Rich Madaleno’s announcement of his gubernatorial campaign has resulted in profiles in today’s Baltimore Sun and Metro Weekly.

Tag Archives: Rich Madaleno

Democratic Statements on Hogan’s Veto of Earned Sick Leave

Bill Sponsor Del. Luke Clippinger (D-46)

Video Courtesy of Bryan P. Sears, The Daily Record.

Sen. Rich Madaleno:

Today the people of Maryland saw the Hogan Hype Machine at it again. Hiding behind the empty promise he offered in January, Governor Hogan vetoed real progress for the working families of Maryland.

Sadly, Hogan sat on the sidelines for while Democrats in the legislature did the hard work. If Governor Hogan truly cared about providing sick leave to more working Marylanders, he would have signed this compromise legislation today.

Republicans in Congress are working to dismantle our healthcare system and Hogan’s actions today denies 750,000 Marylanders the ability to see their doctor or care for a sick family member. We need a Governor who will stand with working Marylanders.

State Party Chair Kathleen Matthews:

Hard work should pay off, and working Marylanders shouldn’t have to decide between a paycheck and taking care of themselves and their families.

Democrats brought all sides of the table together to extend earned sick leave to more than 700,000 Marylanders.

Instead of heeding the calls of working Marylanders, Governor Larry Hogan dismissed them.

Voters will remember in next year’s election that Governor Larry Hogan put his own agenda ahead of the health of working Marylanders and their families.

General Assembly Passes Bill to Protect Planned Parenthood. Next Stop is Hogan’s Desk

The General Assembly passed great legislation sponsored by Sen. Rich Madaleno and Del. Shane Pendergrass designed to ensure that Planned Parenthood stays funded, regardless of the federal budget, so that all Marylanders have will retain access to their vital family planning and health services:

“Today we made sure that no matter what happens in Washington, Maryland will ensure that all women have access to health services — especially those who have historically faced barriers to quality health care — women with low incomes, on Medicaid or living without health insurance, people of color, those living in rural areas, and LGBTQ people,” said Madaleno.

“This is a great day to be a Marylander and Planned Parenthood is grateful to the General Assembly for its leadership,” said Karen J. Nelson, President & CEO of Planned Parenthood of Maryland.

The bill now heads to Larry Hogan’s desk. Will he allow it to become law without his signature–I doubt that he will sign it–or will he force a veto override? This gives the Governor a great opportunity to keep his promise during the 2014 campaign that he won’t work to restrict access to abortion or birth control.

But the Governor has said he remains personally opposed to abortion. Opposition to Planned Parenthood, long the object of Republican ire, has become a totem for Republicans in the wake of bogus accusations that Planned Parenthood profited off of the sale of fetal tissue. At the national level, the issue helped cement Rep. Jason Chaffetz’s reputation as a complete jackass:

Once again, Trump’s victory has brought the national home to Maryland. Whether or not Hogan has the votes to uphold a veto, his decision will speak volumes about his views on Planned Parenthood. Will Hogan stand with Trump and extreme congressional Republicans? Or will he keep his promise to preserve access to abortion and birth control in Maryland by protecting Planned Parenthood?

MoCo’s Giant Tax Hike, Part Three

By Adam Pagnucco.

The need to fund MCPS was one reason given by county officials for their recent hike in property taxes. Another reason was the effects of the U.S. Supreme Court’s decision in the Comptroller of The Treasury of Maryland vs Wynne case. We examine that issue today.

The Wynne case started when two Howard County residents with income from a firm that did business in other states applied for an income tax credit to offset their out-of-state earnings. While they received a credit against their state income taxes, they were denied a credit against their county income taxes. The residents sued, and the case made it all the way to the U.S. Supreme Court, where the court sided with the plaintiffs on a 5-4 vote. There were two consequences for local jurisdictions. First, they could no longer tax out-of-state income. Second, they owed refunds to residents who had paid taxes on out-of-state income dating back to 2006. Between the two changes, Montgomery County’s Department of Finance estimated lost county income tax revenue of $76.7 million in FY17 and FY18, $31.5 million in FY19, and $16.4 million annually after FY19.

