By Adam Pagnucco.

County Executive Marc Elrich has vetoed a bill passed by the council that would effectively cut impact tax collections. While the bill passed the council on a 9-0 vote, making it unlikely that Elrich’s veto will be upheld, the policy debate lays out stark differences between the executive and the council.

Impact taxes are charged to development projects in order to pay for the additional demands for infrastructure that they create. MoCo levies two: a school impact tax and a transportation impact tax. Both are used to finance the capital budget and are dedicated to schools and transportation projects respectively. The county council periodically adjusts impact tax rates, credits and discounts, and various structural aspects of how they are administered.

This year, the planning board proposed as part of a new subdivision staging policy (which sets the county’s policies on infrastructure) a package of tax changes. Bill 38-20 instituted a range of changes to impact tax collections that would effectively reduce the county’s receipts. Among the planning board’s proposals were to cut the school impact tax rate to 100% of the cost of a student seat from the current 120% of the cost of a student seat and to apply discounts to single-family detached and multifamily units in desired growth areas to incentivize growth, both of which would cut receipts. These cuts would be partially reduced by a new utilization premium payment applied to development projects in areas with crowded schools.

To offset the impact tax losses in Bill 38-20, the planning board proposed Bill 39-20E, which would raise recordation taxes. Currently, recordation tax receipts are split between the operating budget’s general fund, the capital budget (especially schools) and rental assistance programs. And so the planning board’s vision was to cut impact taxes and raise recordation taxes to spread the cost of financing infrastructure across both new and existing development.

Lots of changes were made to the planning board’s proposals but the bottom line is that the council passed Bill 38-20, which cut impact tax receipts, and has not yet passed Bill 39-20E, which would raise recordation tax receipts to help pay for lower impact taxes. (The latter had significant opposition from the real estate community.) The recordation tax increase is not dead, however; the council will return to that issue eventually if for no either reason than to examine the capital budget next year.

That leaves the county executive, who repeatedly expressed concerns about the changes to impact taxes and other growth policies throughout the fall. Elrich believes that Bill 38-20 will cost the county $12.5-20 million a year in lost impact tax revenues, all of which go to paying for school construction and transportation projects. (That number is subject to dispute.) Elrich also never bought in to the trade of lower impact taxes for higher recordation taxes. He would rather use higher recordation taxes to cover operating budget shortfalls or more school expenditures than to offset lower revenues from impact taxes. Accordingly, Elrich vetoed the cut in impact taxes even though it passed the council on a 9-0 vote. The council will win the policy debate for now, but the politics (and the budget maneuvers) will go on.

Elrich’s veto message is printed below.

MEMORANDUM

November 30, 2020

TO: Sidney Katz, President, County Council

FROM: Marc Elrich, County Executive

RE: Veto explanation: Bill 38-20 Taxation – Development Impact Taxes for Transportation and Public-School Improvements – Amendments

With new development comes increased infrastructure needs; the newly renamed “Growth and Infrastructure Policy” (Growth Policy) reduces the funding available to provide the necessary infrastructure while the need to provide infrastructure is more critical to our success than ever. While I have long been concerned with how impact taxes work and I believe that there are alternatives that should be implemented, I cannot support simply reducing the necessary revenues without an appropriate replacement. Therefore, I am vetoing Bill 38-20.

The primary purpose of the Growth Policy is to put forth policies for adequate infrastructure – schools, transportation and more – that accompany new development. While I have other concerns about the bill, my primary concern is the projected revenue loss, which is estimated to be between $12.5 million and $20 million per year based on an analysis of projects in the development pipeline.

These reduced revenues are occurring at a time when we know we don’t have enough funding to address current needs or other infrastructure investments needed to grow our economy and maintain our status as a desirable place to live. For example, legislation to increase state aid for school construction will require the county to provide local matching funds; traditional state aid costs the County $3 for every $1 from the State or an average of $200 million annually. It is important to ensure the County will be able to continue to match traditional state aid for school construction as well as the approximately $400 million in additional state aid expected from the Built to Learn Act. (This Act will take effect immediately upon the legislature’s expected override of the Governor’s veto of the “Kirwan” bill.) School overcrowding and a $1.5 billion-dollar backlog in new construction, renovation and modernization needs burden our school system – one of our prime assets.

In addition, regional business leaders have said that improved transportation is central to economic development, pointing out the importance of efforts like Bus Rapid Transit.

