By Adam Pagnucco.

When Governor Larry Hogan announced a phase 1 reopening of Maryland’s economy on Friday night, several local jurisdictions (including MoCo) declined to go along. County Executive Marc Elrich said, “If there’s an uptick in cases, our hospitals can’t withstand an uptick… We will change the rules as soon as the science says we can change the rules. When that happens, we will start down the road of reopening things.” Elrich issued an executive order maintaining the current shutdown at the county level and the council approved it.

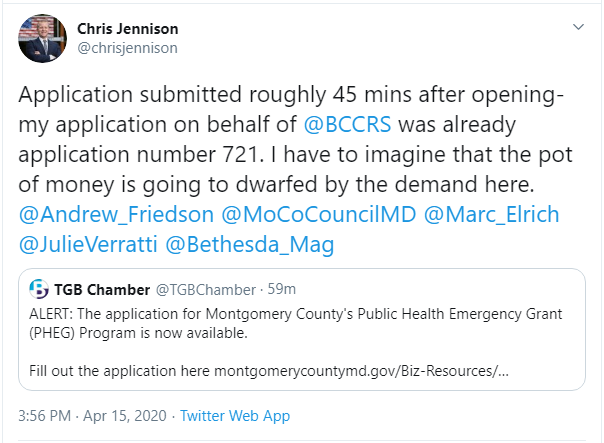

Elrich’s interest in protecting public health is understandable and commendable but there is a problem: the economy. Everyone understands that the economy has taken and will take collateral damage from COVID-19 restrictions. That said, the chief enemy of job creation is uncertainty and there is tons of that now. June 1 is coming and with it will be rent and mortgage payment deadlines. Many tenants and property owners will miss those deadlines in whole or in part just like they did in the prior two months. Worse yet, it’s hard for tenants and owners to work out flexible payment arrangements when no one knows when reopening will occur. That may cause many businesses to throw in the towel and cease operations permanently.

Given the above, how can the county reconcile the competing objectives of protecting public health and restarting the economy?

The executive has not set a date to ease restrictions. Instead, he has proposed the following 12 criteria that would guide any phased-in reopening:

- Sustained (14 days) decreases (rolling average) in:

i. The number of new cases in the setting of increased testing;

ii. COVID-19 related hospitalization rate;

iii. COVID-19 related ICU rate;

iv. COVID-19 related fatalities;

v. COVID-19 like and influenza like illnesses presenting to the health care system;

vi. Percentage of Acute bed usage by COVID-19 related patients;

vii. Percentage of ICU bed usage by COVID-19 related patients;

viii. Percentage of emergency/critical care equipment by COVID-19 related patients (e.g. ventilators); - A sustained capacity to test 5% of population per month;

- A sustained flattening or decrease in test positivity;

- Sustained, robust system in place to contact initial interviews within 24 hours, and initiate contact tracing process within 48 hours of initial lab notification; and

- Initiated and created meaningful infrastructure to identify and begin addressing demonstrated COVID related inequities in health outcomes, access to social support services

Let’s assume for the sake of discussion that these are the right criteria. (I may revisit that.) At the moment, only one of them – the number of cases – appears on the county’s COVID-19 page. The state’s COVID-19 page has more data, including cases, fatalities and hospital bed usage, but even the state’s page has nowhere near the data referenced by the county executive’s criteria.

At present, the public has no way to judge how close the county is to reaching the criteria the executive considers key to reopening. That must change.

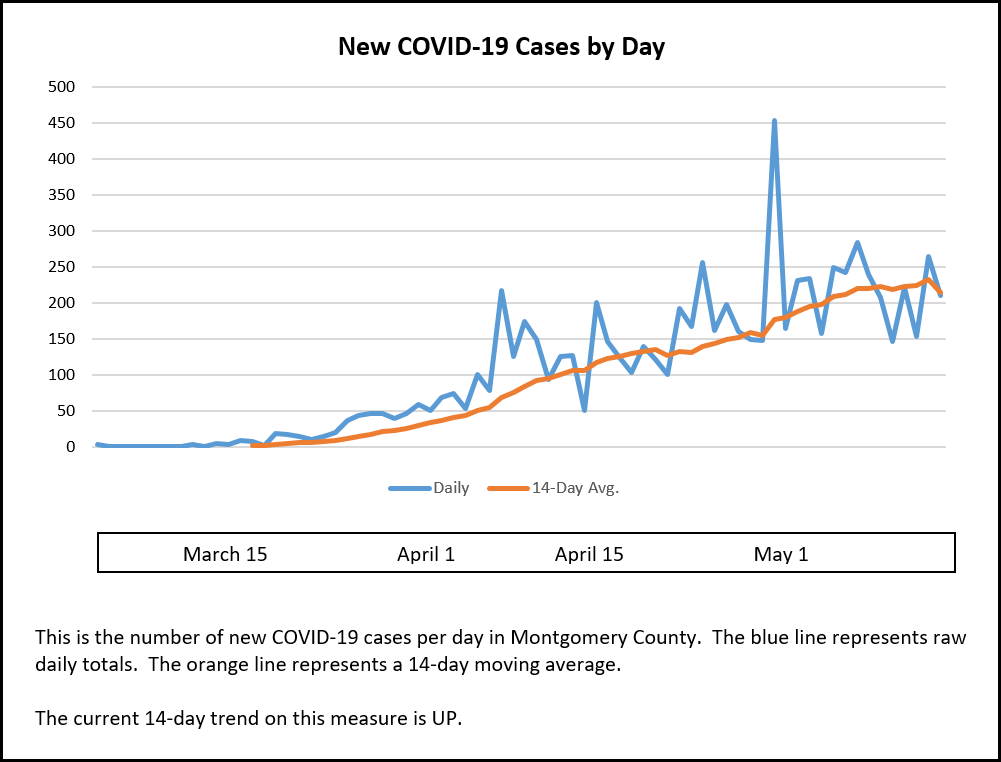

The county should publish data series on every one of its criteria on its website. Each series should include an easy-to-understand chart explaining what the series is and what its trend is. Here is one example I constructed for new cases, which is the only series currently published by the county.

At the end of the 12 data series, the county should state how many of the executive’s 12 criteria are trending up, trending down or are stable. The county should also clearly indicate how many of the criteria need to be trending down or remaining stable for phase 1 reopening to begin.

Furthermore, the county should update the public via blast email and social media every day on this data.

Implementing this system accomplishes a number of criteria simultaneously. First, it bases the decision to reopen on science. Second, it makes the decision transparent to the public. And third, it provides real guidance to businesses, tenants and property owners on how close the county is getting to reopening. That will help everyone make the decisions they need to make on the basis of real information, not rumor and fear.

The county must implement this as soon as possible. The alternative is to leave residents and employers in the dark on how long the shutdown will last, thereby risking further permanent destruction of jobs and businesses.