When the Executive sent the council his recommended budget in March, then-current state law required that Montgomery County pay an estimated $115 million in refunds and interest in nine quarterly installments stretching into FY19. The hit in FY17 was $50.4 million. But Montgomery County State Senator Rich Madaleno, Vice Chair of the Senate’s Budget and Taxation Committee, passed a state bill that extended the refund payment period out to FY24. This reduced the county’s immediate liability and the Executive responded by asking the council to reduce his recommended property tax hike from 3.9 cents to 2.1 cents per $100 of assesable base.

Senator Madaleno’s legislation enabled the council to cut the Executive’s original $140 million tax hike by $33.7 million and still increase county funding for MCPS by $110 million. But the County Council did not take advantage of it. They increased property taxes by the Executive’s original amount anyway, a tax hike of 8.7 percent. Why did they do that? We will explore that question soon, but first we will examine another source of potential reductions in the tax hike: savings from collective bargaining agreements.

More in Part Four.

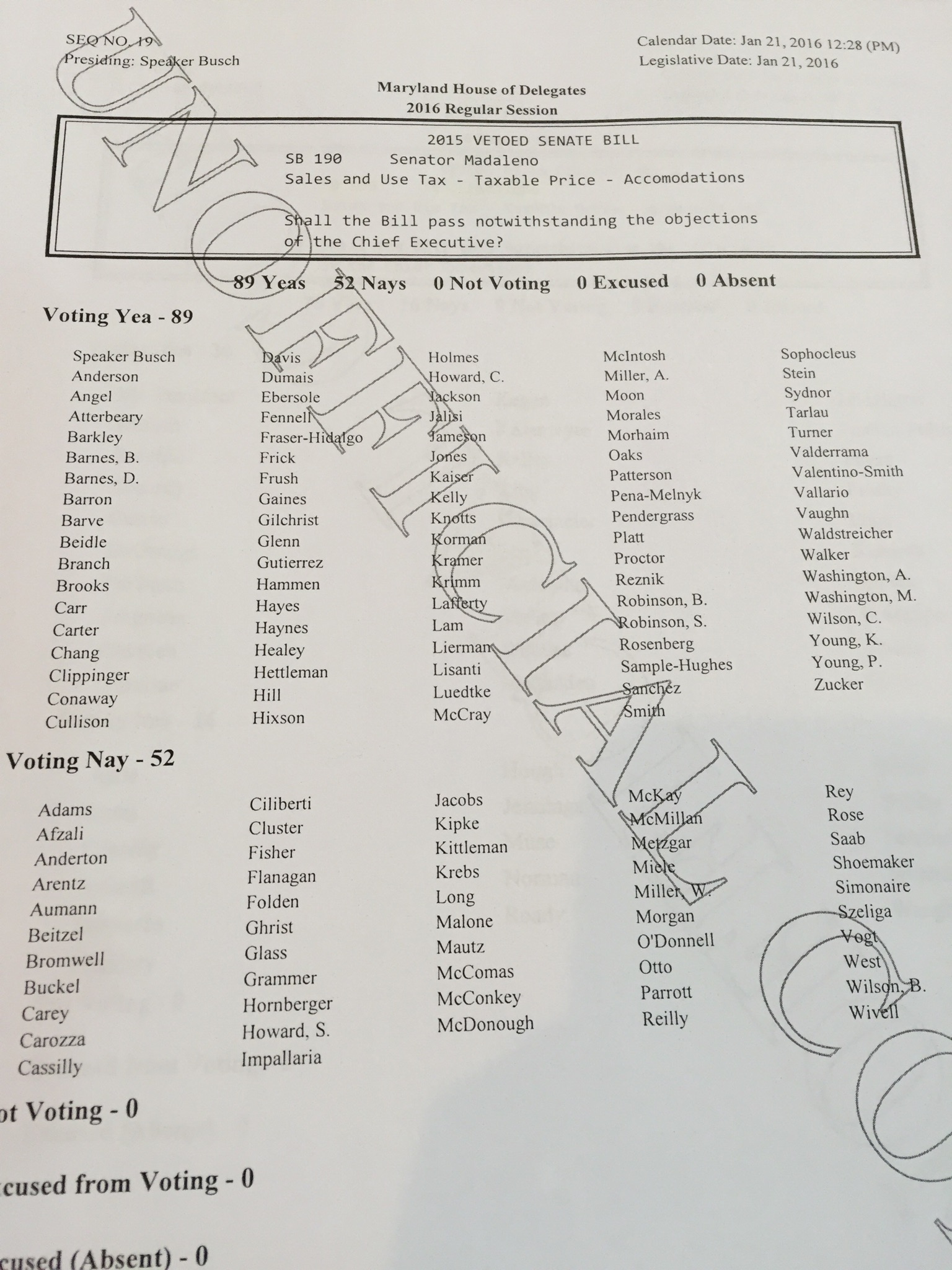

House Overrides Governor on Marriott/Hotel Accommodations

