By Adam Pagnucco.

Suppose you’re a County Council incumbent gearing up for the next election. There are eight months to go. The economy isn’t great. A big, unpopular tax hike was passed a year ago. Seventy percent of the voters just voted for term limits. Dozens of challengers with all kinds of messages carrying the powerful weapon of public financing are fanning out through the county. So what do you do?

There may not be a lot of good options these days, but antagonizing two of the more powerful groups in the county would not be a high priority on anyone’s list. And that’s what happened last Tuesday.

The pebble in the council’s shoe this time was debt service. Much of the county’s six-year capital budget is financed by bonds, and of those, the biggest single financing source for projects is General Obligation (GO) bonds. GO bonds are not tied to specific revenue sources as some other bonds are; rather, they are backed by the full faith and credit of the county. The county is rightly proud of its AAA GO bond rating, the highest rating offered by credit agencies, and kept it even through the terrible years of the Great Recession. But maintaining a AAA rating, which allows the privilege of paying the lowest interest rates on the market, is difficult. When a local jurisdiction carries too much debt relative to its resources, it risks a downgrade and higher interest rates. County leadership is justifiably careful about this and has acted to protect its bond rating in the past.

Recently, County Executive Ike Leggett requested that the council cut the level of GO bonds issued in future years, saying that the current amount is excessive and might be regarded as a credit risk. Last Tuesday, the council unanimously voted to cut the six-year issue of GO bonds from $2.04 billion (the level in the last capital budget) to $1.86 billion. On an annual basis, GO bond issuances would decline from $340 million in FY18 to $300 million in FY22-24.

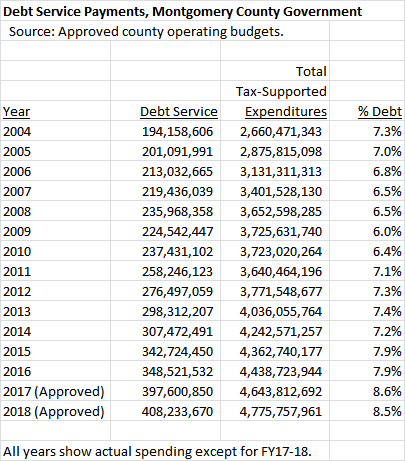

The concerns of the Executive and the council about GO bonds are legitimate. Bonds are paid off through debt service, which is part of the operating budget and competes with other types of spending. But debt service is a different kind of spending than any other county expenditure. Once bonds are issued, they MUST be paid one way or the other or the alternative is default. Below is the recent history of county debt service payments in comparison to the total tax-supported budget. Debt service roughly doubled between FY05 and FY18. As a percent of the tax-supported budget, it fell from 7.3% in FY04 to 6.0% in FY09, but has since risen to 8.5% in FY18. If it keeps rising, it will eventually squeeze out money for public schools operations, public safety and a range of valuable services.

Much of the increase in debt service has been driven by school construction. The county’s six-year capital budget in FY05-10 included $786 million in local funding for school construction. By the FY17-22 capital budget, that total had risen to $1.4 billion. That’s real money, folks! And while the state kicks in school construction money too, it could do a better job of it.

The council’s cut of GO bonds is normally the kind of action that occurs after an election, not right before one. Now the county’s elected officials are in trouble with two influential groups.

The PTAs

The Parent Teacher Associations (PTAs) have one of the largest networks in the county. Almost every one of the county’s 200 or so public schools has a PTA. Most have groups of officers and many have volunteer committees. Perhaps most importantly, most have listservs with parents on them. No one really knows exactly how many parents are on the PTA listservs, but it is at least in the thousands. The PTAs don’t endorse candidates, but they have a large latent communication capacity to inform parents about the actions of politicians. Accordingly, they are one of the great sleeping giants of county politics.

Perhaps the number one issue for the PTAs is school construction. Last year, they strongly supported a recordation tax increase proposed by Council Member Nancy Floreen that was marketed at the time as being mostly intended to pay for more schools. The size of that tax hike (roughly $200 million over six years) is close to the size of the present cut in GO bond issuances ($180 million over six years). That suggests that the tax hike will be at least partially supplanted and – after capital money is moved around – will now be effectively used to reduce future debt service, not to finance additional school construction as the council promised. That is not going over well with the PTAs.

The Realtors

The Realtors are one of the most active political players in the county, especially inside the business community. They spent $45,000 on direct contributions to county-level candidates in the 2014 cycle – including to County Executive Leggett and eight winning council candidates – and spent tens of thousands more on mailers promoting their endorsees. Nonetheless, they were targeted by the recordation tax increase and fiercely resisted it. If the increase were marketed as paying down debt service, which now could be the case through the backdoor, the PTAs would never have come out to support it and it would probably have died. Now the rationale used to defeat the Realtors – school construction – has been put in question by subsequent action of the council.

The PTAs and the Realtors may have disagreed about the recordation tax hike, but they may now both see it alongside the GO bond cut as a bait and switch. One big group got a tax increase it didn’t want. The other big group may not get the spending increase it did want. Neither group is happy.

So here’s the question. What happens next?