By Adam Pagnucco.

School construction has been one of the hottest issues for years in Montgomery County. Enrollment in Montgomery County Public Schools (MCPS) has been increasing by close to 2,000 students a year for a decade with no sign of stabilizing. The result is crowded schools throughout the county.

According to the Superintendent’s FY18 Recommended Capital Budget, 109 of MCPS’s 197 schools were over capacity in the 2016-2017 school year. Of those, 35 had enrollments of at least 120% of their capacity. Even if the Superintendent’s request is fully funded, by the 2022-2023 school year, 87 schools will be over capacity and 29 will be at least 120% capacity. Overcrowding will continue because construction will not keep pace with enrollment, which is projected to grow by nearly 10,000 students over that period. MCPS is using 388 relocatable classrooms this year, a number that has not changed much over the last five years despite significant spending on school construction.

Over 80 percent of MCPS school construction costs are paid by county taxpayers with the remainder coming from state aid. Here are five facts about school construction that all MoCo residents should know.

- MCPS enrollment is growing faster than the rest of the state COMBINED.

According to the Maryland State Department of Education, September enrollment in MCPS grew by 15,036 students between 2005 and 2014. Over that period, public school enrollment in the rest of Maryland SHRANK by 543 students. MCPS’s absolute increase and its growth rate (11%) were both first in the state. Other systems are growing too (notably Howard and Anne Arundel) and all counties have maintenance requirements. But in terms of new capacity needs, MCPS is in a category of one.

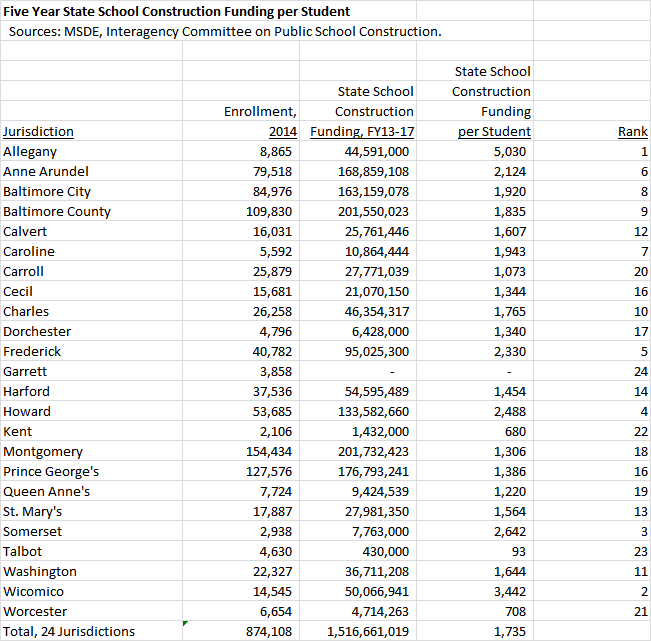

- MoCo gets less school construction money from the state per student than all but a handful of other counties.

Over the five-year FY13-17 period, MoCo received $201.7 million in state aid for school construction, just ahead of Baltimore County and tops in the state. That’s a substantial amount of money. But relative to its September 2014 enrollment, MoCo’s construction aid per student ($1,306) ranked 18th of 24 jurisdictions. MoCo had 18% of the state’s public school students but received just 13% of state construction dollars, the biggest gap in the state.

- The state’s funding formula discriminates against school construction in MoCo.

The state finances a percentage of eligible costs for school construction projects approved for state aid with the local jurisdiction paying the rest. MoCo is one of seven jurisdictions for which the state covers 50% of funding for school projects approved by the Board of Public Works, the lowest rate available. Other jurisdictions including Prince George’s (63%) and Baltimore City (93%) receive much higher cost splits.

- State legislators from the City of Baltimore extracted a billion dollars from the state for their school construction program.

In 2013, Governor Martin O’Malley and the General Assembly’s presiding officers made passing a revenue increase for transportation a high priority. Despite the fact that one of the projects to be funded was Baltimore’s $2.9 billion light-rail Red Line, city legislators withheld their votes until they got more money to rebuild their aging schools. (City school enrollment fell between 2005 and 2014.) The result was a new seven-year billion-dollar state aid program for city schools that greased the wheels for the transportation funding hike. The city delegation’s work shows that significant progress can be made on this issue.

- MoCo residents are now paying a new tax hike in part to fund school construction.

Last May, the Montgomery County Council approved a recordation tax increase on home sales projected to raise $196 million over six years. The council justified the tax hike on the grounds that $125 million of the money was supposed to be spent on school construction. No recent media reports indicate that any other Maryland county has raised local taxes for the explicit purpose of financing school construction.

Disclosure: Your author’s son attends Flora Singer Elementary School in Silver Spring. Despite opening just four years ago to relieve overcrowding at nearby Oakland Terrace, the school is already over capacity.