The Maryland House joined the Senate by promptly voting to override the Governor’s veto of Rich Madaleno’s bill that requires the same tax rate levied on hotel rooms sold by third-party hotel bookers as by the hotels themselves. This bill is a major step toward keeping Marriott in Maryland and Montgomery County.

As explained in previous posts, Hogan vetoed the bill out of fear of looking like he was supporting a tax increase. Bizarrely, this meant that the Governor favored forcing business located in Maryland who bring business and employment to the State to pay more taxes than out-of-state hotel bookers. The latter pocketed the savings and did not pass it on to consumers.

Here is the roll-call vote. All Democrats voted to override except Del. Eric Bromwell (D-Baltimore County) and Del. Ned Carey (D-Anne Arundel).

Override Thursday: Voting Rights and Marriott

Voting Rights Restoration Override Vote Postponed

The Maryland Senate special ordered (i.e. postponed) the vote on the Governor’s veto of the bill to restore the voting rights of ex-felons to a later date. The House overrode the Governor’s veto yesterday. The lead sponsors are Sen. Joan Carter Conway and Del. Cory McCray.

The Senate President stated forthrightly on the floor that this was to allow time for the appointment of a replacement to former Sen. Karen Montgomery (D-14). Rumor has it that many General Assembly Democrats are not thrilled about the timing or handling of this appointment.

