By Adam Pagnucco.

Council Member Marc Elrich, who recently equated potential gentrification near the Purple Line with “ethnic cleansing,” is taking flak for his remarks and is not backing down. We will leave it to others to judge his choice of words. But what interests us is the policy proposal he has made: specifically, Elrich would like to see rent control imposed near Purple Line stations. That’s worth discussing.

Economists tend to disagree on many issues but a huge majority of them oppose rent control. Liberal New York Times columnist Paul Krugman has written, “Almost every freshman-level textbook contains a case study on rent control, using its known adverse side effects to illustrate the principles of supply and demand.” A massive review of economic research on rent control found evidence that it encourages conversions of rental units into condos and leads to higher rents in non-controlled units. Rent control repeal in Cambridge, Massachusetts led to a surge in property values in both controlled and non-controlled units and a 20% increase in housing investment. Even Communists denounce rent control. In 1989, Vietnamese Foreign Minister Nguyen Co Thach told a news conference that rent control did more damage to his capital city than American bombs. “The Americans couldn’t destroy Hanoi, but we have destroyed our city by very low rents. We realized it was stupid and that we must change policy.”

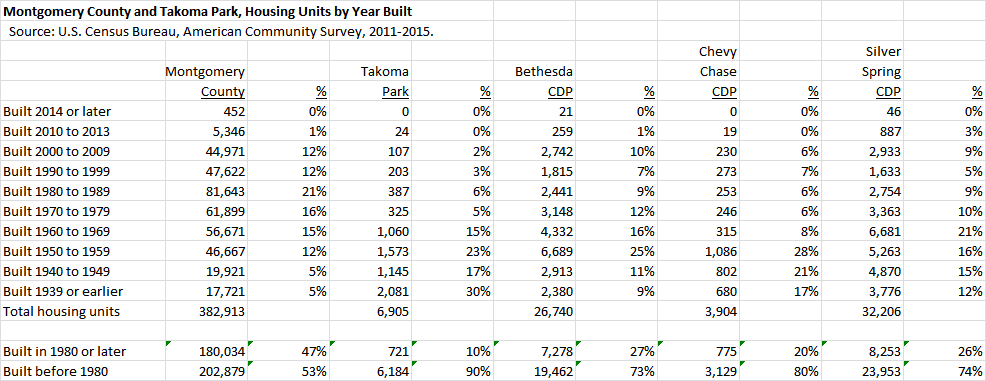

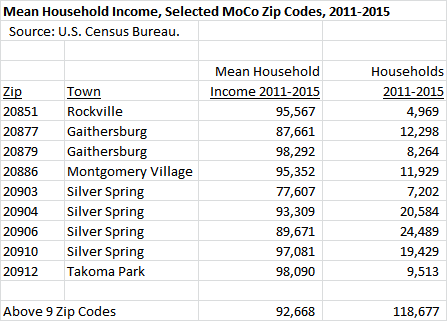

One need not go to a Communist nation to observe the effects of rent control. MoCo has a good example of that policy right here at home: the City of Takoma Park, which passed a rent control law in 1981. We examined U.S. Census data to analyze how the city’s housing stock compares to the county’s. Below we show that just 10% of the city’s housing was built in 1980 or later, much lower than the county’s percentage of 47%. That’s not a fair comparison since the city is much older than the vast majority of areas in the county. However, other older areas inside the Beltway like Downtown Bethesda (27%), Chevy Chase (20%) and Downtown Silver Spring (26%) have much higher percentages of their housing built in 1980 or later than Takoma Park.

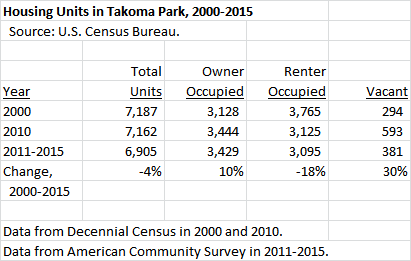

It gets worse. Takoma Park has been losing rental housing units for years. Below we show the city’s total, owner-occupied and renter-occupied housing units in 2000, 2010 and the five year period of 2011-2015. During that time, the city’s total housing units fell by 4% and its renter-occupied units fell by 18%. Owner-occupied units increased by 10% and vacancies rose by 30%. No housing policy that produces double-digit losses in rental units can be described as good for renters.

