By Adam Pagnucco.

On March 31, the county council passed Bill 16-20E, which established a $20 million Public Health Emergency Grant Program to assist businesses and non-profits with 100 or fewer employees that have been damaged by the coronavirus crisis. The idea behind the bill was to get relief to small businesses quickly before they go under.

Unfortunately, the county bureaucracy may have other ideas.

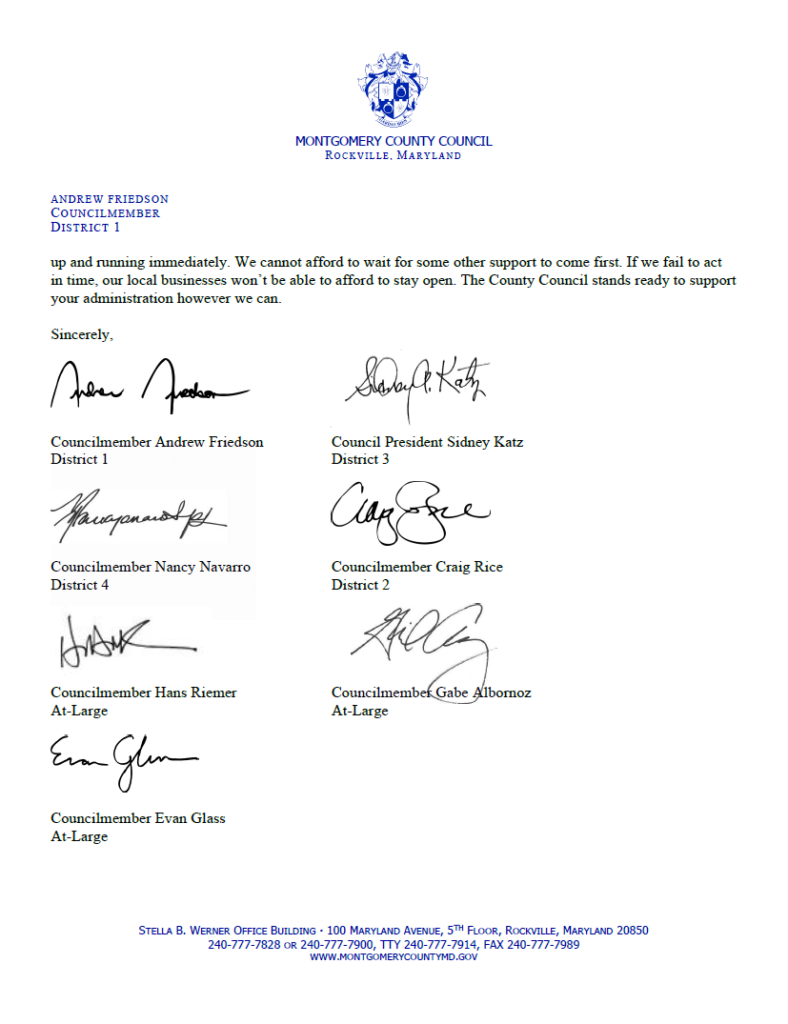

Yesterday, seven council members released a blistering letter to the county executive slamming the administration for taking too long to implement the grant program. The letter stated in part:

This lack of urgency is beyond disappointing and directly contradicts the Council’s clear intent to get this funding to our local employers as quickly as possible. While the County’s capacity to help may be limited, our ability to move quickly should not be, especially as the level of government closest to our residents and employers. For the businesses struggling to keep their lights on and for the employees who depend on them, this program is only effective if it can get funds out in time to provide help when it’s desperately needed. Without question, that time is now.

We must move with the urgency that this moment requires because our small businesses and nonprofits are counting on us. The only thing that will help businesses right now is getting them the relief money already approved and appropriated by the Council. We urge you to get the Public Health Emergency Grant Program up and running immediately. We cannot afford to wait for some other support to come first. If we fail to act in time, our local businesses won’t be able to afford to stay open. The County Council stands ready to support your administration however we can.

We reprint the letter below.

