This is that short time every four years when political science professors become popular with the foreign media, which is how I found myself hanging out in the cold this morning in front of my polling place. Overhearing media interviews with voters entering and exiting the polls turned out to be more interesting than I expected.

One man in his late 20s gave what I think of as the standard small-d democratic answer, speaking about the importance of participating in the electoral process. Like many Americans, he preferred not to disclose his voter choice and to get back home to help take care of his kid.

The interviewers struck gold, however, when they managed to find the rare, outspoken Trump supporter in inner Montgomery County. A woman in her late 40s or early 50s, she very politely took time to explain why she preferred Trump to Biden.

Trump will “keep America as it is” while Biden wants to “change it.” Biden wants to make America “socialist.” The specific reason she cited for supporting Trump was his desire to keep out “illegal immigrants” and protect the border. She wanted to vote in person because she doesn’t trust the mail and is concerned that “the Democrats are going to steal the election” through mail ballots.

Put simply, this perfectly pleasant woman was in complete sync with the FOX and Trump narrative. It’s not something you see a lot of in my part of the world where Trump signs are literally nonexistent, and Biden will easily win over 80 percent of the vote. I suppose it’d be like watching someone explain their Biden vote in Carroll County.

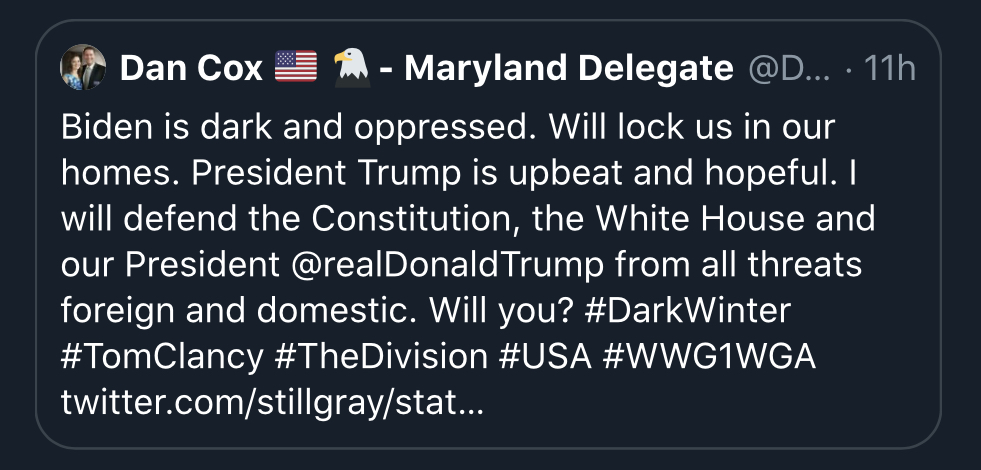

The most unsettling part to me is the easy willingness to believe that somehow Biden can inexplicably steal the election by mail. So it remains important for leaders, officials and experts to keep providing accurate information to counter the deluge of misinformation about our democracy that the president and seems eager to spout. People who care about our democracy in both parties should participate, just like the Texas Republicans who are fighting efforts to disfranchise over 100,000 voters in Harris County.

Meanwhile, Democrats need to keep working to get out the vote in the few remaining hours of this election. Let’s also not buy into the panic over counting the votes. America has done this many times before, so it’s not like it’s a mystery. Pandemic or no pandemic, our officials are well prepared to do it again.

The doubt sown over this very question by President Trump as well as his willingness to peacefully transfer power is what fills many Americans with dread rather than hope as we approach election night. It’s what makes this election year so abnormal.

But by far the best response that Americans can provide is to keep streaming to the polls until they close and then to keep calm while we await the complete count. For a variety of reasons, some states may start out red or blue and then go the other way. It is not a stolen election if Florida starts the night as blue (early voters) and then trends red (election day voters). Nor is it stolen if Pennsylvania is red on election night but then mail ballots turn it blue. All votes are equal.

We, the People, need to show respect for our democratic process even if the president does not and goes ahead with his publicly stated plan to declare victory prematurely. I realize that the repugnance of these sorts of actions amplified by social media encourages the opposite. Just remember that we all lose if those boards in front of stores in downtowns across the country turn out to have been necessary.