By Adam Pagnucco.

In the wake of the failure of his bill that would have phased out a special property tax break for MoCo country clubs, the Facebook page of Delegate David Moon (D-20) saw an eruption of commenters expressing outrage, disbelief and mockery. (Some raised the prospect of starting country clubs in their back yards to get similar tax breaks.) In response to repeated requests, Moon analyzed the arguments against his bill and told the story of how it died. Moon’s account contains references to a well-intended amendment by Delegate Eric Luedtke (D-14), who tried to narrow the bill to allow it to pass. But he also describes the tactics used by a lobbyist hired by the clubs to kill the bill which demonstrate just how far some special interests will go to protect what they have been granted by government. We intend to find out what that lobbyist was paid when reports come due.

We reprint Moon’s breakdown of the arguments against his bill below.

*****

Let me finally try and add some detail to this bill.

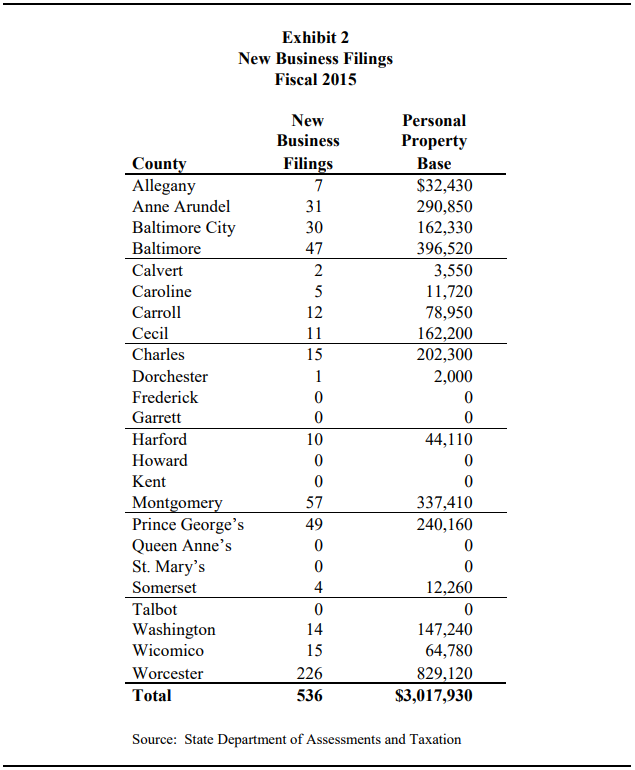

Argument 1 – Treating MoCo Differently Than Other Counties: The bill as originally introduced repealed these tax breaks for all of Montgomery County’s golf courses. State law doesn’t allow counties to asses property differently from one another, so the bill needed a constitutional amendment (subject to approval by voters), to give MoCo permission to repeal the Country Club tax breaks. Some people (including Ike Leggett) argued that MoCo shouldn’t be taxing country clubs differently from other counties. I found that argument unpersuasive, as MoCo has a majority of the state’s country clubs receiving this tax break. Additionally, MoCo loses far more money from this tax break than other counties. This is because in 2002, state law created a flat fee for country club assessments at $1,000 an acre. The problem with that is that in MoCo, many of our country clubs are sitting on land worth between $300,000 and $1 million per acre. You will not find that scenario in any other county, as their land is worth far less. So the flat fee seriously harms counties with valuable land. I offered one amendment to change the bill to simply say the county should decide the country club tax assessments, since they are the ones losing money from this. That amendment failed narrowly. But even still, some people simply had a problem with amending the state constitution to fix this problem. I honestly don’t care what the mechanism is to address the issue (we inserted slot machines into our state constitution, for example). I also have a statewide bill (HB 1340) that addresses this issue by changing the $1,000/acre assessment to 1% of market value, to account for the different land values in Maryland. A few of my colleagues suggested this issue should be taken up as a statewide measure and didn’t think it made sense as a local bill. But to be honest, one of the reasons I did both a local bill and a statewide bill is that it will likely be far more difficult to persuade lawmakers from around the state to fix this broken system. It now remains to be seen whether lawmakers who opposed my MoCo bill on the grounds of treating all the counties the same will now support the statewide bill. I will forward the state bill to the County Executive to see if it now addresses his stated concerns.

