By Adam Pagnucco.

County Executive Marc Elrich has vetoed Bill 29-20, which would grant high-rise developers on Metro station projects payments in lieu of taxes in return for 15-year exemptions from property taxes. I wrote a three-part series on this legislation quoting the bill’s supporters in Part One, evaluating their arguments in Part Two and raising concerns in Part Three. The bill passed the council with amendments on a 7-2 vote, with Council Members Tom Hucker and Will Jawando voting no. Under the charter, the council may override a veto with 6 votes.

The executive’s veto message is printed below.

*****

October 16, 2020

TO: Sidney Katz, Council President

FROM: Marc Elrich, County Executive

RE: Veto explanation of Bill 29-20, Taxation – Payment in Lieu of Taxes – WMATA Property – Established, Enacted with amendments

I share the Council’s desire to find ways to spur smart growth and to broaden our tax base. However, I strongly oppose the approach used by the Council in this legislation. It is too costly and does not achieve my goal of increased affordable housing. Therefore, I am vetoing Bill 29-20, Taxation – Payment in Lieu of Taxes – WMATA Property.

Below is a description of the bill and my explanation of the veto.

Description of Bill 29-20

Bill 29-20 requires 100% exemption of the real property tax for 15 years. This exemption is known as a Payment in Lieu of Taxes (PILOT). The requirement applies to development that is higher than 8 stories on property owned by WMATA at a Metro station. The development must include at least 50% residential rental housing, and one-quarter of the moderately priced dwelling units (MPDUs) must be affordable for residents at 50% of area median income (AMI). The PILOT would begin no later than the second year after the property tax is levied. The law would sunset in 2032, but any existing PILOT would continue until the end of its 15-year period. To be eligible for a PILOT, a developer would be required to use contractors and subcontractors who have no more than two final penalties of $5,000 or more in the three prior years for violations of applicable wage and hour laws. At least 25% of the workers constructing the project must be County residents. Special taxing district taxes are exempt from the PILOT.

This Bill harms the budget without providing a meaningful public benefit.

At a time when the County is struggling to fund critical services, where the outlook for the next couple of years is uncertain at best, and where full economic recovery from this pandemic may take as much as ten years, it is certainly not prudent to reduce revenues coming into the County coffers.

During the Council’s deliberations on the Bill, supporters could only cite one potential development as being eligible for this 15-year, 100% tax break – the proposed Strathmore Square at the Grosvenor/Strathmore Station. Under the provisions of this legislation, Strathmore Square’s owners would receive a tax break of more than $100 million. As a member of the County Council, I supported the zoning changes that made this proposed development possible, but I simply do not believe it is a responsible use of County resources to supplement a market-rate housing complex at this level of expense.

Should similar developments occur at the other potential WMATA sites across the County, lost revenue would likely exceed $400 million. To be clear, I want more housing constructed in our County, and I see the significant benefit of housing that makes transit usage extremely convenient. However, I do not believe providing developers with $400 million in incentives is worth the 8,000 new housing units. Put another way, this Bill would provide a developer with a $50,000 per unit subsidy regardless of cost of rent. We simply cannot afford this cost.

Public benefit

Generally, PILOTs are used to incentivize production of more affordable housing that we would not otherwise get. Under current law, new residential development must include between 12.5% and 15% MPDUs (the minimum percentage requirement depends on the location of the project). Enactment of an entirely new program with such a substantial subsidy must do more than require one quarter minimum required number of MPDUs be affordable to those earning 50% AMI. In fact, we need more of these deeply affordable units, and I would support turning that provision into a requirement, rather than simply using it as part of an incentive package. Again, the public benefit proposed by this Bill does not warrant the expenditure.

Authority already exists to provide PILOTs

As you know, the County already has the authority to offer PILOTs. It makes sense to continue to allow them on a project-by-project basis – not all projects need the same PILOT term or value. Flexibility should be maintained to enable negotiation of the best possible agreement in the public interest.

Additionally, if we want to provide tax incentives that support commercial development to bring new businesses here, those incentives should go to the occupant of the building, not to the developer of the building. This legislation gives public funds to help build buildings not to incentivize businesses that would be tenants in those buildings.

Use of limited public funds should be targeted for affordable housing production and meeting affordable housing goals, which is not the focus of this Bill

By the estimates developed by WMATA and some Councilmembers, about 8,600 units can be built on the properties covered by this Bill. Approximately 1,300 of those units would be the required MPDUs; approximately 7,300 would be market rate units. The recent regional housing study and the related housing goals were clear that our housing need was not simply about the total number of housing units. The report and the related goals specify income-based targets: three-quarters of the future projected 40,000 units need to be below 70-80% of area median income. Therefore, only one-quarter or 10,000 of the projected 40,000 units, are needed to be at market rate. If this legislation succeeded in producing the number of units estimated by WMATA, then about 7,000 (those on WMATA property) of the 10,000 market rate units needed would not produce property tax revenue for 15 years. The legislation would shift property taxes almost entirely onto below market rate units.

