By Adam Pagnucco.

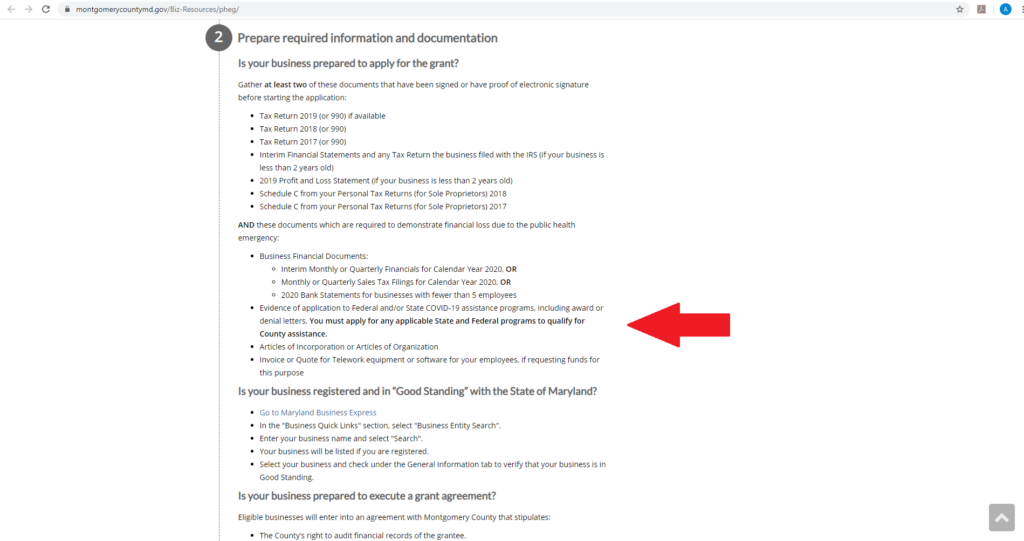

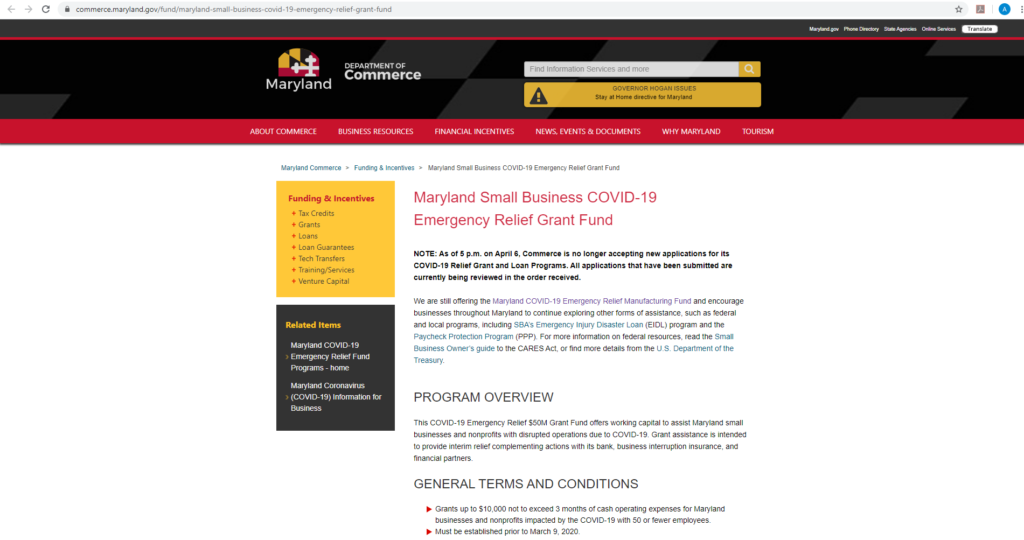

At 9:09 PM last night, I published a post on the county’s $20 million COVID-19 small business assistance program noting that no regulations governing its disbursements had yet been sent to the county council or published for the public. Roughly 20 minutes later, the regulations were sent to the council and forwarded to me by multiple sources almost immediately. The regulations appear below.

There are many details of interest to applicants, who should read every word of these regulations. The provisions that stand out to me are the ones setting aside $10 million for near-term disbursement and reserving $10 million for later. Consider these specific provisions.

Section 4 (b). $10,000,000.00 of funds appropriated for this Program are reserved for businesses or nonprofit organizations that demonstrate Significant Financial Loss. The initial grant award disbursed under this component of the Program is $10,000. The remaining amount of Significant Financial Loss demonstrated by these businesses and non-profit organizations may be disbursed subsequently, subject to the availability of funds.

Section 5(e)(B)(6). Business that have suffered Significant Financial Loss will be eligible for an immediate disbursement of up to $10,000. If the Percentage Decline is 50% or greater, Subtract the Adjusted PHE Revenue from the relevant historical average (Monthly Historical Average for monthly Adjusted PHE Revenue, Quarterly Historical Average for quarterly Adjusted PHE Revenue) to get the Recommended Grant Amount, up to a maximum of $10,000.

Section 5(e)(B)(7). Subtract the Adjusted PHE Revenue from the relevant historical average (Monthly Historical Average for monthly Adjusted PHE Revenue, Quarterly Historical Average for quarterly Adjusted PHE Revenue) to get the Recommended Grant Amount, up to a maximum of $75,000.

Section 5(e)(B)(8). Subject to the availability of funds, once the initial $10,000,000 reserve has been committed, applicants who qualified for more than an initial disbursement of $10,000 and applicants who qualify for a grant that have not received funding will be evaluated and the remaining balance will be disbursed.

And so $10 million will be disbursed sooner and $10 million will be disbursed later. Instead of the full $75,000 maximum grant provided in the legislation passed by the council, applicants will get a maximum of $10,000 in the first round and may get a chance for more money later. When will the second $10 million go out? That’s not clear, but the caveat of “subject to the availability of funds” in Sections 4(b) and 5(e)(B)(8) is not encouraging. Given the volume of paperwork required in the application process, it could take a while.

None of this appears in the legislation creating the program. The council prioritized speed in disbursing the full $20 million it allocated for assistance. The executive branch took twice as long as the District of Columbia to get its assistance program going and now plans to hold back half the money. The council just introduced a new appropriation of $5 million for restaurants and retailers. Given these regulations, what will happen to that money?

The executive branch is not implementing this program in accordance with the legislative intent of the council. The council must take additional action to enforce its will. NOW.

The regulations appear below.