By Adam Pagnucco.

As of right now, here is the status of key election results in MoCo.

School Board At-Large: Lynne Harris 53%, Sunil Dasgupta 46%

School Board District 2: Rebecca Smondrowski 60%, Michael Fryar 39%

School Board District 4: Shebra Evans 66%, Steve Solomon 33%

Circuit Court Judge: Bibi Berry 23%, David Boynton 21%, Michael McAuliffe 21%, Christopher Fogleman 20%, Marylin Pierre 14%

Question A (Authored by Council Member Andrew Friedson, freezes property tax rate with unanimous council vote required to exceed): For 62%, Against 38%

Question B (Authored by Robin Ficker, would limit property tax receipt growth to rate of inflation and remove council’s ability to exceed): For 42%, Against 58%

Question C (Authored by Council Member Evan Glass, changes county council structure to 4 at-large seats and 7 district seats): For 61%, Against 39%

Question D (Authored by Nine Districts for MoCo, changes county council structure to 9 district seats): For 42%, Against 58%

You can see the latest results here for school board and judicial races and here for ballot questions.

But all of this is subject to a HUGE caveat: not all the votes have been counted. How many more remain?

Three batches have yet to be counted. First are the remaining election day votes. As of right now, only 3 of 40 election day vote centers in the county have reported 80% or more of their results. At this moment, 6,474 election day votes have been cast for president. That suggests tens of thousands of votes more could come in.

Second are the remaining mail votes. According to the State Board of Elections, MoCo voters requested 378,327 mail ballots. At this moment, 177,628 mail votes have been cast for president. This suggests that roughly 200,000 mail votes are out there. Not all of them will ultimately result in tabulated votes but it’s still a lot.

Third are provisional ballots. How many are out there is not known right now. However, this will be by far the smallest of these three categories and they will make a difference only in tight races.

So let’s put it all together. At this moment, 312,452 total votes for president have been tabulated. (I don’t have an official turnout number, but since the presidential race has the least undervoting, this figure is probably reasonably close to turnout so far.) This suggests – VERY roughly – that 55-60% of the votes have been counted, with the vast majority of outstanding votes coming from mail ballots.

What does that mean for the results above? To determine that, we need to examine how different the election day votes and the mail votes were from the total votes tabulated so far since those two categories are where most of the remaining votes are coming from. And of those two categories, mail votes will be far larger than election day votes.

President

MoCo’s votes for president (as well as Congress) are not in doubt but the differential results by voting mode are suggestive of a pattern affecting other races. Former Vice-President Joe Biden has received 79% of total votes as of this moment. However, he has received 51% of election day votes, 65% of early votes and 90% of mail votes. That illustrates a strong partisan pattern associated with voting, with election day votes most friendly to Republicans and mail votes most friendly to Democrats. Keep that in mind as you proceed to the races below.

Circuit Court Judges

Challenger Marylin Pierre has so far received 14% of early votes, 14% of election day votes, 15% of mail votes and 14% of total votes. Each of the incumbent judges cleared 20% on all of these voting modes. This is a non-partisan race so the partisan pattern noted above has minimal effect here. With little reason to believe that the next batch of mail votes will be different than the mail votes already tabulated, it’s hard to see Pierre pulling ahead.

School Board

The district races are blowouts. Let’s look at the at-large race between Lynne Harris and Sunil Dasgupta. Harris has so far received 53% of early votes, 60% of election day votes, 53% of mail votes and 53% of total votes. These are not big leads but they are fairly consistent. For Dasgupta to pull ahead, he would need to pull at least 55% of the outstanding votes yet to be counted, more than flipping the outcome of the existing votes. Unless the next batch of votes – especially mail – is somehow fundamentally different from what has already been cast, it’s hard to see that happening.

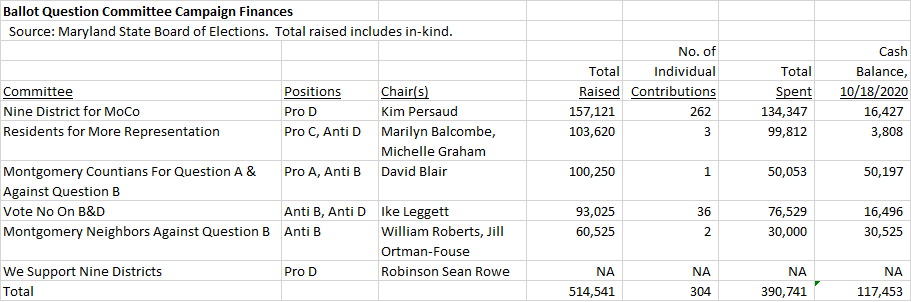

Ballot Questions

There are two things to note here. First, none of these results are close at this moment. Second, while these are technically non-partisan, the Democratic Party and the Republican Party endorsed in opposite directions and both sides worked hard to make their views known. The partisan split seen in the presidential election had an impact on the ballot question results.

First, let’s look at election day voting. Judging by the presidential race, this was the most favorable voting mode for the GOP. Here is how election day voting (so far!) compares to total voting (again, so far).

Question A For Votes: Election day 51%, total 62%

Question B For Votes: Election day 60%, total 42%

Question C For Votes: Election day 52%, total 61%

Question D For Votes: Election day 60%, total 42%

This looks like good news for supporters of Question B (Robin Ficker’s anti-tax question) and Question D (nine districts). After all, there are probably tens of thousands of election day votes yet to be counted.

However, the big majority of outstanding votes are mail ballots. Joe Biden received 90% of mail ballot votes tabulated so far, a sign that Democrats dominated this voting mode. Here is what the mail votes (so far) look like.

Question A For Votes: Mail 68%, total 62%

Question B For Votes: Mail 34%, total 42%

Question C For Votes: Mail 65%, total 61%

Question D For Votes: Mail 33%, total 42%

The mail votes uphold the winning margins of Questions A and C and depress the results for Questions B and D. That’s not a surprise if 1. Democrats voted disproportionately by mail and 2. Democrats stuck with their party’s position on the ballot questions. Indeed, we know here at Seventh State that this post on the Democrats’ statement on the ballot questions got huge site traffic.

As a matter of fact, one could even go so far as to say that once the ballot questions turned partisan, it may have been the beginning of the end.

Plenty of votes remain to be counted so let’s respect that. We may know a lot more by the weekend.