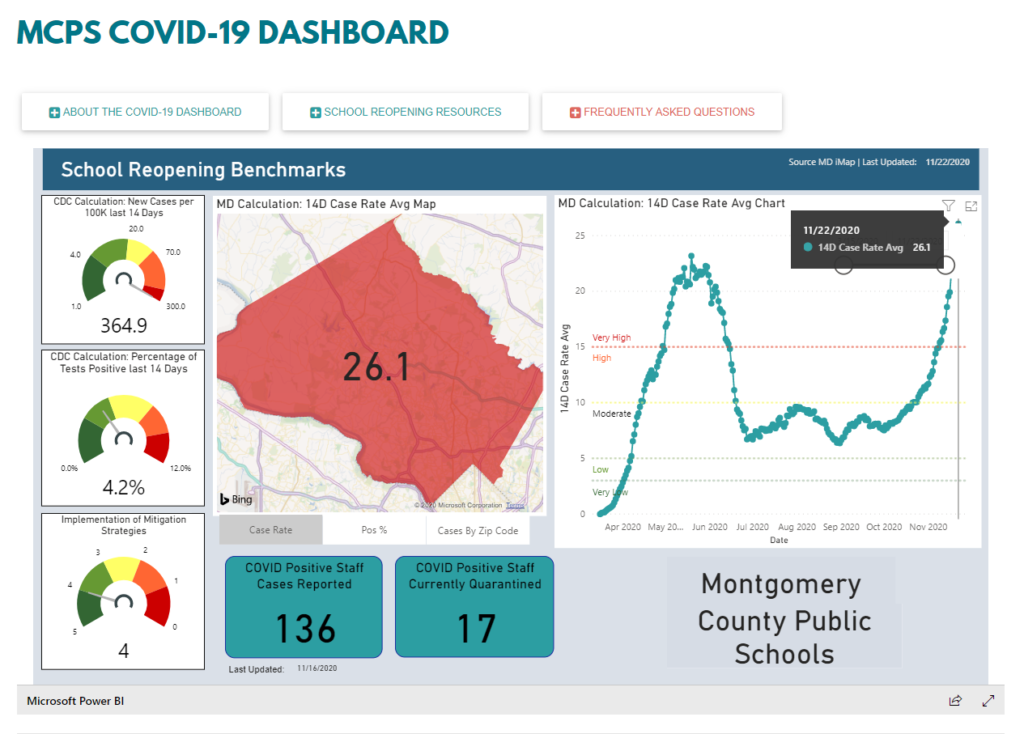

Yet at a time when we know that (post-Covid19) we need improved transportation and relief for overcrowded schools and delayed modernizations, this Growth Policy reduces our ability to finance those needs.

These and other increased needs are coming while we are lowering our General Obligation bond borrowing to slow the growth of debt service costs, which lowers the amount of infrastructure we can fund with bonds. Less bonding and fewer impact tax revenues will not allow us to address our education and transportation needs. Even as the Growth Policy reduces revenues, the need for the infrastructure will not disappear. Either the funds will have to come from somewhere else, largely from county residents, or we will have to forgo important infrastructure improvements which will make righting our economic ship even more difficult.

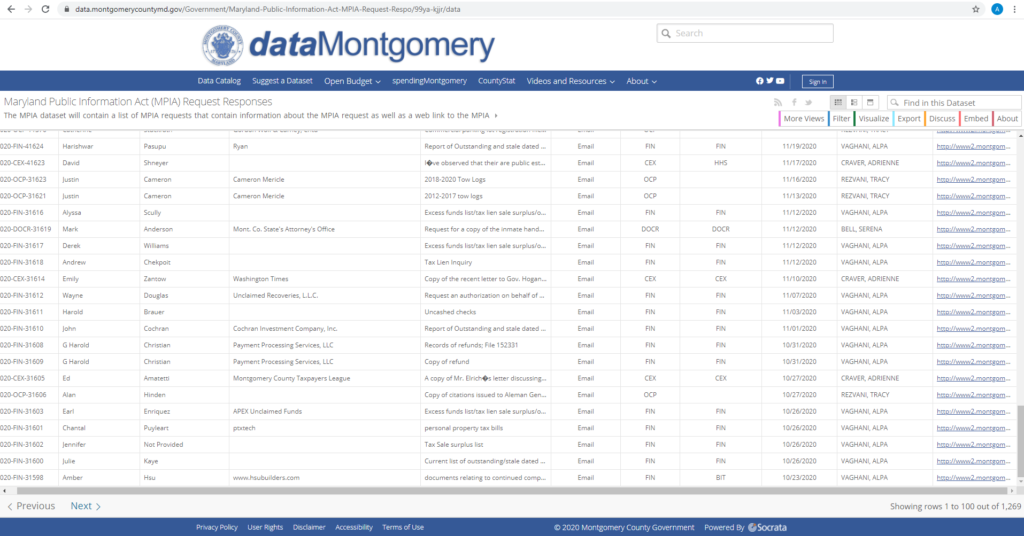

I laid out my concerns in a letter I sent to the Council on September 10 (attached) and I highlighted my concerns again in another letter on November 10 (attached). My staff also raised several issues throughout the process. While I appreciate some of the improvements to the Growth Policy, including the improved annual school test and the clarification for agricultural storage facilities, I cannot sign this bill as it is currently written.

