By Adam Pagnucco.

The COVID cuts have begun. County Executive Marc Elrich has sent a mid-year savings plan to the county council, which has tweaked it and given it tentative approval through a straw vote. The ostensible cut numbers are $44 million from the operating budget and another $28 million from the capital budget. That compares to revenue writedowns of $48 million in FY20 and $192 million in FY21, meaning that the cuts are roughly a third of the revenue loss.

But let’s be clear. The county has not adopted a true fiscal strategy as it did ten years ago, at least not yet. Its real strategy – if you can call it that – is to pray for a bailout from Washington.

Let’s look at what exactly these cuts are.

The most common form of “cut” in the savings plan comes in the form of lapses. The county budget defines lapse as, “The reduction of budgeted gross personnel costs by an amount believed unnecessary because of turnover, vacancies, and normal delays in filling positions. The amount of lapse will differ among departments and from year to year.”

Lapses occur naturally because of churn in the workforce. Imagine an employee leaves a position that has a cost of $100,000 a year at the end of a fiscal year. Now imagine that the county takes six months to fill the position. That lapse has cut the county’s cost of filling that position to $50,000 in the current fiscal year. However, that cost will jump to $100,000 in the next fiscal year assuming that it remains occupied. These costs are common throughout published budgets. By keeping lapsed positions vacant for longer, county departments can produce “savings.” No one is getting laid off through such practices and they are equivalent to deferring planned future spending, not making actual cuts. Department managers may wish to fill these positions but extending lapses means they will have to wait longer.

Elrich’s savings plan included over 60 lapsed positions in the savings package. Many of them were lapsed for only part of the fiscal year. It’s hard to tell the exact number because not all individual positions were listed. Their total combined cost was $7.0 million, or about a fifth of the administration’s operating budget reductions. The council added another $3.5 million by converting Elrich’s proposed abolition of vacant positions in the police department into lapses. Even though no employees are actually getting cut through these lapses, the $10.5 million counts as a “cut” because it means the county will be spending $10.5 million less than it was planning to spend in FY21.

In Elrich’s plan, nine county offices and departments – the Community Engagement Cluster, Consumer Protection, the County Council, Environmental Protection, Finance, Housing and Community Affairs, Legislative Oversight, the Housing Opportunities Commission and Procurement – relied exclusively on lapses for their share of “cuts.” Seven more – the Circuit Court, County Attorney, Human Rights, Inspector General, Management and Budget, Public Information and Technology Services – used lapses for a majority of their “cuts.”

Another set of reductions relates to turnover, telework, shifting funding to state money and adjustments for service reductions already set in place (like transit and recreation facilities). Examples of these kinds of cuts are $4.2 million in previously reduced transit service, a $2.9 million reduction for Next Gen 911 “in anticipation of state aid,” $1.9 million in “utility savings due to continued telework” and $766,713 in savings from recreation facilities that have been closed for months. Much of this is booking savings the county was already going to receive. Little of this represents new actual service cuts.

Most of the impactful cuts are concentrated in health and human services, the police department, transportation and the parks department. Then there is Montgomery College, which has agreed to direct $4.4 million of county money to its fund balance rather than spend it this year. That money will be available for the next annual budget. MCPS has been spared – for now. There are also modest adjustments to the capital budget related to cost savings on certain projects, delays on the state’s Purple Line project (which is tied to three related county projects) and deferrals of Ride On bus purchases. These trims will pale in comparison to a likely bloody capital project adjustment season early next year.

