimated that the County receives $20 million in “profit” in FY17, therefore starting with the faulty premise that to make the County whole, only $20 million in DLC profits each year need to be replaced. Unfortunately, he ignores that in FY17, the Department of Liquor Control earmarked $20.7 million for transfer to the General Fund and another $10.9 million to pay debt service on Liquor Bonds – bonds that have paid for road, and school construction in our County.

Therefore, the revenue to be replaced equals $31.6 million, not $20 million.

Mr. Pagnucco’s proposal then makes the argument that there will be a huge economic spinoff from privatizing by increased sales. He relies on a report done by the Comptroller’s Bureau of Revenue Estimates, which was itself built on an amazing number of alternative facts. But, for the sake of argument, say it was a sound analysis. Even Mr. Pagnucco admits that the tax revenue estimates presented in the report actually proves the county’s point that opening the alcohol market really only benefits the State coffers. He himself noted the county would receive less than $1 million of the revenue, while the rest of the estimated $35 million in economic spinoff benefit would go to the state’s general fund.

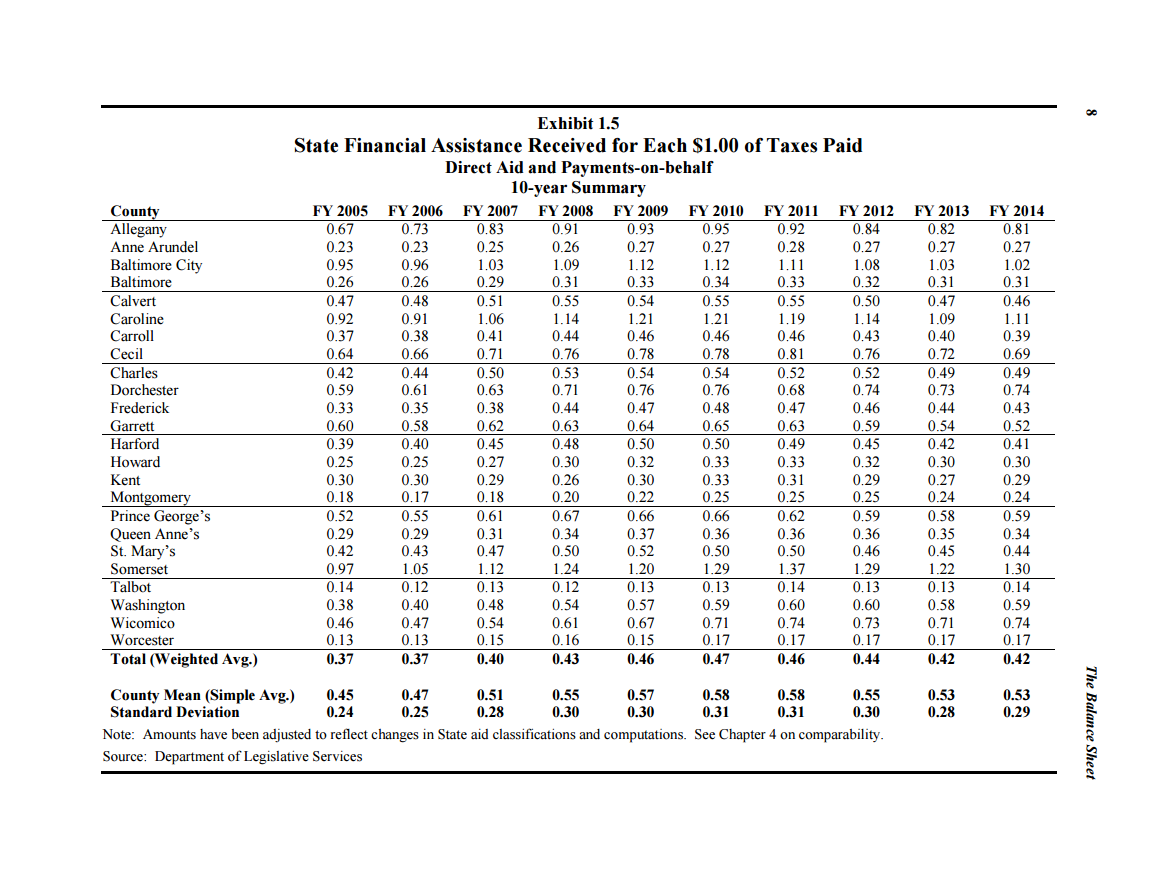

So he suggested that we pass a State law to compel the State to share its new revenue with us. The consultant, and everyone familiar with how Annapolis works, rightly pointed out that first, it requires the state to be a willing partner, and second and more importantly, there exists a legitimate concern about revenue sharing with the State. What the State giveth, the State taketh away. Just in the 1990s alone, the following County revenue sources were reduced or eliminated by the State:

- Liquor tax revenue sharing: eliminated; loss of $4.4 million to counties

- Beer tax revenue sharing: eliminated; loss of $4.2 million to counties

- Tobacco tax revenue sharing: eliminated; loss of $12.7 million to counties

- Property tax grant: eliminated; loss of $82.5 million to counties

- Teacher social security: eliminated; loss of $145 million

- Financial institution franchise tax sharing: eliminated; loss of $17 million to counties

- Transportation taxes revenue sharing (not highway user): eliminated; loss of $19.6 million to counties

- Abandoned property revenues: eliminated, loss of $5 million to counties

- Corporate filing fee revenues: eliminated; loss of $1.6 million to counties

- Security interest filing fee revenues: eliminated; loss of $1 million to counties

Mr. Pagnucco claims that the County can replace the bond money by raising our cable franchise fee and siphoning off dollars from the Cable Fund. With this statement he negates his own argument that his proposal would be “cost neutral” since it would in fact require raising fees.

But what he more importantly failed to realize is that Cable fund money cannot legally be used for purposes other than cable-related needs: technology and communication purposes. We cannot take Cable Funds to build roads and schools. Plus, utilizing this revenue would just create a budget hole elsewhere.

Another faulty assumption in Mr. Pagnucco’s proposal is using Worchester County as an example of how privatization in Montgomery County would work smoothly. He claims that after privatizing its liquor business, Worchester experienced reduced revenues but that the loss was negligible and that such a loss would equate to a mere $5 million per year for Montgomery. However, in reality, the unhappy ending to the Worchester story of privatization is that Worchester County is now going out of the liquor business forever and will generate exactly zero revenue for its budget in the future.

The final faulty assumption in Mr. Pagnucco’s proposal is his assumption that the county could just open up more liquor stores, which he notes would create additional profits. See paragraph above: Worchester’s unhappy ending is testament that it just won’t happen.

Finally, Mr. Pagnucco says he was not proposing getting rid of the DLC – he just wanted to provide competition (i.e.; “end the monopoly”) by allowing our licensees to decide from whom to purchase products. But that’s not how it works. In the liquor business it is the suppliers/manufacturers who decide which ONE distributor/wholesaler will sell their products. The so-called monopoly doesn’t end, it simply transfers from the County to the private sector. Why turn over this asset that belongs to our county residents to the private sector for nothing?

We should be looking forward, not back. The DLC is, as they say, under new management. It has a new director, and is on course to continue making positive changes to improve operations and customer service.

Ike Leggett

County Executive