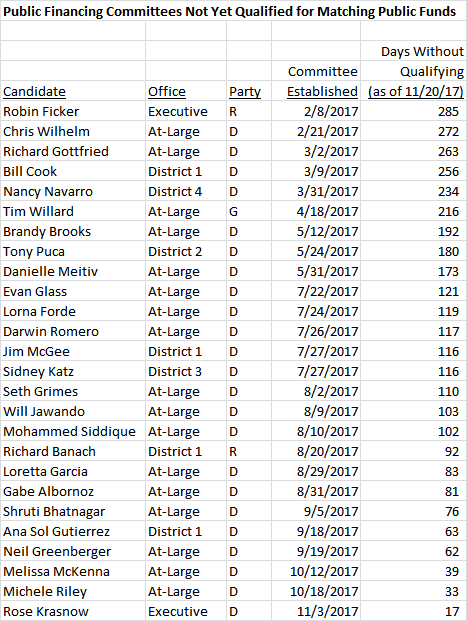

Takoma Park’s housing decline is not going to turn around soon. According to the site plans, preliminary plans and sketch plans listed on the MoCo Planning Department’s development tracking map, only two housing projects with a combined seven units are pending in Takoma Park. Those units are all single family, which are exempt from the city’s rent control law.

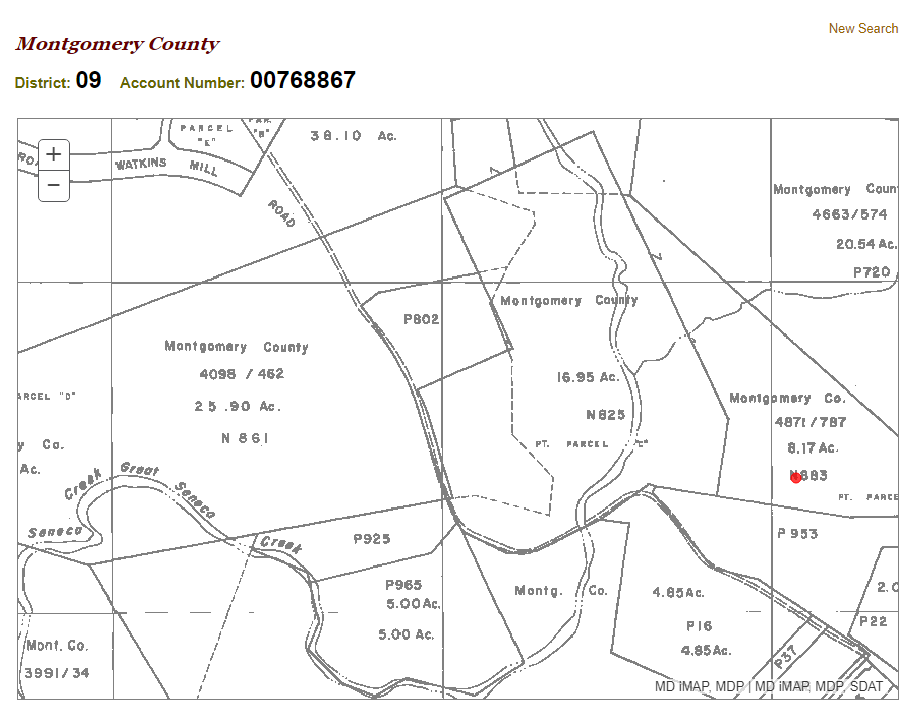

This extract from the Planning Department’s site plan map shows the huge contrast in development plans between Takoma Park and Downtown Silver Spring.

The implication of all this is clear: housing developers are steering clear of Takoma Park’s rent control law. These folks are not going to be any more enthusiastic about rent control near Purple Line stations. Why does that matter? When it comes to building new housing, there are basically three options. First, you can build it near transit. Second, you can build it away from transit, thereby incurring the associated congestion and environmental costs. Or third, you can try to block it from being built, and that’s one probable effect of rent control. But that won’t stop population growth – instead, it will result in overcrowded housing, unsafe living conditions and code violations. (Such phenomena are not unknown in some areas of the county.) Rent control near the Purple Line just encourages options two and three.

Finally, the Purple Line is a huge investment, costing at least $2.65 billion to construct. Only an insane society would pour billions of dollars into a transit project and then stop new housing from being built next to it. Even Vietnamese Communists would agree.

Disclosure: Your author is a long-time supporter of the Purple Line and is a publicly listed supporter of Council Member Roger Berliner for Executive.