By Adam Pagnucco.

The County Council is calling its recently passed budget an “Education First” budget since it included an increase above the state-required minimum level for Montgomery County Public Schools. Let’s evaluate that claim.

The council and the school system have had strained relations for a decade. The problems began under former Superintendent Jerry Weast, who antagonized several Council Members with his hard-charging, overdriven style. Nevertheless, Weast won several major budget increases for MCPS during his tenure. Then came the Great Recession, which forced the county to make substantial spending cuts across all of its agencies. One obstacle to cuts at MCPS was the state’s Maintenance of Effort (MOE) law, which sets a local jurisdiction’s per-pupil contribution to public schools as a base which cannot be lowered in future years unless a waiver is obtained from the state’s Board of Education. In Fiscal Years 2010, 2011 and 2012, the county cuts its per-pupil contribution to MCPS, and in 2012, it did so without applying for a waiver. As a result, the General Assembly changed the MOE law to force counties to apply for waivers or else have their income tax revenues sent directly to school systems. At the same time, the General Assembly shifted a portion of teacher pension funding responsibilities, once solely the province of the state, down to the counties. The combination of these two changes provoked outrage from county officials, some of whom vowed to never support a dime over MOE for MCPS in the future.

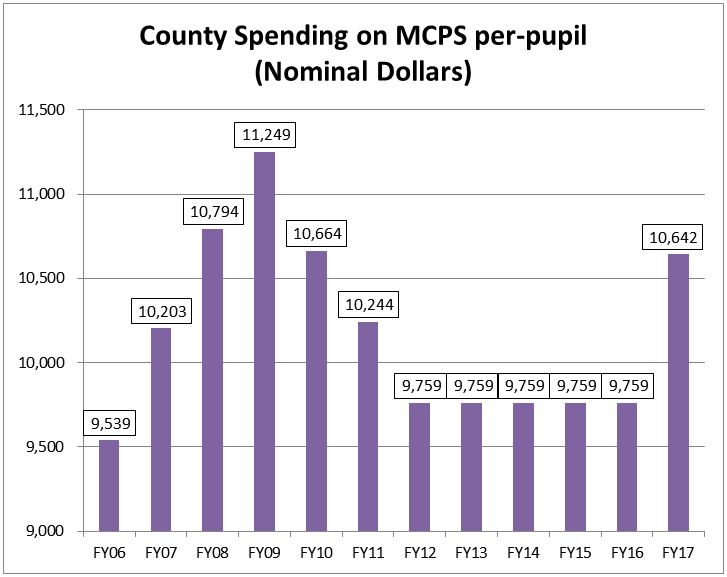

The chart below, which shows the recent history of Montgomery County’s local per-pupil contribution to the schools, illustrates the effects of these events. After rising through FY09, the per-pupil contribution fell for three straight years and then was frozen for four straight years. This year, the Executive proposed and the council approved an increased per-pupil contribution. (Roughly $300 of the increase is accounted for by the county’s payment of teacher pensions.) This is why the County Council is calling its budget an “Education First” budget.

But three items of context apply here.