The remaining 3,000 market rate units are likely to be spread out at the 23 “activity centers” along with the more than 25,000 affordable housing units. It does not make sense to focus the market rate housing at Metro stations and push the other affordable housing elsewhere. As the recent Housing Preservation study points out, affordable housing units near transit are at greatest risk of being lost and are being lost.

Given the projected number of market units needed, there is no lack of zoning in the Metro Station areas in order to accommodate the needed units; while they may not be built on top of Metro property, they may be built nearby within easy walking distance of the Metro.

High rise housing is expensive to build and expensive to rent

Furthermore, a focus on high rise buildings ignores the fact that by its very nature, high rise development is the most expensive that can be built. Advocates want to maximize use of land but if density is used to build high rises, it will be unaffordable to most of the people identified as needing housing. Seventy-five percent of projected need is affordable housing – why would the focus be on subsidizing market rate housing? Zoning in central business districts for high rises far exceeds the zoning for types of housing that are generally affordable and more family friendly – including garden style and mid-rise apartments.

The Bill could increase the cost of WMATA land.

Under Federal law, WMATA must seek the highest and best price for their land. Land that is exempted from all property taxes for 15 years is more valuable because the calculation of its value includes the costs to acquire and develop, including taxes, weighed against market rents. If two properties are side by side, one exempt from taxes and the other not, and they were producing the same value of unit, the land value of the exempt property would be greater because its cost of development would be less than the cost to develop the tax-paying property. This would, in turn, likely raise the parcel’s appraised value. The Bill could potentially be counterproductive by raising the value of WMATA’s land.

The Bill sets a difficult precedent

It is not clear why there is a public need to specifically incentivize development on WMATA owned property. It is likely that other properties near Metro will ask for the same PILOT. Those properties offer similar value in providing transit proximate development – a residential walkshed is a radius of ½ mile from Metro; a walkshed is the area around a station that is reachable on foot for the average person – how far someone is willing to walk to their home or business from transit. Additionally, a commercial walkshed is ¼ mile from heavy transit, which would raise the question of whether commercial development should be favored closer to Metro. There does not seem to be a logic to the approach of this Bill.

The impetus for this Bill seems to be based on one project at one Metro site as evidenced by testimony and the Council packets. One project should not drive countywide policy.

The specific project was discussed during Council deliberations – at the Grosvenor Metro Station by FiveSquares Development which had been working with WMATA for about five years either directly or through their affiliate, Streetscape Partners.

The Bill is particularly focused on one project at the Grosvenor Metro. In December 2017, as a member of the County Council, I voted in favor of the Grosvenor-Strathmore Metro Area Minor Master Plan which allows for this development to proceed. WMATA documents that we reviewed show that the original assumption for their property was that about 500 units could be built. This Minor Master Plan up-zoned portions of the Plan Area to allow for greater density, particularly on the Metro site both to take advantage of the Metro location and to provide density to make the project feasible. This up zoning resulted in allowing more than 2,200 units to be built there, essentially quadrupling the density.

The documents show that FiveSquares was substituted for Streetscape as the developer and that the appraisal of the land would only be done after the completion of the rezoning process. So, the price was set based on the appraisal which, like all appraisals, took into account all of the costs and the market for units that would be needed to support those costs. One has to assume that FiveSquares fully understood what they were doing because had they thought the appraisal was wrong, they could have walked away from the project. FiveSquares agreed to the appraisal and signed a deal. The appraisal assumes that the property can be developed at the determined price and FiveSquares obviously concurred with that assessment. Having been personally involved as an Executive negotiating over the value of land, I know that it is common for buyers and sellers to differ in appraisals and then to reach agreements that attempt to accommodate the assumptions of both parties. One has to assume that FiveSquares knew what they were doing when they accepted the assumptions and the appraisals that went with it.

If FiveSquares had a problem with the price and appraisal, they had an opportunity to reject the appraisal and the deal. At no point during the Council’s consideration of the Minor Master Plan was there any indication that additional public subsidies would be required to get a high-rise project “shovel ready,” let alone a 15-year abatement of all property taxes.

I would also note that others have commented that FiveSquares will pay for amenities; those amenities attract residents and make the project feasible. They would also have been included in the appraisal and are key in marketing the property.

