By Adam Pagnucco.

The big news coming out of County Executive Marc Elrich’s recommended Fiscal Year 2021 budget is that he is proposing a tax hike. As you might imagine, I will have something to say about the specifics of that tax proposal in future days. But first, it’s worth remembering what Elrich said about taxes when he was running for executive two years ago. Over and over, he made statements ranging from saying that he did not want to raise taxes all the way to flatly refusing to raise them. Consider the following:

1. In July 2018, Elrich told WAMU that he “doesn’t want to raise taxes, but would like to see developers pay a greater share of infrastructure costs in the county.”

2. In a candidate forum in October 2018, Elrich said, “I’m not raising taxes and I’m not raising fees.” Check out Elrich’s remarks at 1:25 of this video.

3. In May 2018, Bethesda Beat reporter Lou Peck asked Elrich this question:

As county executive, could you foresee yourself proposing a property tax increase above the charter limit of the rate of inflation, requiring another unanimous council vote?

Elrich replied:

I would seriously hope not. I feel that before you go talk about a tax increase, I would have to demonstrate to people that I’ve done everything I can do to lean out the county, to make sure we’re as efficient as possible, that I’ve taken people and been able to repurpose them, rather than just going to taxes first. I think the days of going to taxes first are over.

4. In November 2018, Elrich said the following to Source of the Spring:

“A lot of people ask me about taxes,” Elrich said. “One of the issues in the campaign, people said, ‘Oh, Marc is going to bring in all these massive numbers of social programs and raise taxes on everybody.’ And actually that’s not what we’re doing. We know that the budget is going to be constrained.

“We’re pretty committed to staying inside the box and trying to run the government more efficiently,” he continued. “I’ve been telling people I’ve got $5.5 billion or more in revenue, and if I’m going to look for doing new things and being creative, I’m going to look at the revenue I have [and] figure out how to use it better. I think we can do a better job.”

5. Immediately after he was elected, WAMU asked Elrich about taxes.

Despite being Maryland’s largest county with more than a million people, Montgomery County tax revenues aren’t growing fast enough to keep up with rising costs, Elrich said.

But, he said, a tax increase is out of the question.

“If you don’t handle the money you have better, you’re gonna have a hard time doing what you’re doing today, let alone doing things that you need to [in the future],” Elrich said. “But I think it’s actually a good thing to have this decision that there’s not going to be additional taxes because it means you actually have to think about what you’re doing.”

As a candidate, Elrich proposed an alternative to tax hikes: restructuring the government to increase efficiency and save money. In a November 2018 op-ed in the Washington Post, Elrich wrote:

Far from saddling taxpayers with higher bills, I will streamline county government. Unions and their members, our county’s workforce, know and trust me. That is why we announced our plan to restructure county government together. Our county is facing difficult financial times; without thoughtful changes, employees will face across-the-board cuts.

Elrich elaborated on his restructuring plans in his 2018 questionnaire response to the Greater Silver Spring Chamber of Commerce.

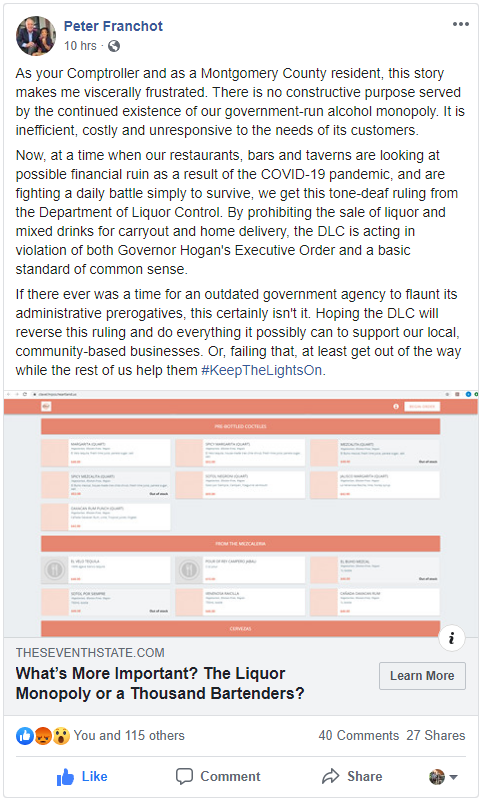

I have explained how I would begin to rethink government in my First 90 Days Financial To-Do List, which you can find on my website. In this list, I lay out how I would initiate a long-term financial plan, increase the net profit contribution from the Department of Liquor Control, begin a structural review of county departments in partnership with the county workforce, implement a labor-management partnership called gainsharing (in which both parties agree on targets for improving performance and reducing cost and everyone receives a share of the savings generated), leverage a business process improvement system called Lean, assess the appropriateness of county reserve levels, improve data practices, review non-competitive county contracts, establish an innovation fund, increase government accountability, and develop budgets that prioritize spending and ensure that the county meets financial commitments in a sustainable way.

After Elrich’s election, the Sentinel interviewed him and reported, “Elrich said he plans to restructure the County government to make it run more efficiently, saying that doing so will help pay for the new programs he proposes without needing to raise taxes.”

So according to candidate Elrich, there would be no need

for tax hikes because he would work with the unions to restructure government

and save money. What is his actual

governing record through his first two budgets?

1. Elrich’s recommended FY20 operating budget contained an increase of 82 full-time equivalent (FTE) positions in county government. This does not include position increases in other agencies like MCPS, the college or park and planning. The personnel cost increase recommended for county government was $37 million. For the three county government unions, Elrich negotiated contracts containing raises of up to 9.4% for some employees.

2. Elrich’s recommended FY21 operating budget contains an increase of 189 FTEs in county government with a personnel cost increase of $21 million. Again, this omits increases in MCPS, the college and park and planning. Elrich’s negotiated contracts with the three county government unions contain raises of up to 8% for some employees plus lump sum bonuses of $1,000 and longevity increases for some employee categories.

3. The county council trimmed Elrich’s contract with MCGEO last year but his contracts and increases for managers and non-union employees this year will cost a combined $27.4 million in FY21 and $37.7 million each year thereafter.

And so, if there has been any restructuring at all, it

has not saved any money or created any obvious new efficiencies. Instead of streamlining government – as he

said he would do – Elrich just wants a tax hike.

Would anyone like to rerun the 2018 county executive election right about now?