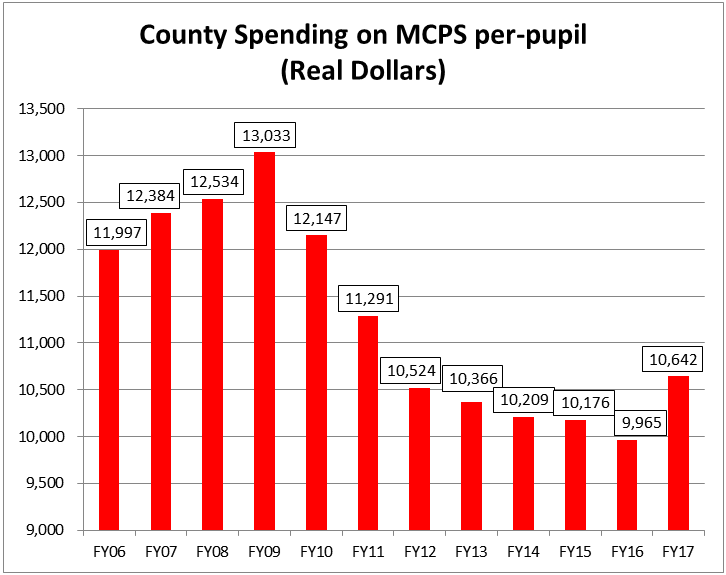

First, the above chart does not include the effects of inflation, which erode dollar contributions over time. The chart below shows per-pupil contributions in real dollars using 2017 as a base. (Inflation in 2016 and 2017 is assumed to be 2.1%, the average of 2007-2015.) Adjusted for inflation, the county’s current per-pupil funding is nowhere close to what it was before the Great Recession struck.

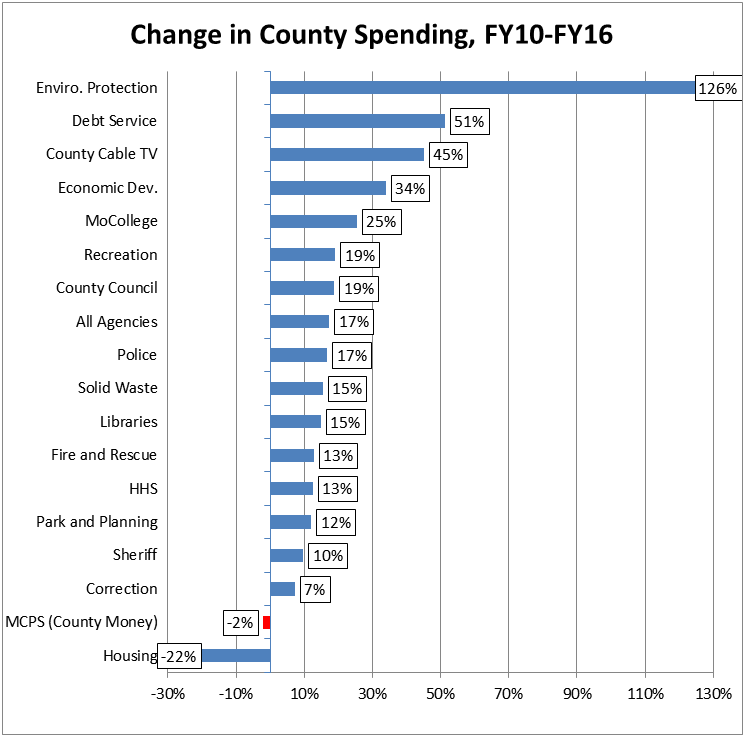

Second, while MCPS was living under austerity, other county departments were receiving sizeable funding increases. The chart below compares funding increases across several county departments and agencies including MCPS between FY10 (the pre-recession peak year) and FY16. In terms of county dollars only, MCPS’s budget was cut from $1.57 billion to $1.54 billion over this period, a 2% cut, while many other departments enjoyed double-digit increases. Can one good year make up for seven years of austerity for the public schools?

Third, while county officials criticize the General Assembly for tightening the MOE law and shifting teacher pensions, it is the state that has been pumping substantial funding increases into MCPS’s operating budget. The chart below shows that while county funding for MCPS was cut by $33 million between FY10 and FY16, state aid to MCPS rose by $192 million.

The bottom line is that the new FY17 budget does add $110 million in local money to MCPS, an amount which exceeds the state-required maintenance of effort by $89 million. But this one funding increase comes after seven years of reduced and frozen per-pupil contributions, a period during which the rest of the government enjoyed double-digit increases. Council President Nancy Floreen has described the budget as “a historic partnership with the Board of Education” and “a plan for the future.” Does that mean that the council will continue to exceed maintenance of effort and give the school system increases that match the rest of the government in future years? Or will this be a one-year respite, after which austerity will return?

We will have more in Part Three.