Fiscal impact of a PILOT and the FiveSquares project

According to the Bill’s Fiscal Impact Statement that compared Strathmore Square with existing nearby buildings, the development’s approximate annual property tax bill upon completion would be between $5.8 million to $7.1 million a year. Over 15 years, the approximate loss of property tax revenue would be between $87 million and $106.5 million for just this single project.

No evidence that this Bill is necessary to stimulate market-rate (non-affordable) housing and this approach is not done region-wide

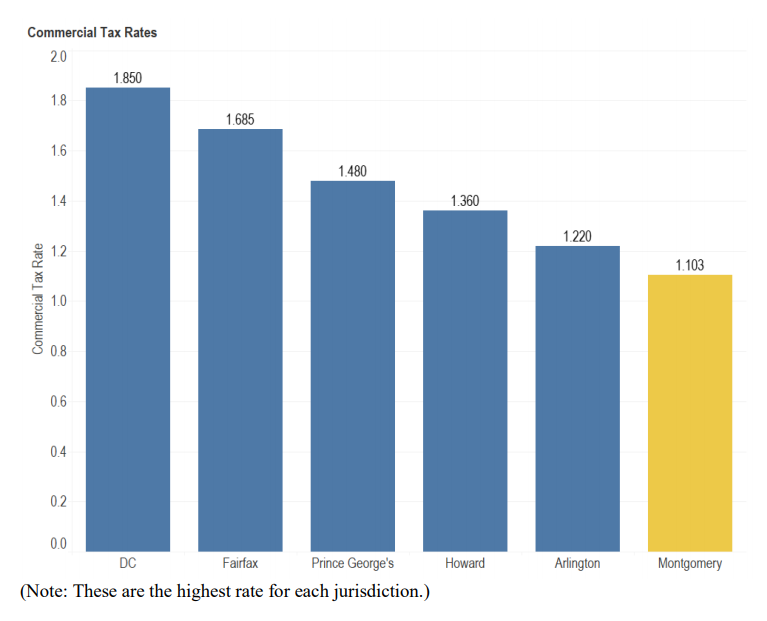

There is no evidence that this subsidy is required. In fact, if you look around the region, many of our neighboring jurisdictions have their highest taxes on property nearest Metro sites and the tax rates are substantially greater than in Montgomery County. If property taxes were the key to development, we would have won the development battle a long time ago because we are lower than most surrounding jurisdictions.

Furthermore, market housing is being built rapidly in Bethesda and is likely to spread to other densely zoned areas as Bethesda builds out. Rents in Bethesda are extraordinarily high, and it does not make sense to subsidize the construction of apartments that rent at prices far out of reach for most County residents. The Bill, coupled with a separate proposal from the Planning Board to reduce impact fees in most areas, will only deepen the obstacles to growing the tax base. While it is true that residents of these buildings will pay income taxes, the loss of property taxes is significant, and residents could live in other market rate housing where we collect both income taxes and property taxes. For the commercial sector, the only ongoing tax we receive to help provide infrastructure is the property tax.

This Bill was designed without a market analysis to establish whether this type of general legislation is needed. As noted above, the authority already exists to provide these PILOTS on an individual project basis, and a Countywide approach is not warranted.

Workers deserve prevailing wage

A majority of the Council voted against requiring the prevailing wage at these projects. The provision would have required that all contractors and subcontractors pay prevailing wages and be licensed, bonded, insured, and abide by wage and hour laws. Legislation that dedicates public funds to market-rate housing should, at least, also support the workers who build the housing. This provision was supported by the Baltimore-Washington Laborers’ District Council, an affiliate of LiUNA; United Association (UA), United Brotherhood of Carpenters, International Brotherhood of Electrical Workers (IBEW), CASA, Jews United for Justice, Progressive Maryland, Montgomery County Education Association (MCEA), SEIU 32BJ, SEIU Local 500, SEIU Local 1199, UFCW MCGEO Local 1994, and UNITE HERE Local 25. If WMATA was building a structure on the same property, current law would require them to abide by the prevailing wage. I believe the developments contemplated by this Bill should as well. The lack of such a provision to treat workers equitably and to share in the subsidy is another major deficiency in this legislation.

Using limited funds for market-rate (non-affordable) housing development means fewer funds for other services including affordable housing, recreation, and education, which has a racial equity/social justice impact

A Racial Equity and Social Justice (RESJ) impact analysis was not applied to this Bill, which was introduced before the RESJ requirement took effect. Because the Bill will have a significant budgetary impact, it deprives the County of tax dollars that could be used for other programs, including affordable housing that would benefit communities of color most. This Bill allows housing to be built for those who can afford it, not for lower income populations who are disproportionately Black and Latino.