By Adam Pagnucco.

The untold story about the Giant Tax Hike is that it could have been cut substantially while still maintaining every dime of funding for MCPS in the Executive’s recommended budget. How could that have been done?

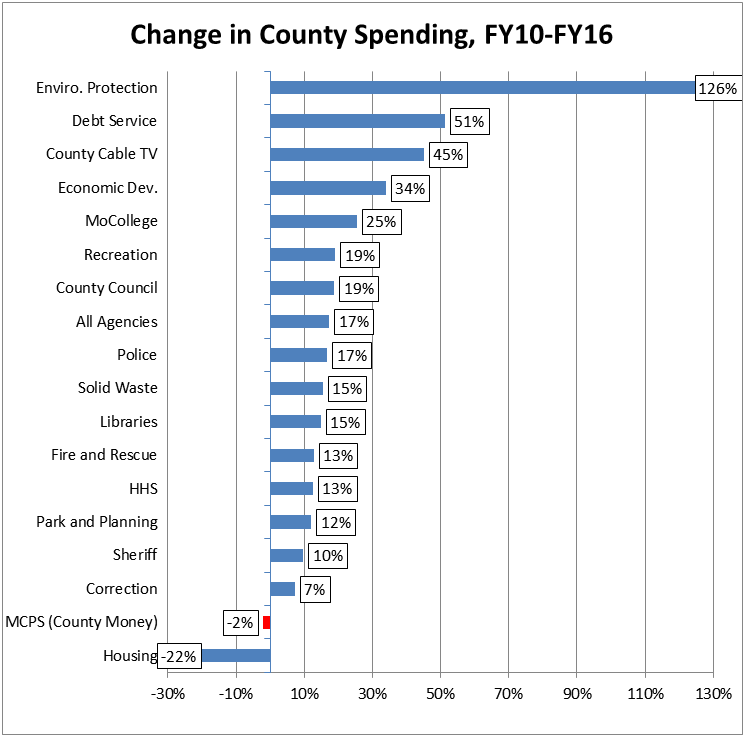

The Executive called for an increase in property taxes of $140 million over the charter limit. Three sources of savings were available to offset it. First, Senator Rich Madaleno’s state legislation enabling the county to extend the time necessary to pay tax refunds mandated by the U.S. Supreme Court’s Wynne decision freed up $33.7 million. Second, the County Council had obtained $4.1 million by not funding some elements of the employees’ collective bargaining agreements. Third, county agencies other than MCPS were due to receive a combined $36.3 million in extra tax-supported funds in the Executive’s recommended budget. Using some or all of that money for tax relief would have reduced the tax hike even more. If all of that money were redirected, the tax hike could have been cut in half with MCPS still getting the entire funding increase in the Executive’s budget.

Instead, the council kept the entire 8.7% property tax hike and distributed $25 million of it throughout the entire county government, as well as its affiliated agencies and partner organizations. While MCPS may have undergone seven straight years of austerity, most of the other agencies and departments had already received double-digit increases over their pre-recession peak amounts. This new money was on top of those increases.

Council President Nancy Floreen was very honest about this, writing:

While this is an “education first” budget, it isn’t an “education only” budget. As much as many people care about our outstanding school system, we know that others have different priorities. This budget is very much about those people as well.

This budget provides a much-needed boost to police and fire and rescue services as we will be adding more police officers and firefighters and giving them the equipment they need to continue to make this one the safest counties in America. This budget is about libraries, recreation, parks, the safety net, Montgomery College, and transportation programs that help get people around this county better.

This budget means that no matter where you live in the county, if you call an ambulance, you can count on a life-saving response time. Our police force will now be equipped with body cameras. Potholes will be filled, snow will be plowed, grass in parks and on playing fields will be mowed and trees will get planted in the right-of-way. While our unemployment rate has fallen steadily over the past couple of years, our newly privatized program for economic development promises an even better job market in the future. We are going to help new businesses in their early stages and hope they will remain here once they become successful. We are going to aggressively seek to get established businesses to relocate here and we are going to fight to keep the great businesses of all sizes that already call Montgomery County home. Our avid readers and researchers will appreciate the interim Wheaton Library and extended hours at several branches. And students will have better access to after-school enrichment programs.

As Council President Floreen demonstrates above, this is not so much an Education First budget as it is an Everything First budget, with nearly every department and agency getting a piece of new tax revenues.

Let’s compare what happened this year to what occurred in 2010. Back then, the county was suffering from the full effects of the Great Recession. Its reserves were dwindling to zero, revenues were in freefall and its AAA bond rating was on the verge of being downgraded. The County Council responded by passing a budget with furloughs, layoffs, no raises for employees, a cut in the county’s earned income tax credit, an absolute reduction in spending and a $110 million increase in the energy tax. Given the dire economic emergency, all options were bad ones, but the council really had no choice. The cuts and tax hike were forced upon them.

This year, there is a stagnant economy (which we will discuss in Part Six) but no Great Recession. Reserves are substantial and have been on track to meet the county’s goal of ten percent of revenues. There is no threat to the bond rating. And yet, the council chose to pass a $140 million property tax increase – larger than the energy tax hike during the recession – when it could easily have reduced the tax increase, funded MCPS’s needs and not cut any other departments. But it did not.

Like all big choices, this one will have consequences. We will explore them in Part Six.