A guest blog by Adam Pagnucco.

Congressional District 8 has three strong Democratic candidates with a chance to win. One of them is District 20 State Senator Jamie Raskin.

Strengths

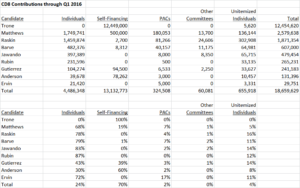

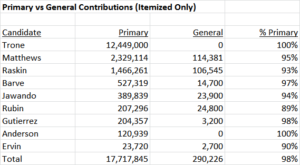

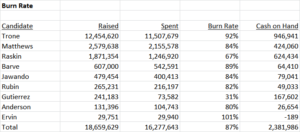

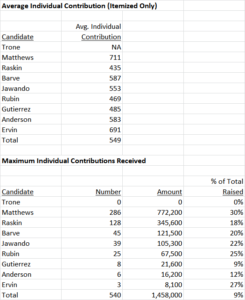

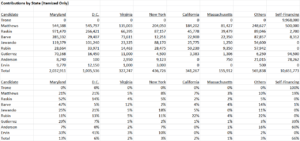

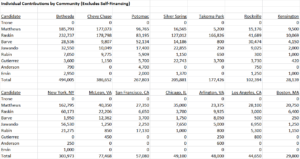

Raskin has successfully established his brand as the effective, results-oriented progressive in the race, and he uses it as a contrast against two well-funded opponents who have never held office and have no local political history. He started with a geographic base that accounted for roughly a sixth of the district and expanded it into other areas with a nearly year-long ground campaign. His supporters are passionate, knowledgeable, loyal and numerous. It would not be a stretch to say that he has wrapped up close to 90% of the district’s regular Democratic activists, the kind of people who play big roles in County Council and state legislative races. His fundraising has been mostly local and is competitive with Kathleen Matthews. His mail program has been second only to David Trone’s, although Emily’s List has been catching up in their advocacy for Matthews.

Weaknesses

As the third-ranking candidate in terms of finances, Raskin is running a more targeted race than either Matthews or Trone. He has made a token investment in television in favor of a robust mail campaign, which can be targeted to regular voters. There is good reason for this, but let’s remember that Rob Garagiola made a similar choice against John Delaney in 2012. If turnout is high and jammed with low information voters who have not seen Raskin’s mail, he would be at a disadvantage. Also, Raskin’s dispute with Delegate Kumar Barve over an inaccurate television ad has earned him negative coverage in the Post (twice), the Sun and Bethesda Magazine during the crucial final weeks of the race.

What Our Sources Say

Source: “Raskin has had the clearest message – that you should vote for him because he is the one who has actually passed bills that deliver on the progressive values all of the candidates say they support – but the question is whether he has put enough resources into TV ads to compete with the Trone-a-thon (and to a lesser extent the Matthews ads) that have blanketed the region with spots for his competitors.”

Source: “A hypothetical: If you could choose between a candidate who had a fantastic TV game but mediocre ground game, or a candidate with a fantastic ground game but mediocre TV game, who would you choose? If you chose the latter, congrats, you’ve picked the winner of the CD8 race.”

Source: “Raskin isn’t a bad guy but the issues he’s advanced in the State Senate that he talks about frequently on the trail — a place with only 14 Republicans — have absolutely ZERO chance of happening in a Republican Congress. The key progressive battles in Congress won’t be waged in the near term on social issues, but as Chris Van Hollen showed, they’ll be fought on budget issues. That’s the effective progressive void CVH will leave in the House and Raskin simply doesn’t have the budget chops to fill it.”

Source: “He inherited Frosh’s very strong Montgomery County network which, along with his own record, gave him an instant third of the vote. That’s an enviable position to be in. On the other hand, he has a long voting record in a year of outsiders, is arguably to the left of Bernie Sanders, and doesn’t have a great deal of humility. Still, if he wins it is a great victory for activism, involvement, and progressivism.”

Source: “Jamie’s candidacy is the test of whether there is value to being in the state legislature for people who aspire to higher profile office (offices on the top of the ballot that most voters learned about in civics class in high school – President, Senate, House). Hard working legislator, deep community connections, excellent reputation and undeniably brilliant. But, does he have any kind of advantage from having all of those elements in front of an electorate that does not follow Annapolis? Do the liberal party insiders who support him have as much electoral power as the state legislators and county councilmembers think they do? We’re about to find out!”

How He Could Win

Raskin supporters tend to be very liberal, know that Raskin is very liberal, and have lots of information about the race. That message is reinforced through the grass-roots network that Raskin has built. High information voters like these almost always vote and they will have an outsize impact on a low turnout election. Turnout in Montgomery County has been trending downwards for years, and if that continues, it will favor Raskin. Under this scenario, his people will stay with him and the remaining low information voters will be divided between Matthews and Trone. Whether this will play out in the context of a competitive Democratic presidential primary is anyone’s guess, but Raskin’s base is the envy of the field and he has a good chance to win.