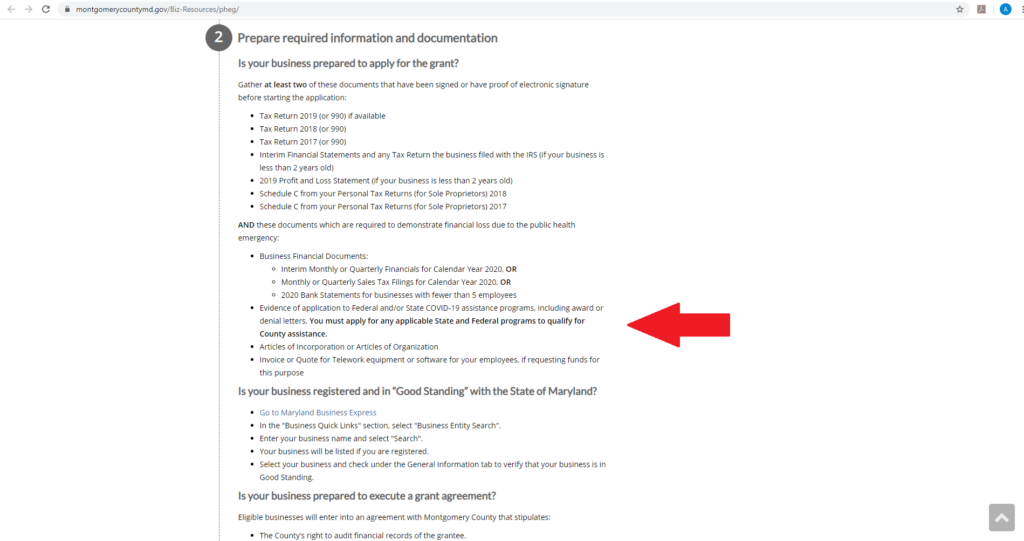

Shortly after the letter was written, the administration published a required document list for businesses applying for assistance. (As of this writing, the application itself is not finalized.) The documents include a dizzying array of tax statements, bank statements, interim monthly or quarterly financial statements, corporate articles and invoices and quotes for telework software (if applicable) as well as a requirement that businesses verify their good standing on a state website. Most crucially, the document list states in bold: “You must apply for any applicable State and Federal programs to qualify for County assistance.” It then requires applicants to submit “evidence of application to Federal and/or State COVID-19 assistance programs, including award or denial letters.”

There is no requirement in the legislation passed by the council that applicants for county assistance must first apply for state or federal assistance. The council considered an amendment making county assistance “secondary” to state and federal assistance and allowing it to be used as a “supplement” to such aid but decided against it. This requirement has been added by the administration in direct contradiction of the will of the council.

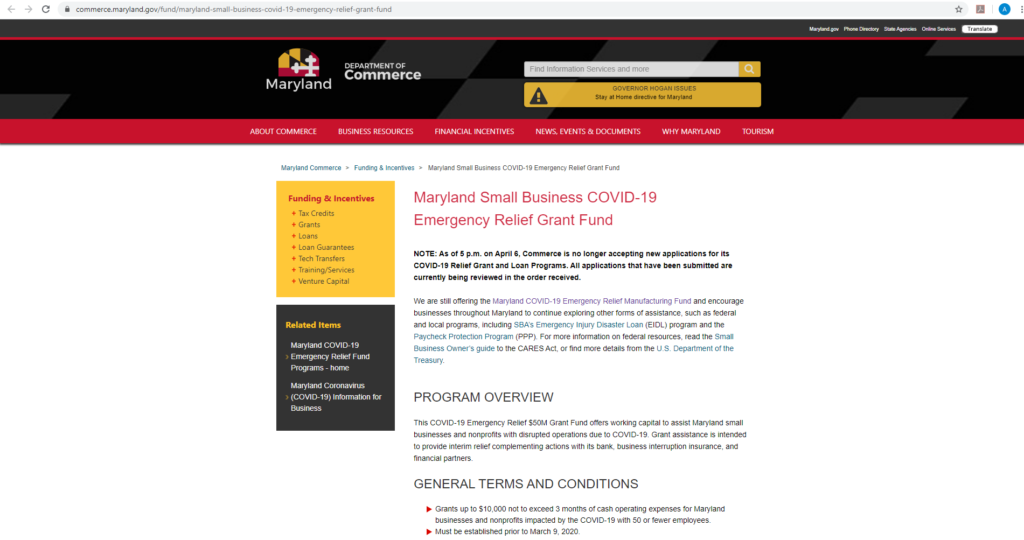

This requirement is of great consequence. When following the links provided by the executive branch, one quickly sees that two of the state’s assistance programs – the Maryland Small Business COVID-19 Emergency Relief Grant Fund and the Maryland Small Business COVID-19 Emergency Relief Loan Fund – stopped accepting applications on April 6, two days before the administration published its document list. So by the executive branch’s criteria, if a MoCo small business missed the state application window, which was only open for about two weeks, it is disqualified from seeking county assistance.

The county is requiring business assistance applicants to apply to these two state funds but both are shut down.

As for the federal assistance programs, the U.S. Small Business Administration (SBA) is under heavy criticism for not getting money out quickly. Some small businesses report that they have not heard anything from SBA after applying, not even a confirmation email. One of the SBA programs relies on private financial institutions to process applications, and some of them are either not taking applications or limiting them to existing clients. One community bank president even said, “What I thought was a brilliant plan is turning into a quagmire of quicksand.”

MoCo is insisting that its businesses jump down these bottomless state and federal rabbit holes to get county assistance. Again, this requirement simply does not appear in the legislation that the executive branch is charged with implementing.

So which businesses will be best able to navigate the process set up by the administration? Naturally, they will be the ones who are the most financially sophisticated, have the best accountants and have the most familiarity with government business assistance programs. Those who lack those assets – especially those with limited English language skills and less entrepreneurial experience – will be left behind. And so a county that prides itself on progressive values might actually wind up directing assistance disproportionately to the most privileged elements of the business community while the others will face extinction.

It’s not too late for the county to streamline its process. But it has to act fast. As in, NOW.