By Adam Pagnucco.

Left largely undiscussed during the debate over MoCo’s recently passed rent stabilization bill was the overall condition of the county’s rental market. Yes, Council Member Andrew Friedson brought up our recently published data showing that rents are declining in MoCo and are projected to continue falling for the rest of the year. But there’s a lot more to this issue, especially when considering the long-term needs of tenants and the associated implications for the county’s economy.

The bottom line is that MoCo is emerging as one of the most unattractive places in the D.C. area to build rental units.

Put yourself in the shoes of a regional developer, real estate investor or creditor and consider the following facts.

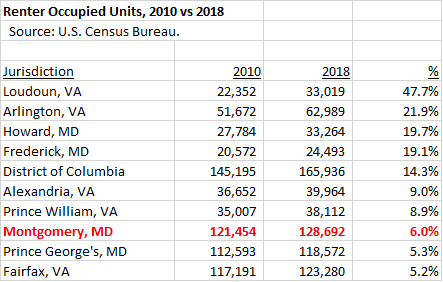

1. MoCo’s rental market is one of the slowest growing in the region.

This is the first sign that not all is right in the county. MoCo has a relatively affluent population, 11 Metrorail stations, a nationally recognized school system, a new light rail route (the Purple Line) under construction and is planning several bus rapid transit routes. Developers should want to build here, but disproportionately, they are not. If Downtown Bethesda were removed from the county’s unit statistics, one wonders how poorly the rest of the county would rank in the D.C. region.

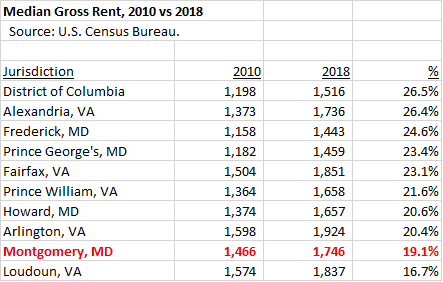

2. Rents in MoCo are also growing slowly.

With the exception of Loudoun County, every other major jurisdiction in the region has seen more growth in average rent than MoCo. That’s good for tenants but not so good for investors looking for an adequate return. That is especially the case given the level of uncertainty in MoCo’s real estate market, which would normally demand higher returns to compensate investors for dealing with it. More on that in a bit.

Here is an interesting fact. Loudoun, Arlington and Howard have been the three fastest-growing large jurisdictions in the area in terms of renter occupied units. They are also three of the four slowest-growing jurisdictions in terms of rents. That’s how a market should work – rapidly expanding supply should keep prices down even with substantial demand, and Loudoun has been one of the fastest growing counties in the nation. But MoCo has seen slow growth in both construction and rents, making it an outlier.

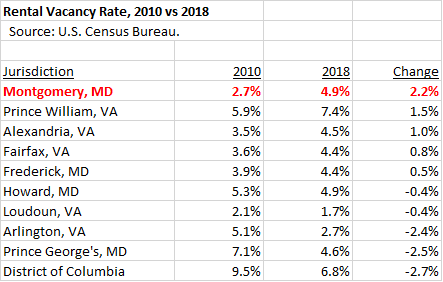

3. No other major jurisdiction in the area has experienced a larger increase in rental vacancy since 2010 than MoCo.

You might think that with MoCo’s relatively stagnant construction demand for housing would push vacancy down. Instead, it’s gone up – by more than any other jurisdiction in the region. In 2010, MoCo’s rental vacancy rate was 2.7%, the second-lowest of 10 large area jurisdictions. In 2018, MoCo’s rental vacancy rate was 4.9%, tied for the third-highest rate. The vacancy rate gain (2.2 points) was the largest in the area. This is going to get worse as vacancy rates for Class A and Class B units are projected to approach 7% in coming years.

4. Evictions in MoCo are time consuming and expensive.

In 2018, the county’s Office of Legislative Oversight (OLO) studied evictions in MoCo and stated, “The Montgomery County Sheriff’s Office reports that on average it takes 12-13 weeks to evict a tenant for nonpayment of rent, though the process can sometimes be significantly longer.” OLO also found that the cost to evict a tenant can range from $5,700 to $16,600, landlords “are often unable to recover lost rent” and “costs and process delays discourage small property landlords from renting out.”

Landlords with lots of units and market power might be able to spread these costs to other tenants in the form of higher rents. Other landlords might choose to avoid the county altogether if they believe its procedures are more onerous than its neighbors.

5. The county executive is an open housing skeptic.

Before becoming executive, Marc Elrich built his political career by opposing development, voting against seven different master plans (six centered near transit stations) and famously comparing growth to a tumor. He has not changed much since then. Over the last three years, he has compared gentrification to ethnic cleansing, said he doesn’t believe in missing middle housing, said he doesn’t want to lose affordable units “to build housing for millennials” and opposed regional targets for housing construction. His opposition to accessory dwelling units even attracted criticism from his fellow socialists. The executive doesn’t control county land use policy, but he does control the Department of Housing and Community Affairs, the county’s principal regulator of landlords.

6. The county’s moratorium policy is a major source of uncertainty for residential builders.

MoCo stops new applications for housing development in school clusters that exceed certain capacity thresholds. Last year, the county imposed moratoriums on four high school clusters and 13 individual elementary school service areas that accounted for roughly 12% of the county and included parts of high-profile housing markets like Downtown Silver Spring and North Bethesda. This year, more areas could be at risk. The moratoriums do nothing to stop school crowding but they do create serious uncertainty for the real estate industry. Who wants to spend millions on design, architecture, planning reviews, public outreach and land use attorneys only to see a project stopped dead in its tracks by an arbitrary moratorium?

7. The county just passed temporary rent stabilization.

The council made major changes to Council Member Will Jawando’s rent control bill, allowing rent increases up to the county’s voluntary guidelines and extending the bill’s duration to 90 days after a catastrophic health emergency. The direct economic impact of the bill may be mild because it is temporary, allows small increases and takes effect in an environment in which rents are declining. But it could be extended at a later time, a possibility that adds to the uncertainty of investing in MoCo. It also has tremendous symbolic importance. Let’s remember that Takoma Park has had rent stabilization for decades and has suffered absolute losses of rental units.

Consider this. It’s hard to find two terms that are more hated by the residential rental industry than “moratoriums” and “rent stabilization.” At this moment, MoCo is the only jurisdiction in the Washington region that has both of them.

MoCo is still seeing residential construction from projects that were approved before the current downturn, before the current round of moratoriums, before the approval of rent stabilization and before the current executive took office. But after that wave (a rather small wave) of construction wraps up, what will come next?

Imagine that you are a regional developer, real estate investor or creditor and you are evaluating a jurisdiction that has had slow rent growth (and now falling rents), slow unit growth, rising vacancy, expensive and time consuming evictions, a moratorium policy, temporary rent stabilization that could be extended and a county executive who is an open skeptic of housing construction. Right next to that jurisdiction are several others with fewer or none of those drawbacks.

Given all of the above, why would anyone want to build rental units in MoCo?