By Adam Pagnucco.

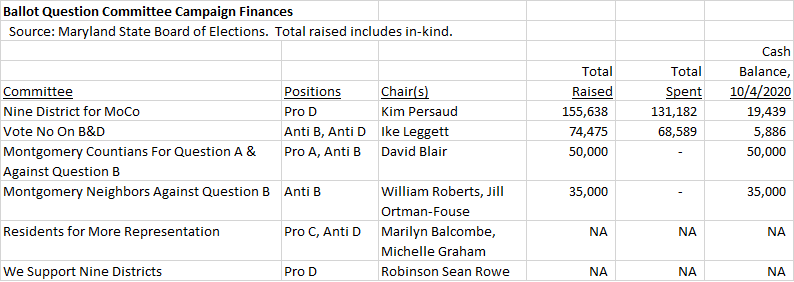

The six committees formed to advocate for and against MoCo’s ballot questions have filed campaign finance reports through October 4. Let’s see who is paying for all of this – so far.

First, a quick summary of the ballot questions.

Question A: Would freeze the property tax rate but allow a unanimous vote of the council to increase it. Authored by Council Member Andrew Friedson.

See Why Progressives Should Support the Friedson Amendment.

Question B: Would remove the ability of the county council to break the current charter limit on property taxes, thereby capping property tax revenue growth at the rate of inflation. Authored by Robin Ficker.

Question C: Would add 2 district seats to the county council, thereby establishing 7 district seats and 4 at-large seats. Authored by Council Member Evan Glass.

See MoCo Could Use More County Council Districts.

Question D: Would convert the current council’s 5 district seats and 4 at-large seats to 9 district seats. Authored by Nine District for MoCo.

See Don’t Abolish the At-Large County Council Seats, Nine Kings and Queens.

Here is a summary of committee finances for the entire cycle.

Nine District for MoCo, by far the oldest committee, has raised and spent the most money. It has had far more individual contributions (252) than Ike Leggett’s Vote No on B and D (30) with no other committee reporting any. Real estate interests have accounted for 83% of Nine District’s cash contributions. Interestingly, while Washington Property Company president Charlie Nulsen and the three county employee unions were major Nine District contributors in prior reports, they have not contributed any more since July. Nine District has collected contributions from leaders of the county’s Republican Party, which has raised money for the group on its website. The group has spent money on fees for Baltimore consultant Rowland Strategies, legal fees, robocalls and advertising (especially on Facebook).

Vote No on B & D, Leggett’s committee, spent $9,610 on graphic design for printing and campaign materials and $58,437 on direct mailing. So far, this is the only expenditure by any committee on mail. (Where’s my mailer, Ike?) Two other committees have collected money but not spent it and two more have collected less than $1,000.

Here are the biggest contributors to these committees and their positions on the ballot questions.

David Blair – $100,000

Supports Question A, Opposes Questions B and D

The former county executive candidate has given $50,000 each to Leggett’s group opposing Questions B and D and his own group supporting Question A and opposing Question B.

Charlie Nulsen – $50,000

Supports Question D

The president of Washington Property Company made one $50,000 contribution to Nine District for MoCo on 6/4/20. This was a critical boost for the group as it was in the home stretch of gathering signatures to appear on the ballot.

Monte Gingery – $40,000

Supports Question D

The head of Gingery Development Group has made three contributions totaling $40,000 to Nine District for MoCo.

MCGEO – $30,000

Opposes Question B, Supports Question D

The largest county government employee union gave $20,000 to Montgomery Neighbors Against Question B and made a $10,000 in-kind contribution to Nine District for MoCo. MCGEO President Gino Renne is the treasurer of Empower PAC, which gave another $5,000 to Montgomery Neighbors Against Question B.

Willco – $15,000

Supports Question D

The Potomac developer gave an in-kind contribution of $15,000 to Nine District for MoCo which was used to pay Rowland Strategies.

UFCW Local 400 – $10,000

Opposes Question B

This grocery store union which shares a parent union with MCGEO gave $10,000 to Montgomery Neighbors Against Question B.