The following is by Councilmember Marc Elrich (D-At Large):

Earlier this week, the Council’s HHS committee voted 2-1 (Berliner and Rice vs Leventhal) to delay the full implementation of the minimum wage by two years for BOTH large and small businesses. (My bill cosponsored by 4 of my colleagues would raise the minimum wage 2020 for businesses with more than 25 employees and 2022 for those under 25.) While everyone acknowledges that there will be some impact on some small businesses, yet again no evidence was presented that demonstrated that it would be a significant impact. While there are numerous studies, the meta-analysis of those studies show slight to no impacts on employment.[1] Statements should be supported by data or analysis. The absence of data is part of what made the PFM study so bad, because their original massive job loss assertions, and even their second lower revised figure, did not reflect the data from anywhere (as this blog and others have documented[2]). On the other side of the scale, studies clearly show the devastating impacts of poverty on children and families. I taught for 17 years at a high poverty school, and I saw up close the impact of poverty on students.

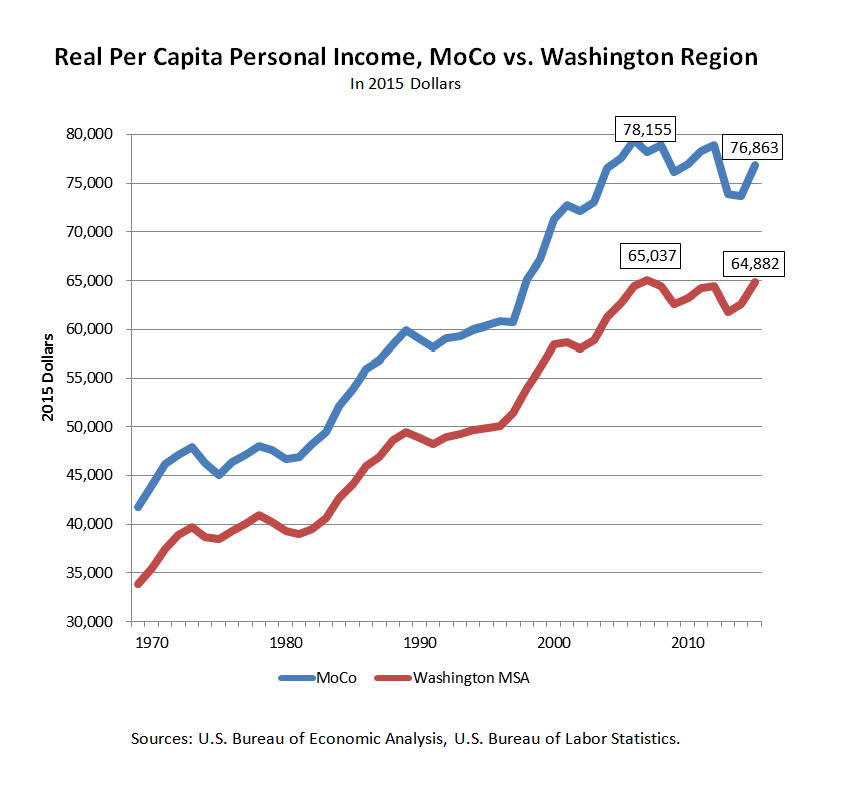

We have an opportunity to move toward a decent standard of living for these workers who have been working hard at low wages. Councilmember Berliner’s amendment to delay large businesses by two years to 2022 puts us two years behind Target’s stated nationwide plan. That is particularly inappropriate given that our county is one of the wealthiest in the entire country.

Councilmember Berliner argued for the delay using Minneapolis as the model and said that Montgomery County should use the same timing as they had. Using Minneapolis’ implementation schedule as a model would assume that it is a comparable jurisdiction. But it is not. Below I compare the living wage in the two jurisdictions. There are some big differences.

This table compares the living wage NEEDED TODAY in each jurisdiction.

| Living Wage | Minneapolis | Montgomery County |

| Single adult | $11.36 | $15.80 |

| 1 adult 1 child | $24.68 | $29.82 |

| 1 adult 2 children | $31.04 | $34.87 |

| 2 adults 2 children | $16.85* | $18.72* |

*This number is per adult in the two-adult family

(Source: Living Wage Calculator, MIT)

In every case, more than $15 an hour is needed TODAY in Montgomery County, but the cost difference between living here versus Minneapolis is the equivalent of $4 an hour, or $2 an hour if 2 adults are working.