Argument 2 – Some Country Clubs Are In Poor Financial Shape: A common argument made against my bill is that of the 15 or 16 MoCo golf courses receiving this tax break, not all had wealthy members. Some argued that they were teetering on the brink of closure and would shut down if this bill passed. The country club lobbyist got all the janitors and service staff from the clubs to come to Annapolis and tell lawmakers they would all be fired if the bill passed. It was a true spectacle. I tried to counter this argument with amendments to make the bill more need-based. I proposed that we cap the tax discount at the first $400,000 per acre of market value, so that almost all of the clubs would be unaffected except for the super wealthy ones that charge huge initiation fees ($40,000 to $70,000 just to join). The country club lobbyist opposed this and other amendments. Basically, they were saying this would put courses out of business, but when we proposed amendments to make that not the case, the lobbyist opposed those fixes, too. Nice move! To be fair to my House colleagues, they never had an opportunity to vote for this version of the bill, because we didn’t adopt the narrowing amendments in subcommittee.

Argument 3 – Country Clubs Provide Jobs & Do Charitable Work: Another routine argument during this debate was that the country clubs employ people and let charities use their facilities. My response here is that plenty of entities employ people and do charitable work AND pay their taxes. But what this argument really turns on, is the idea that passing this bill would put the clubs out of business. As I noted above, I had an amendment to address that issue, but the country club lobbyist (who was formerly a State Senator who sponsored the bill for country club tax cuts) opposed the amendment. Come on now.

Argument 4 – Open Space & Those Evil Developers!: Yet another frequently cited argument against my bill was that the country clubs would close and lead to rampant development. The Sierra Club ought to go do a membership drive at country clubs, because apparently there are hundreds of open space conservation activists at country clubs, and we didn’t know it! Kidding aside, there are a number of reasons why this is a flawed argument. First, it assumes that country clubs will close BECAUSE OF this bill. As I noted above, I offered to amend the bill to exclude clubs that are not wealthy. Second, you would have to believe that a wealthy club with hundreds of acres of land worth $1 million/acre and waiting list to join would shut the entire club over a tax bill increase in the thousands. As some have noted, the wealthy clubs could simply add some members or sell a tiny piece of their land IF this was really an issue (and I doubt it is, with the amendments I offered). Moreover, the teetering country clubs are in trouble because there is a generational shift away from golf being a popular hobby. We didn’t throw money at Blockbuster or Tower Records to keep those businesses open when the market shifted on them, but then again, their customers were not wealthy and politically influential people. Additionally, nothing would stop the county from exercising its zoning and staging authority over a failed country club, and I would be willing to bet that’s exactly what would happen if one of these clubs failed. Let’s also be clear that even if you don’t like development, only ONE of these clubs was in the Ag Reserve, and Eric Luedtke offered an amendment which I supported to exclude that club (it was rejected). Many of the clubs inside the beltway are in areas of the county that are zoned for development (not open space), per the master plans that guide county development. If people have a problem with that, they should argue for extending the Ag Reserve to the DC border, near highway exits and transit (an absurd policy proposition). Given that many of these inside-the-beltway clubs are located in highly desirable school districts, this amounts to an argument for residents who are privileged enough to live in the W cluster keeping out others who also want the privilege to live there. The tax implications of this de facto development moratorium are far greater than $10 million a year for the county. Moreover, a supermajority of MoCo lawmakers also cosponsored the bill to drop 50,000 Amazon workers onto the county without worrying about the development implications. But remember once again, that there were amendments offered to take this development issue off the table.

When I first embarked on this effort to rein in country club tax breaks, I thought this would be a simple bill. Boy was I wrong! I now know more than I could’ve imagined about this issue, and the more I learn the more I’m convinced that this situation is seriously messed up. I’ll be back with more legislation on this issue next year, including looking at how we enforce the anti-discrimination provisions regarding country clubs and pesticide restrictions for clubs receiving these tax breaks (since the environmental, open space argument is being made!).

In the meantime, I encourage everyone to listen to Malcolm Gladwell’s fascinating podcast on this topic.