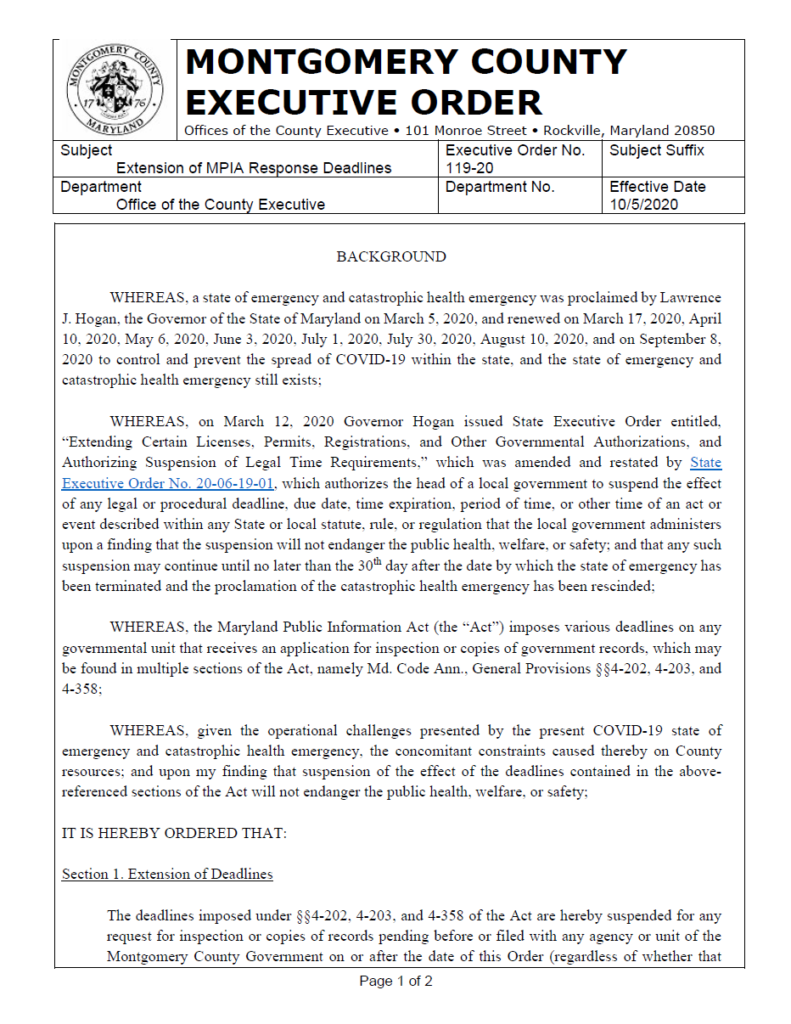

The Council has stated that it will consider an increase in the recordation tax to fill the gap from the reduced revenue, but that discussion is not currently scheduled. Furthermore, using an increase in the recordation tax shifts the costs from the developers of the projects to people refinancing or buying homes as well as to purchasers of commercial properties. Additionally, in these uncertain budgetary times, any potential revenue source may have to be reserved for other needs.

If competitiveness is the issue vis-a-vis our neighbors, then we should consider how our neighbors raised the money to meet their infrastructure needs. I think we will find that their focus was not on ways to reduce the revenues coming from development – rather, the opposite – they looked for ways to ensure the resources needed to provide the infrastructure for a growing community.

I regret that in the middle of this pandemic we have not had the opportunity for a more fundamental discussion of other methods to achieve adequate public facilities under the Growth Policy. While I recognize that one of the driving forces behind the recommended changes is to generate more housing, we know this will generate more residents in need of services, more students in our schools, and more people traveling to their jobs. This strongly suggests the need to increase revenue sources, not reduce them. I would welcome an opportunity to work with the Council to identify fair, alternative methods to fund the necessary infrastructure. For example, our office is working on how we could structure development districts, which have been successfully implemented in Northern Virginia and which were recently recommended by the Economic Advisory Group. Without such a replacement, I cannot support a loss of revenue. That’s not providing adequate public facilities by any measure. We can do better.