The county government knows that plucking low hanging fruit is far from sufficient to survive the current budget crisis, so why is it not doing more? Elrich answered that question in his savings plan transmission memo to the council. Elrich wrote:

Across the country, states and local governments are struggling to deliver vital services to residents and help communities to recover, while adjusting to a significant decline in revenues. Unlike other recessions, however, it is unlikely we will be able to climb our way out of this fiscal crisis without additional Federal aid unless we decimate the services that are so desperately needed by County residents. Do not get me wrong, we are grateful for the aid that the Federal government has already provided to Maryland and Montgomery County to help us navigate these uncertain times, and I am greatly appreciative of our State’s Congressional delegation for their continued assistance and leadership. Simply put, however, without additional aid from the Federal government, deep and draconian spending reductions may well be needed in order for us to balance our budget. These reductions will have lasting impacts on County residents, businesses and employees.

There is enormous uncertainty on whether there will be substantial new amounts of federal aid coming from Washington. U.S. Senate Majority Leader Mitch McConnell has previously said that he would rather let states and local governments go bankrupt than engage in “revenue replacement.” While House Democrats have included nearly a trillion dollars for state and local governments in their COVID relief bill, Senate Republicans seem content to merely allow already-expended aid to be used for broader purposes. (Right now, it can’t be used to plug deficits.) The latter approach offers little to MoCo, which is rapidly spending the $183 million in federal aid it has already received on COVID-related programs. Federal aid may ultimately be used as a bargaining chip to resolve other issues like unemployment benefits, stimulus checks, COVID liability and school reopening aid, which is not a happy place for states and local governments to be.

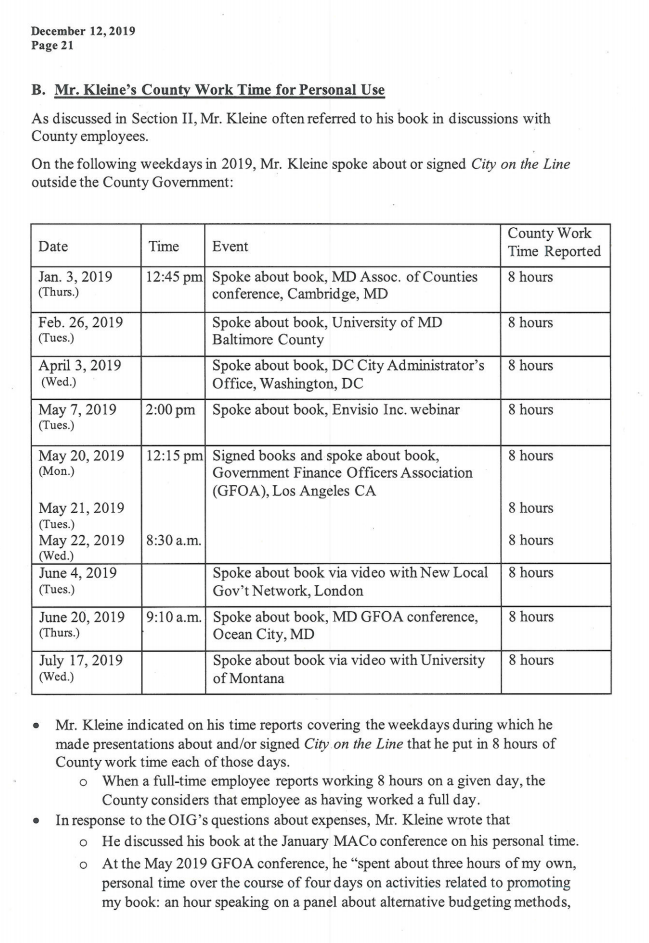

The county would be in better shape if it had done what county executive candidate Marc Elrich said he was going to do two years ago: undertake a genuine restructuring program in cooperation with the county’s unions to save money starting in the first 90 days of the term. Instead, the executive has added positions through his recommended budgets – some of which were trimmed by the council and others now lapsed – and the county’s top manager has spent his time running a book club while getting blasted by labor. The county’s budget director has also said that the county is looking at eliminating at least 100 vacant positions. (How does that save actual cash?) Now the county is praying that Mitch McConnell – who wants us to go bankrupt! – will bail us out.

Prayer is a great thing for matters of faith. It is much less useful for matters of budget.