However, the most important factor in cost of living differences is housing. Housing costs are what drives the cost of living and necessitate a particular wage. Here is a comparison of housing costs:

| Jurisdiction | 1br yr/mo | 2br yr/mo | 3br yr/mo |

| Minneapolis | $7824/ 652 | $12635/1075 | $17967/1497 |

| Montgomery | $15684/1307 | $19476/1645 | $25728/2144 |

| Difference – or how much higher it is MoCo | $7860/655 | $6841/570 | $7761/646 |

(Source: Living Wage Calculator, MIT)

A MoCo resident would need between $570-655/month more than a Minneapolis resident to pay the difference in housing costs. For all other expenses combined, Montgomery County is a few hundred dollars per year more costly to live in than Minneapolis, but annual housing costs are between $6841 and $7860 higher for Montgomery County. To suggest that a wage in Minneapolis, or a schedule for raising wages, should be replicated in Montgomery County ignores the enormous cost difference between the two jurisdictions which leaves our working poor deeply mired in poverty. We are simply prolonging an untenable situation for tens of thousands of families.

Finally, there is one last incorrect assumption in delaying the implementation date, and that is that Minneapolis is noticeably more gentle to small business. It’s been said that the proposed rate of increase is too fast. However, the facts show a different story.

Here is the pace of increase in the two jurisdictions:

| Jurisdiction | Small business increase | # of years | Cost/year | Large business

increase |

# of years | Cost/year |

| Minneapolis | $7.25 | 7 | $1.03 | $5.50 | 5 | $1.10 |

| Montgomery County | $3.50 | 5 | $.70 | $3.50 | 3 | $1.16 |

In other words, the impact in Minneapolis on small businesses is greater in terms of total increase than Montgomery County ($7.25 vs $3.50) and greater as a per-year expense ($1.03 vs .70) For large businesses, the difference in total increase in Minneapolis is also greater than MoCo ($5.50 vs $3.50) but is slightly less per year ($1.10 vs $1.16).

So for small businesses, if the issue is pace, then the Minneapolis schedule is worse for their small business than what I’ve proposed, and for large businesses our target is 2020, no different than what Target has committed to nationally for 2020.

In short, Minneapolis is so different regarding affordability for its citizens that the impact of raising the minimum wage, and the urgency for raising the minimum wage, is simply not the same. Our residents are far more rent burdened and have far less disposable income. And if you’re worried about small employers, our steps are smaller, only 2/3 of the average annual increases that Minneapolis is implementing.

For one last comparison, I looked at Flagstaff, Arizona, which is also raising its minimum wage to $15. Their living costs are slightly higher than Minneapolis but still much lower than Montgomery County. And housing costs in particular are slightly higher than in Minneapolis, but about $6,000 a year lower than those costs in Montgomery County. Yet they are raising their minimum wage for all businesses from $8.05 in November 2016, to $11.00 in January 2018, and then up to $15 an hour in January 2021. So they are increasing by $7 per hour over just 5 years – a rate of increase that exceeds anything proposed in Montgomery County.

The minimum wage needs to reflect the costs that people have to bear in order to sustain themselves. Prolonging the implementation simply erodes the value of the wage. Frankly, in a perfect world we’d be close to $15 today and then let it rise with inflation. Even my bill, with 2020 and 2022 implementation dates will mean that when $15 is reached it will be worth less than $15 today, and I wish we could do better, but the proposed delay just makes things worse and is completely divorced from the reality that low-income families face.

[1] http://jaredbernsteinblog.com/the-minimum-wage-increase-and-the-cbos-job-loss-estimate/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+JaredBernstein+%28Jared+Bernstein%29 and https://www.hendrix.edu/news/news.aspx?id=64671

[2] http://www.epi.org/blog/the-montgomery-county-minimum-wage-impact-study-is-absurd-junk-science/