By Adam Pagnucco.

If the next County Executive and County Council want to prevent another Giant Tax Hike, they will have to do something that has not been done for years: seriously improve the county’s economy. Otherwise, no budget reforms will be enough to pay for the county’s needs.

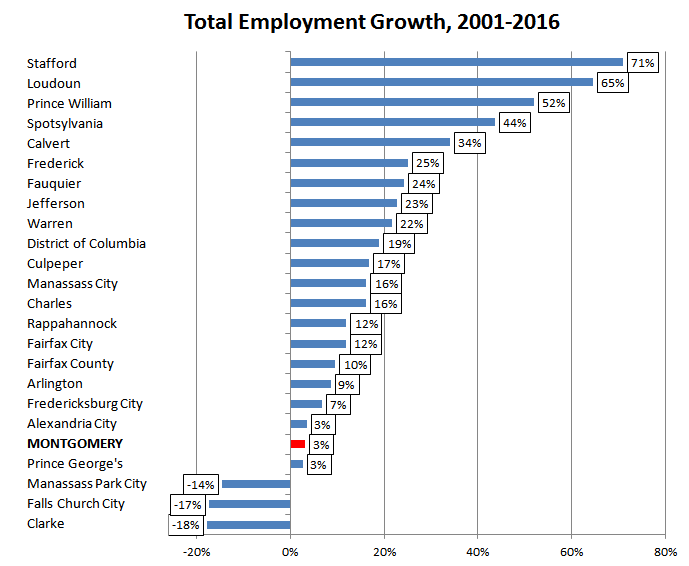

There are many ways to assess a local economy, but for the purposes of this column, let’s look at two big measures: jobs and income. From 2001 through 2016, the U.S. Bureau of Labor Statistics (BLS) calculates that total employment in the Washington metro area grew by 393,048 jobs, a growth rate of 14.6%. In Montgomery County, total employment grew by 14,086, a growth rate of 3.1%. Of 24 local jurisdictions measured by BLS, Montgomery’s job performance ranked 20th. Among the large jurisdictions, only Prince George’s County fared worse.

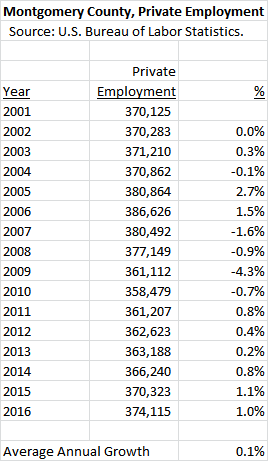

Montgomery fared well in federal employment over this period, growing its federal jobs base by 18.9%. That beat the metro area’s federal employment growth rate of 13.2%. The county’s employment problems are concentrated in its private sector, which grew by just 1.0% between 2001 and 2016. Montgomery’s private sector had 374,115 jobs in 2016, below its peak of 386,626 ten years before. Over the last fifteen years, Montgomery’s private sector employment growth ranked 19th of 24 local jurisdictions.

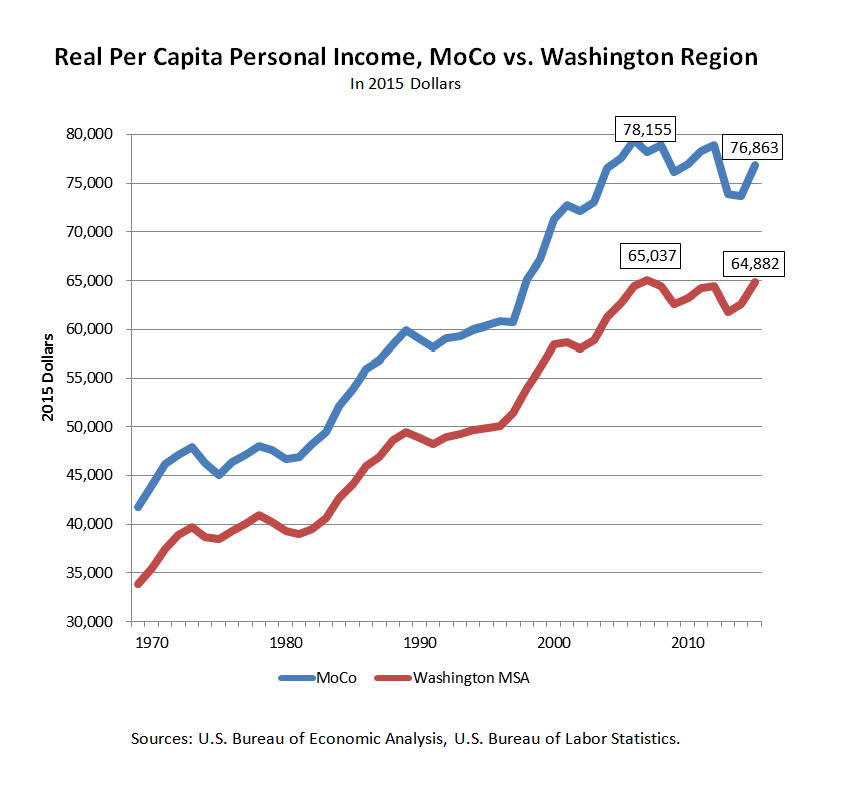

In terms of real per capita personal income, the Washington region enjoyed a long period of growth that peaked in 2007, the year before the Great Recession hit. In the eight years since, the region’s per capita income has struggled to increase for the first time in more than three decades. Montgomery has a higher per capita income than the regional average, but it has suffered from a similar pattern.

Of 19 local jurisdictions tracked by the U.S. Bureau of Economic Analysis (BEA), twelve had real per capita personal income gains between 2007 and 2015. Montgomery was one of the seven jurisdictions that did not. Its 1.7% drop is below the regional total of -0.2% and ranks 14th of 19 jurisdictions in the region.

In broad terms, the employment data and the income data agree: Montgomery County has still not recovered from the Great Recession.

The fragile state of the economy acts like a steel cage on the county’s budget. The county’s needs in public schools, public safety, transportation, health and human services and countless other areas will not go away. But unlike days past, the economy currently cannot generate the tax revenues to finance everything desired by those in office – and their constituents. The county has passed four tax hikes since the Great Recession started – two property tax increases (FY09 and FY16), an energy tax hike (FY11) and a recordation tax hike (FY16). Added to this is a series of recent laws imposing rising costs on employers. While some local jurisdictions in the region (especially in Virginia) have passed tax hikes and the District of Columbia and Prince George’s have passed new employment laws, Montgomery County is the only local government that has passed both in significant magnitude. There may be reason for that, but it has contributed to enormous competitive challenges for the county.

Progressive policies such as those favored by Montgomery County politicians cost lots of money. That money can only be obtained over the long term through a robust economy. Economic growth is affected by the totality of what the county does – its investments in education and transportation, its fiscal and taxation policies, its planning decisions and the nature of new laws and regulations it imposes on employers. If any of these things negatively impacts economic growth, marketing programs, slogans and massive incentives for large businesses will not by themselves make up for it.

The Number One lesson from the Giant Tax Hike is that the next generation of county elected officials must prioritize job creation and income growth. Failure to do so will result in more tax hikes and further long-term decline.