Keep Marriott in Maryland

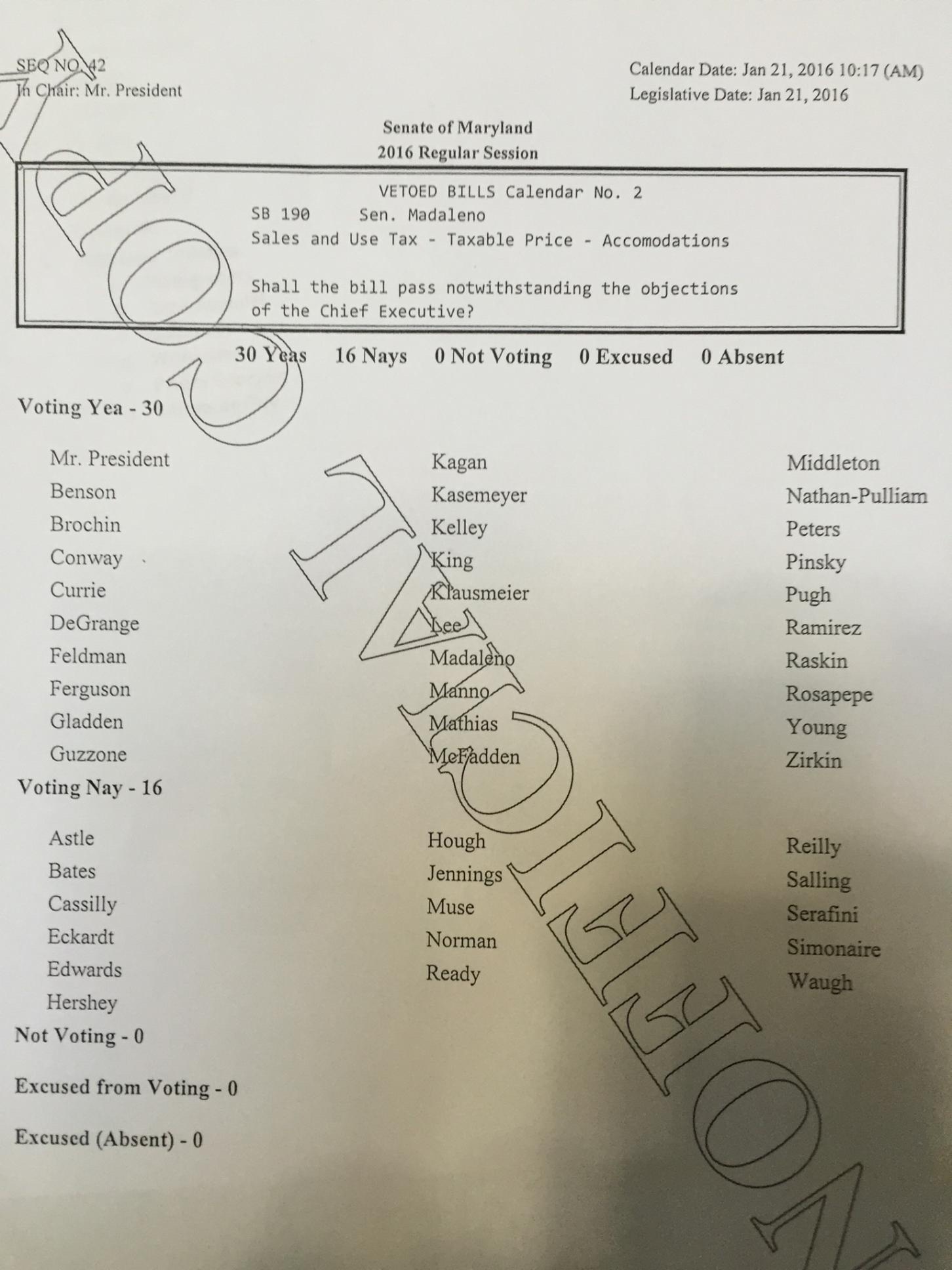

The Maryland Senate took a major step toward keeping Marriott headquarters in Maryland by overriding the Governor’s veto of a bill that requires the same tax rate levied on hotel rooms sold by third-party hotel bookers as by the hotels themselves.

This seemingly obvious fairness–the major request of the Marriott Corporation whose headquarters Montgomery County is working hard to retain–had the Governor cowering in fear that it might be cast as a tax increase. It’s evidence that the Governor’s ideological passion exceeds his desire to keep major companies in Maryland.

As the tally sheet shows, the Senate achieved the 29 votes required to override a veto with one to spare despite Sen. Montgomery’s retirement. A real victory for Senate Budget and Taxation Vice Chair Rich Madaleno who pushed hard for the bill.

Two vote switchers from the original bill are Sen. Addie Eckardt (R-Eastern Shore) and Sen. John Astle (D-Anne Arundel). Eckardt’s switch was not surprising, as Republicans tend to want to rally around the Governor to support a veto.

Two vote switchers from the original bill are Sen. Addie Eckardt (R-Eastern Shore) and Sen. John Astle (D-Anne Arundel). Eckardt’s switch was not surprising, as Republicans tend to want to rally around the Governor to support a veto.

In contrast, Astle is a member of the Democratic leadership team, so his vote to support the Governor was a shock. Indeed, this Montgomery blogger wonders if Montgomery Senate Democrats might return the favor by voting to uphold the veto on funding for Anne Arundel–except that the Speaker wants it.

UPDATE: Sen. C. Anthony Muse also flipped, which is interesting since Gaylord Marriott, located at National Harbor in his district, in Prince George’s made it a top priority. Additionally. Sens. DeGrange and Peters–both Democrats–switched from red on the original bill to voting to green on this vote.

Hogan’s Big Decision

No, it’s not the Purple Line.

It’s about a much smaller tax bill that will speak volumes about the sort of Governor that Larry Hogan intends to be. Equally important, does the Governor want Marriott to stay in Maryland?

Marriott is the second largest corporation located in the State of Maryland. It has made a relatively small ask of the State that should be an easy lift for any pro-business governor, particularly one who has made recruiting new business and jobs the central theme of his administration.

Specifically, Marriott has asked the Governor’s support for a bill that would ensure that online travel companies pay the State the same in taxes as brick-and-mortar companies. Currently, when you buy a hotel from an online travel company like Expedia, you pay taxes and fees equal to what you would pay in taxes if you bought the same room directly from from the hotel.

Sounds good except that Expedia is only passing on the tax for the rate that it paid the hotel for the room–not the tax on the full rate you paid. Expedia pockets the difference, leaving the State poorer and Marriott at an unfair competitive disadvantage.

It’s not even clear that this is legal. A bill sponsored by Sen. Rich Madaleno (D-18) and passed by the General Assembly that would correct this problem currently sits on the Governor’s desk and awaits his signature.

Having the same taxation rates for people engaging in the same economic activity is the only way to ensure the fair competition that is vital to a healthy free market. But Grover Norquist has declared this a tax increase, making life difficult for anti-tax Republicans, like the Governor, who has made sensible past statements indicating that he doesn’t view it that way.

So the Governor has to make a choice. Does he want to continue down the pragmatic, center-right policy lane that he has followed so far? Or will he hew to the demands of national conservative ideologues?

Signing the bill is right economically because it creates a level playing field and prevents online companies from pocketing monies that they were never supposed to gain. It sends a clear direct signal from Maryland to Marriott that we want you here.

Politically, it sends a message that Hogan is going to continue his practical pro-business agenda. Unfettered by the demands of national conservative ideologues–who are a lot less popular than his steady movement toward cutting taxes and reining in the structural deficit–Hogan will continue to do confidently what he sees as best for the State. In short, he’ll stand up to anyone for Maryland.

Hogan’s decision will send a strong message not just to Marriott but to the State.

Jamie Raskin for Congress?

Sen. Jamie Raskin (D-20) is widely considered a lock to enter the race for Maryland’s Eighth Congressional District.

Getting Elected in District 20

Jamie Raskin was first elected to the Senate in 2006 in an impressive defeat of longtime incumbent, Sen. Ida Ruben. Though Raskin was a first-time candidate, he beat Ruben by 2-1 thanks to a strong campaign and grassroots organization.

It also didn’t hurt that Chris Van Hollen notably did not endorse Sen. Ida Ruben, who had not supported him in his original congressional bid in 2002. Since the 2006 Democratic primary, Raskin has been untouchable in this district.

Two of Raskin’s previous campaign managers, David Moon and Will Smith, have now joined him on the House side. Raskin remains very popular and a solid fit for this district, correctly perceived as the most progressive in Maryland.

In the Senate

Jamie made the transition from law professor at American University to politician in the Maryland Senate more smoothly than some likely expected. He worked well with his colleagues and became a leader on the Judicial Proceedings Committee.

Currently, Sen. Raskin heads the Executive Nominations Committee. He is also serves as Majority Whip and is a past Chair of the Montgomery County Senate Delegation.

His work has unsurprisingly focused more on issues related to his committee. Sen. Raskin was a robust supporter of marriage equality. In this session, he is focusing much of his efforts on campaign finance trying to make the system more transparent in the wake of the disastrous Citizens United decision, which opened the floodgates of soft money into American politics.

One of the more loquacious members of the Senate, he is excellent at arguing for his point of view and parrying his opponents. Jamie’s passionate progressive views have also not prevented him in working with others to move forward even if the product is less than ideal from his perspective.

All of these issues and skills would transfer well to Congress, even if he would likely have to get used to operating as part of the minority instead of the majority. There is a reason that lawyers are not lacking in Congress or Washington even if Washingtonians can tell lawyer jokes with the best of them.

Campaign and Competition

Jamie cannot self finance but he is well-positioned to raise a lot of money. His profile extends beyond the local level–and not just because his spouse, Sarah Bloom Raskin, has served on the Board of Governors of the Federal Reserve and is now Deputy Secretary of the Treasury.

Moreover, many of Jamie’s originals supporters are still very active in politics and eager to support his congressional bid. As he showed in 2006, he is quite capable of putting together an organized grassroots campaign.

District 20 has one of the richest pockets of Democratic voters in the State, though fewer than District 16 and similar in number to neighboring District 18. Raskin’s district would serve as a fine base for a congressional run.

Overlap with Other Candidates

Jamie Raskin will be a top-tier candidate. He shares a similar political profile with Rich Madaleno. Both are white males and strong progressives based in neighboring southern Montgomery County districts. They’ve worked closely together in the Senate on many issues. Either would benefit if the other does not run.

Madaleno or Matthews for Congress?

Madaleno on the Night Maryland Became

the First State to Vote Yes on Marriage Equality

Sen. Richard Madaleno, Jr.

Sen. Rich Madaleno (D-18) has been flagged by Bill Turque in The Washington Post as a potential contender for the Eighth District seat:

Madaleno, 49, a onetime aide to former Montgomery County executive Doug Duncan, is vice chairman of the Maryland Senate’s budget and taxation committee and the body’s only openly gay member. He was a key player in passage of the state’s same-sex marriage and transgender rights laws.

If Rich runs, his campaign would likely gain very serious support from the Gay and Lesbian Victory Fund, which has backed his past state legislative campaigns. Madaleno first ran for the House in 2002, becoming the first openly gay man ever elected to that body.

When Rich ran for the Senate in 2006, he was unopposed in the Democratic primary and the general election. While he is better publicly known for his work on LGBT rights, Madaleno is recognized around Annapolis as one of the top budget experts, serving as the floor leader on virtually every major revenue initiative. Additionally, he played a central role in the passage of the Dream Act.

Rich has been consulting family and friends this weekend about whether he should jump in the race. His state legislative district is entirely located within the Eighth District. Moreover, along with neighboring D20, represented by almost certain candidate Sen. Jamie Raskin, D18 holds more Democratic primary voters than any other located within this congressional district. (Note: D16 has even more, though a snippet of D16 is outside the Eighth.)

Kathleen Matthews

Kathleen Matthews has expressed strong interest in the race and seems set on a bid though she has not spoken directly to the press. Though Matthews does not hold political office, she’s not a stranger to politics or the community:

Matthews, who lives in Chevy Chase, left WJLA in 2006 after 24 years. At Marriott, she became a rare high-level Democrat in a corporation where executive chairman Bill Marriott and family members are major GOP contributors. Matthews is credited with making the company more active on social media. She has served on the boards of several charitable organizations.

Her job at Marriott was very high level–Chief of Global Communications and Public Affairs. Moreover, her job likely provides her with a network of potential donors in the business community unmatched by other potential candidates, including GOP donors who would be unlikely to give to other Democrats.

The substantive nature of her work at Marriott would allow her to talk about how she was able to promote liberal goals even in a conservative corporation–not a bad skill for someone to have in today’s House of Representatives:

Matthews, who has long talked about running for office, advocated Marriott’s move toward more progressive policies, including sustainability and LGBT friendliness. She pushed the company to open a hotel in Haiti after the earthquake — Bill Clinton attended the opening last month.

She would be an interesting candidate in a field otherwise likely to be dominated by elected officials. On the other hand, this district is replete with people who work in government-related jobs. Rather than focus primarily on her business experience, I suspect she’ll use it to tout issue positions. She certainly will not lack the communication skills, though it will be a change for the former reporter to have to answer the questions.

Changing the State Budget Process?

Black is the New Orange: Hogan’s Budget is on the Right

Over at the Free Stater, Todd Eberly has a great post that unpacks exactly why governors of Maryland are considered the most powerful in the nation:

According to the constitution of Maryland, the Assembly cannot increase spending in the governor’s budget and it cannot move funds around in an effort to increase funding in one area by reducing it elsewhere. All the Assembly can really do is reduce the amount of spending proposed by the governor. The Assembly can introduce legislation to provide funding for programs – but only if the legislation identifies a funding source (e.g. raising taxes). Certainly, members of the Assembly can work with Hogan and try to convince him to introduce a supplemental budget that provides more funding for programs they value, but failing that, Hogan’s budget will stand.

Senators Rich Madaleno, Guy Guzzone, and Roger Manno have introduced a constitutional amendment to give the General Assembly more power vis-a-vis the governor. As we approach the 100th anniversary of the amendment that established this system, it seems a good time revisit our choice.